Thursday's impressive reversal-day rally fizzled today. The big banks reported their Q3 earnings results today. On balance, they were better than expected. However, yesterday's hotter-than-expected CPI weighed on the bond market, even though today's retail sales was relatively weak.

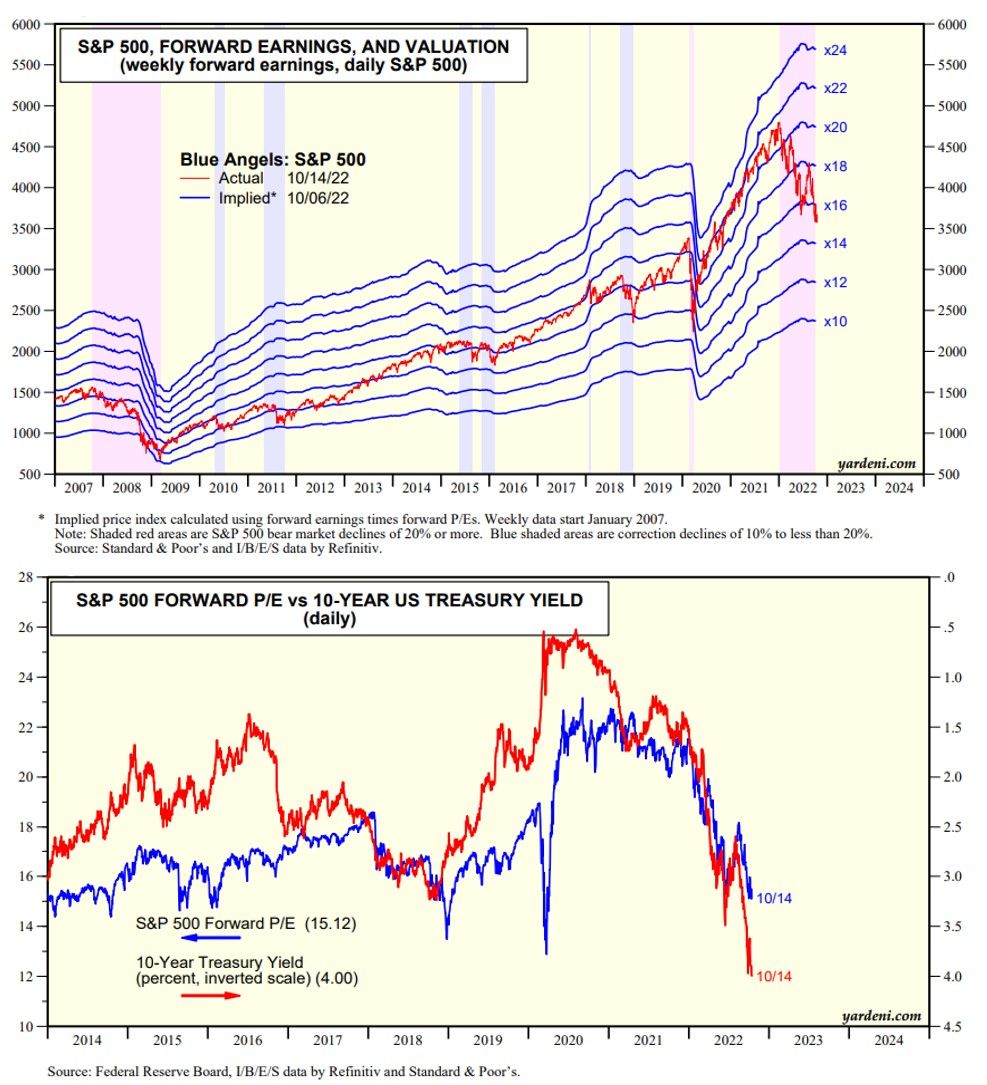

Our Blue Angels framework (chart below) shows that S&P 500 forward earnings have been relatively flat since it peaked in late June. The forward P/E is back down to 15.1, matching the June 16 low. In recent years, this measure of valuation has been highly inversely correlated with the 10-year US Treasury bond yield, which rose to 4.00% today (chart below).

Meanwhile, the 2-year Treasury note yield rose to 4.51%, up from 4.31% a week ago, as investors continue to anticipate a higher terminal level for the federal funds rate. The FOMC is widely expected to raise the rate by 75bps on November 2 to a range of 3.75%-4.00% and by 50bps on December 14 to 4.25%-4.50%.

The widening inverted yield curve spread between the 2-year and 10-year notes suggests that investors are increasingly concerned that the Fed's monetary tightening might soon trigger financial instability, i.e., a financial crisis that leads to a widespread credit crunch and a recession.

We are still expecting a protracted soft landing rather than a hard landing for the economy because we don't expect a credit crunch in the US. The soaring dollar is exporting inflation to the rest of the world and putting pressure on foreign central banks to raise their rates more aggressively. Credit crunches and hard landings are more likely overseas than in the US.