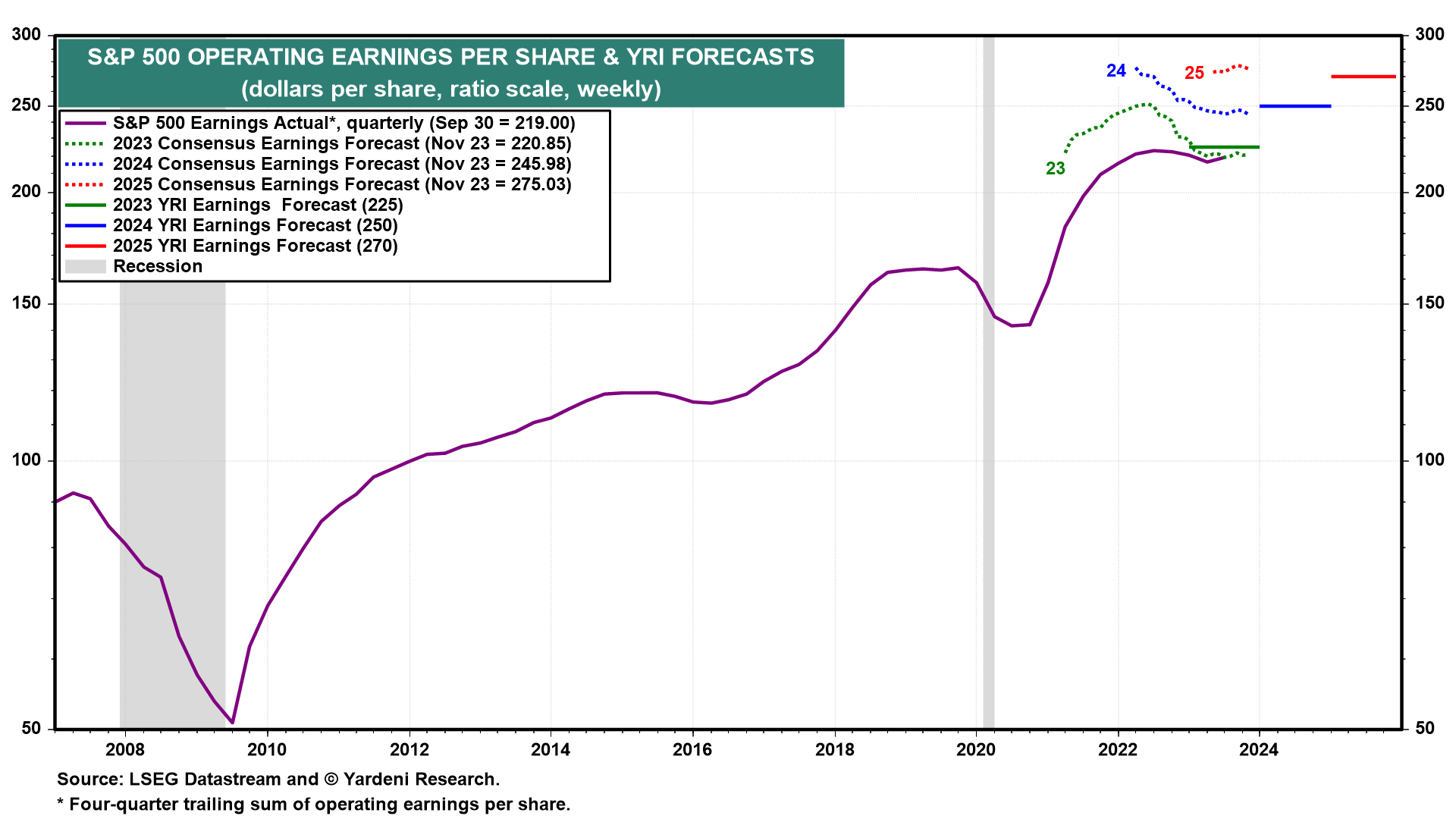

S&P 500 earnings per share are heading up according to industry analysts. We agree. There was lots of pessimism over the past year, with a few influential Wall Street strategists predicting that this year’s result could break bad, i.e., below $200. We stuck with our projections of $225 for this year and $250 for 2024, which seemed farfetched (if not delusional) late last year. But then again, we were in the soft-landing camp, not the hard-landing one.

Let’s review the latest earnings-related developments and compare our forecasts to the latest consensus of industry analysts:

(1) 2023 & 2024 quarterly consensus. There was another earnings hook during Q3’s earnings reporting season (chart). S&P 500 earnings per share turned out to be 4.1% better than expected at the start of the season. However, Q4’s estimate was cut by more in response to cautious guidance by company managements as well as to the impact of the United Auto Workers’ strike. The quarterly consensus estimates for 2024 have been mixed recently.

(2) 2023 & 2024 annual consensus estimates. The annual consensus estimates for 2023 and 2024 have been relatively stable so far this year. They were $220.85 and $245.98 during the November 23 week. Both are about $4.00 below our forecasts (chart). We are sticking with our projections for now. That's because we remain in the soft-landing camp. We are not predicting a recession for either the economy or for earnings in 2024.