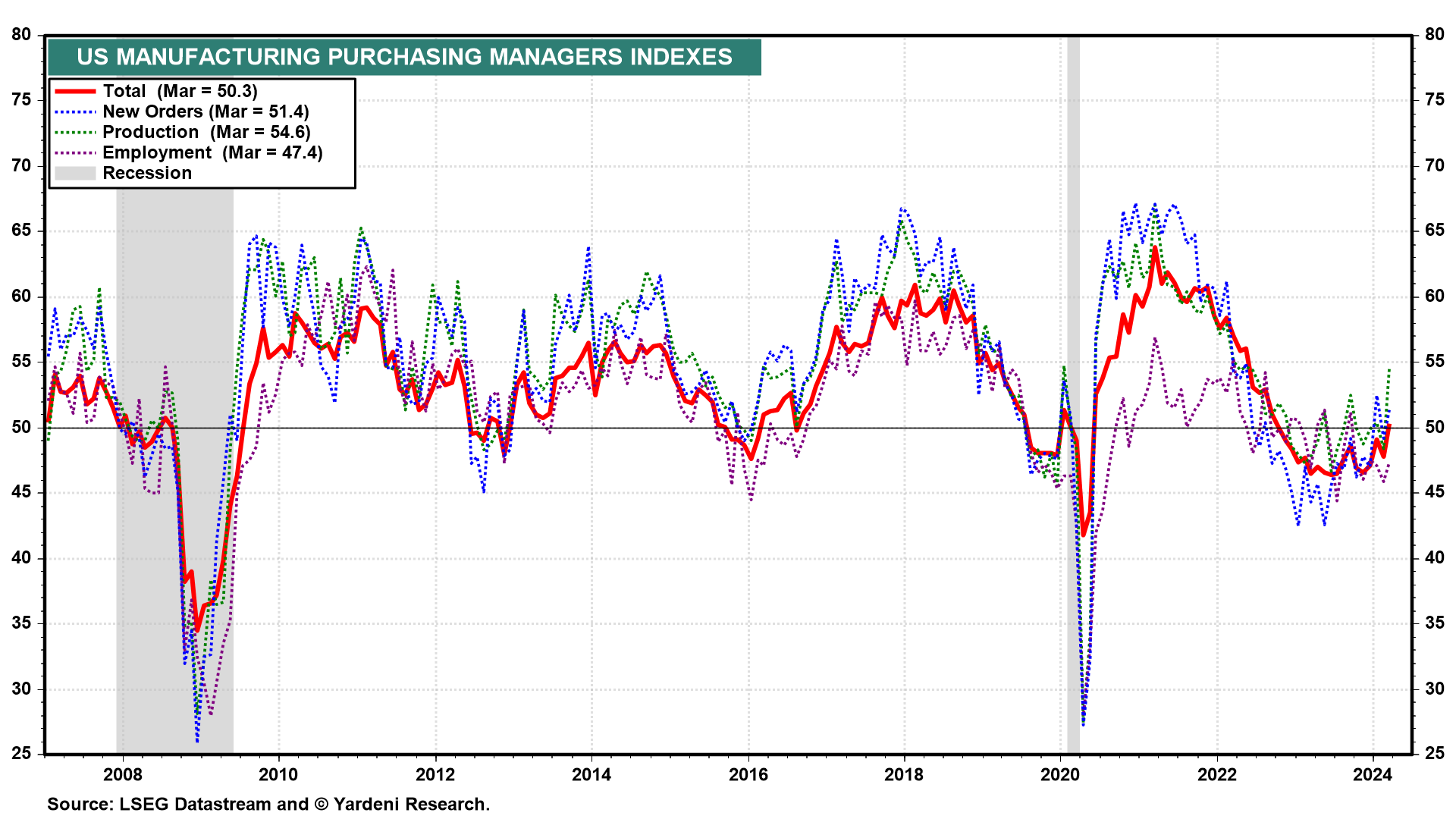

The rolling recessions in manufacturing and retailing are turning into rolling recoveries. That's our conclusion based on today's relatively solid manufacturing purchasing managers report for March. The M-PMI rose to 50.3, the first reading above 50.0 since September 2022 (chart). That was the beginning of the rolling recession that hit goods producers following the post-lockdown goods buying binge that started May 2020. The new orders (51.4) and production (54.6) components of the M-PMI were especially strong. Weighing it down was the employment component (47.4).

The goods buying binge caused real consumer spending on goods to peak at a record high during April 2021 (chart). Amazingly, when the binge ended, real purchases of goods remained near that record high through September 2023, as retailers discounted their excess inventories to reduce their bloated stockpiles. Real consumer spending on goods has been mostly rising in record high territory since last summer.