The rolling recession is rolling over the commercial real estate market (CRE), especially the market for urban office buildings. In our opinion, the challenges facing that market are serious but shouldn’t cause an economy-wide credit crunch and a recession.

The Fed’s May 2023 Financial Stability Report included a review of the CRE credit market. The report observes:

“The shift toward telework in many industries has dramatically reduced demand for office space, which could lead to a correction in the values of office buildings and downtown retail properties that largely depend on office workers. Moreover, the rise in interest rates over the past year increases the risk that CRE mortgage borrowers will not be able to refinance their loans when the loans reach the end of their term. With CRE valuations remaining elevated (see Section 1, Asset Valuations), the magnitude of a correction in property values could be sizable and therefore could lead to credit losses by holders of CRE debt.”

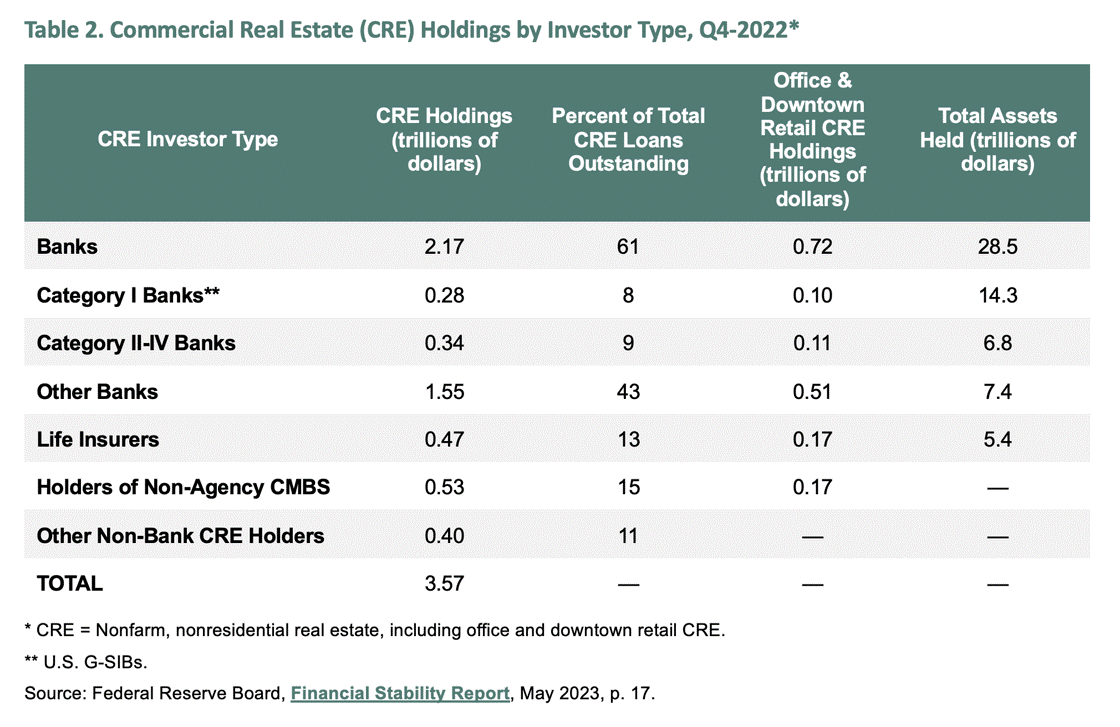

The Fed’s report includes the following table. Below are some of the key findings: