Today's reversal in stock and bond prices from down big to up big, following the release of September's hotter than expected CPI report, has been quite remarkable. It's head spinning action. The day isn't over, but shorting the markets on bad inflation news just turned a bit more risky.

We've been making the case that the US economy has been in a rolling recession since the start of this year. We are thinking that the data suggest that the US economy is also experiencing rolling inflation. Consider the following:

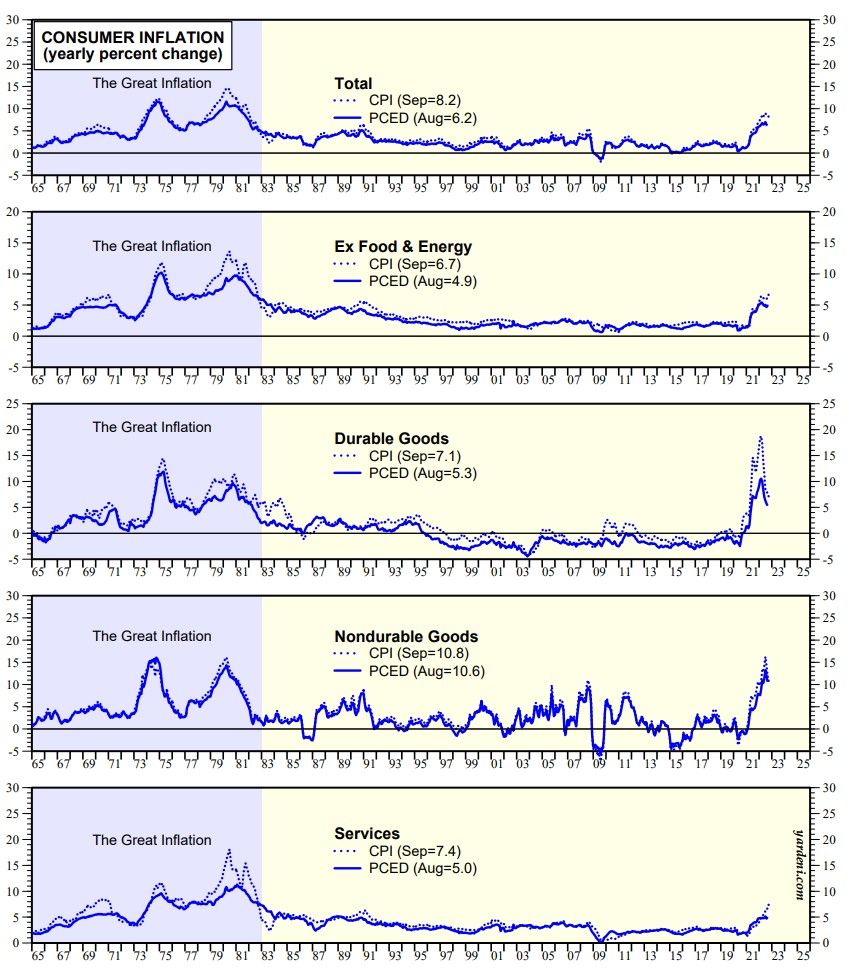

(1) Inflation started to surge in early 2021 when excessively stimulative fiscal and monetary policies caused a demand shock for consumer durable goods (including autos and housing-related goods). That overwhelmed supply chains. Durable goods inflation soared last year. It has been moderating rapidly this year (chart below).

(2) The Ukraine war caused nondurable goods prices to soar earlier this year (particularly for energy and food). Energy inflation has also moderated significantly since July as global economic growth slowed and US consumers sharply reduced their gasoline usage. Food inflation remains elevated partly as a result of the drought in California.

(3) Now that inflationary pressures seem to be easing in the goods sector, they seem to be heating up in services, especially the rent components of the consumer price measures. The rent components of both the CPI and PCED are widely recognized to be flawed. Actual rent inflation for new leases soared late last year and early this year, and is coming down fast according to Zillow.

(4) Keep in mind that the PCED inflation rate tends to be lower than the CPI rate. That's mostly attributable to durable goods (substitution effect in PCED), rent (overweighted in CPI), and health care services (out-of-pocket expense in CPI not in PCED).

(5) I asked Joe Feshbach about today's action. He emailed me the following: "Nuts but great reversal! Gotta buy all dips now."