Today was a good day for the diehard hard-landers and the "stag-disinflationists." They're probably high fiving each other. We are in neither camp–we expect a continuation of “immaculate disinflation,” i.e., a growing economy with subdued inflation. We're high fiving over today’s productivity and labor costs report.

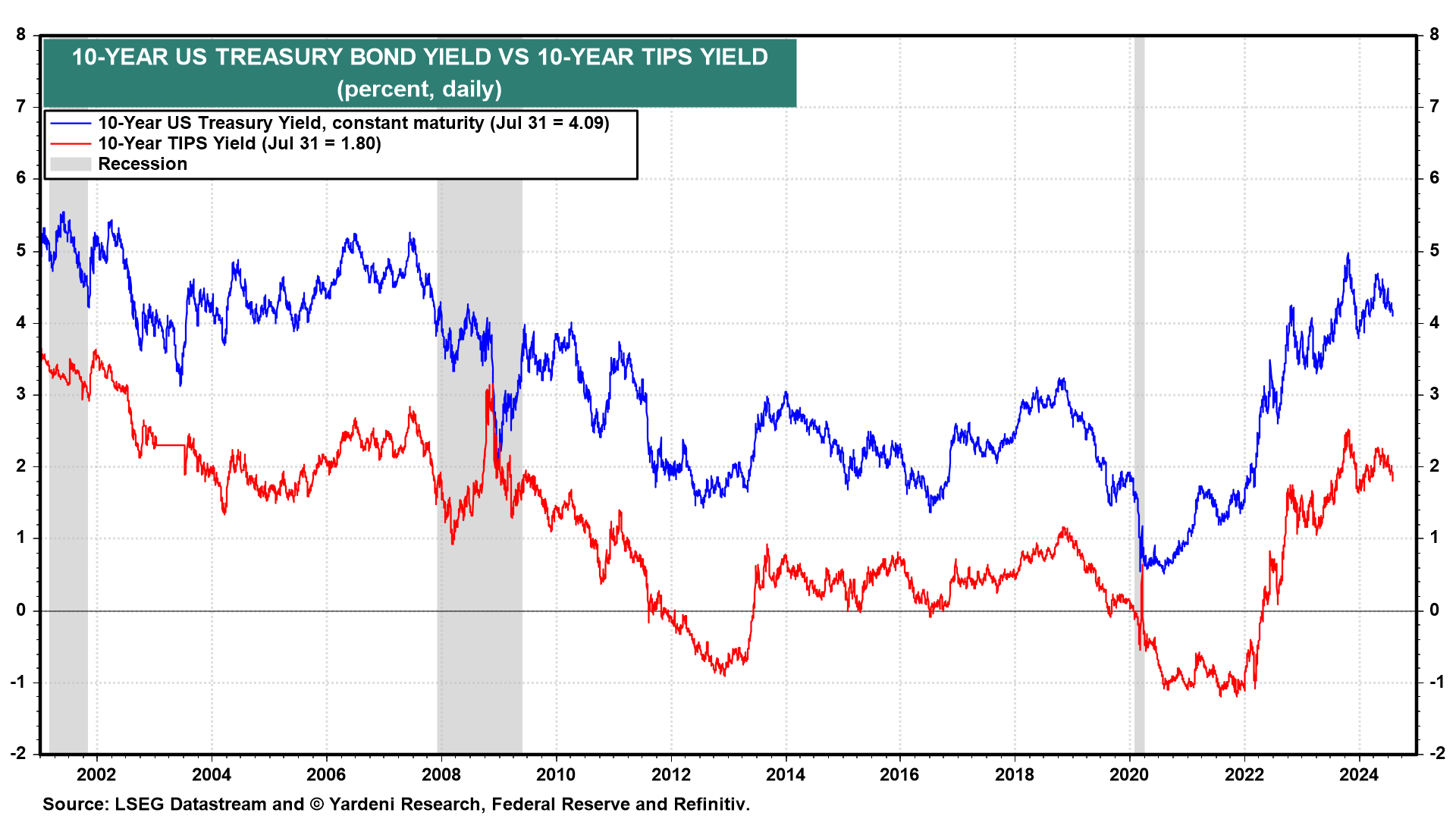

In any event, bond investors are certainly enjoying themselves; the 10-year yield fell 12 basis points to 3.98% and is now down more than 60bps in the past 3 months. The 10-year TIPS yield slid below 1.8% to its lowest since February (chart).

Are we on the verge of a recession, or in one now? We don't think so–especially as the Fed is preparing to cut interest rates to stymie one anyway. But stock investors might be reconsidering whether the odds of a recession are increasing. Let's review some of the data that jolted markets today:

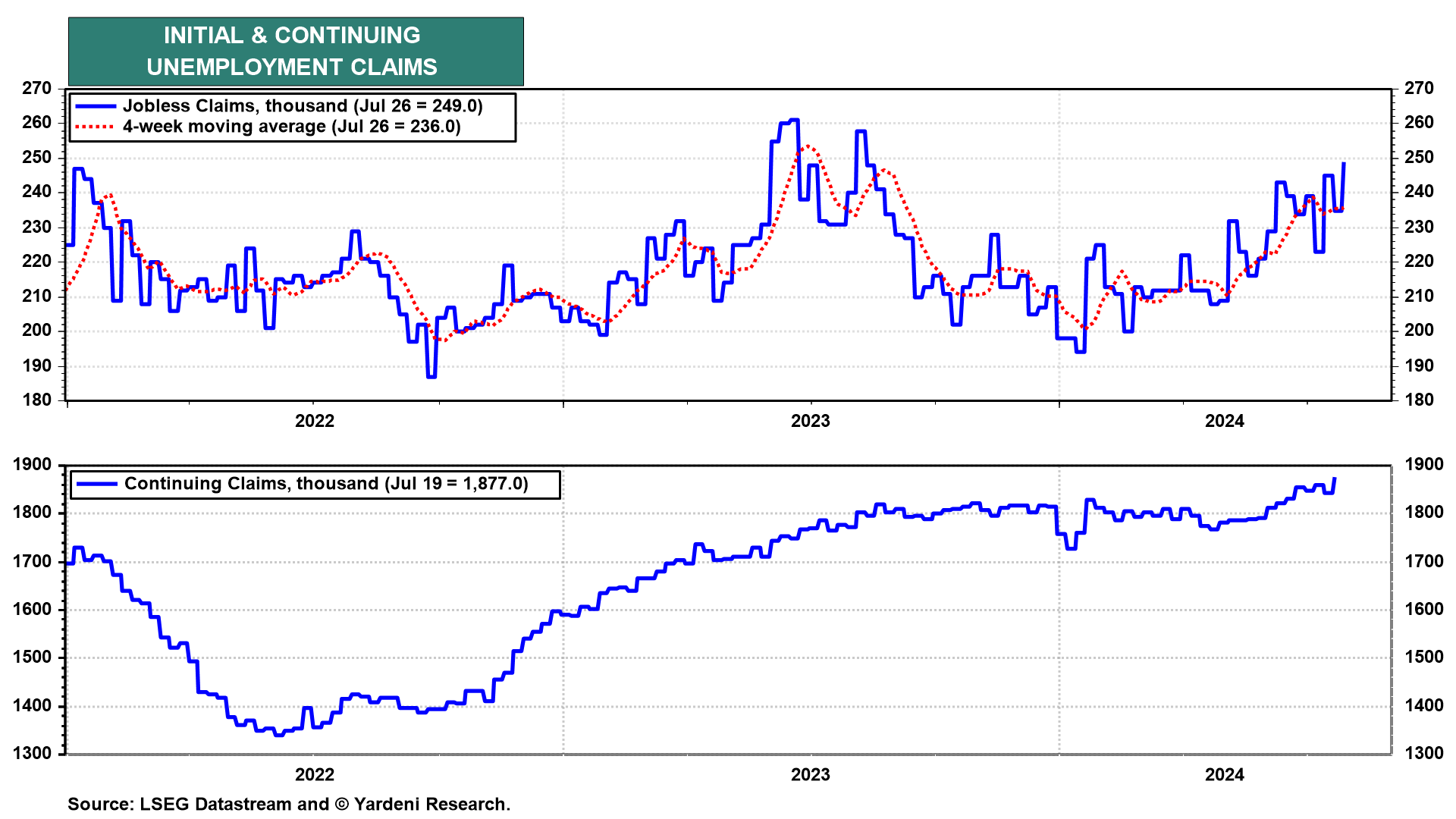

(1) Unemployment claims. Initial claims increased by 14,000 to 249,000 (sa) in the week ended July 27 while continuing claims rose by 33,000 to 1.88 million in the week ended July 20 (chart).

Claims have been gyrating all summer. Of note, 87% of the nsa increase in continuing claims was from Texas, which is dealing with distortions from Hurricane Beryl.

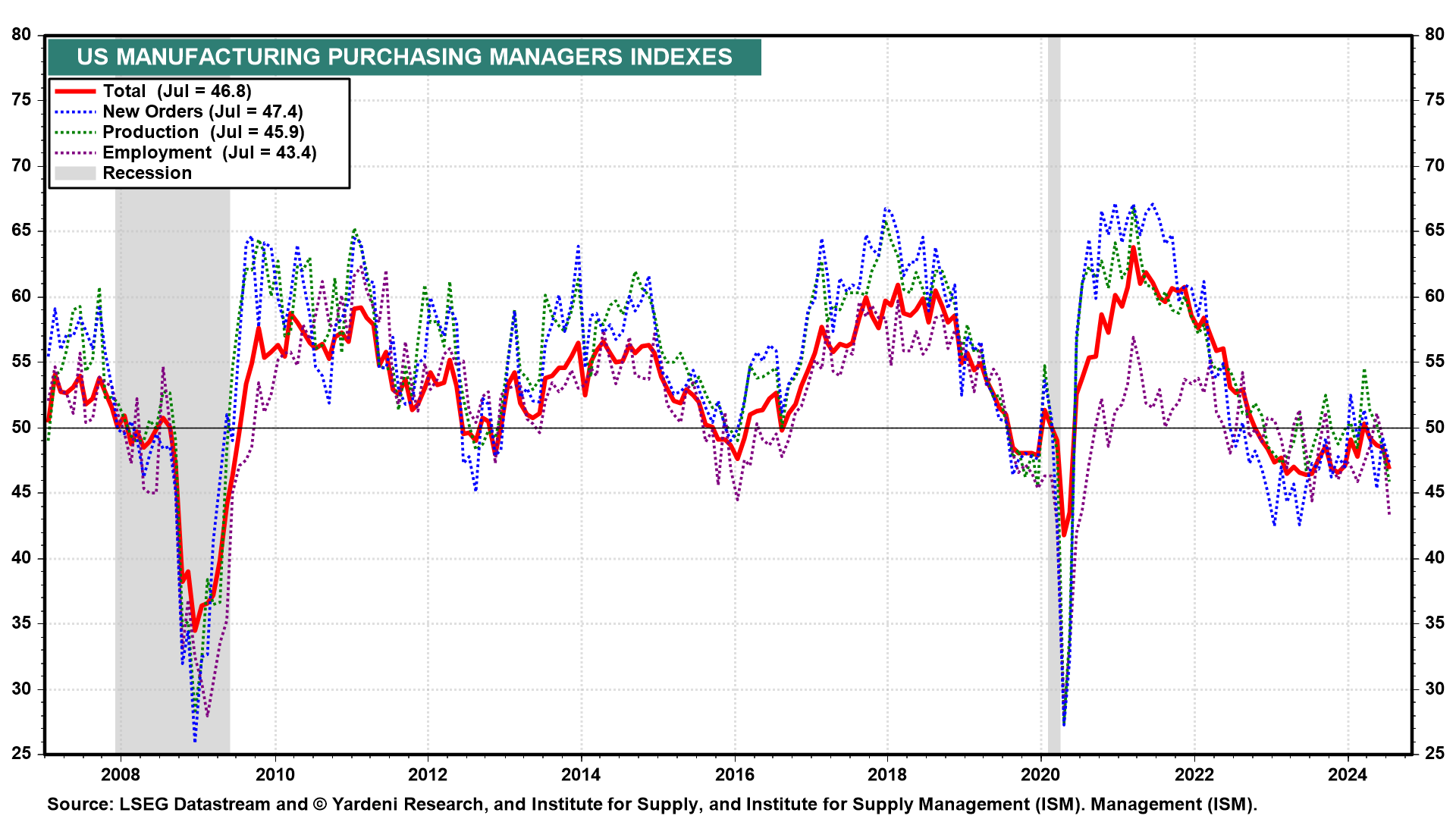

(2) Manufacturing. July's ISM national M-PMI fell to 46.8 from 48.5. The index has generally been below 50.0 for the past two years; the eye-catcher was the employment index, which fell 5.9 pts to 43.4, consistent with lows seen during the pandemic and Great Financial Crisis (chart). Of course, the M-PMI has been accurately signaling the ongoing growth recession in the manufacturing sector, not an economy-wide recession.