Hard luck for the hard-landers today. Today's GDP report was full of upward revisions:

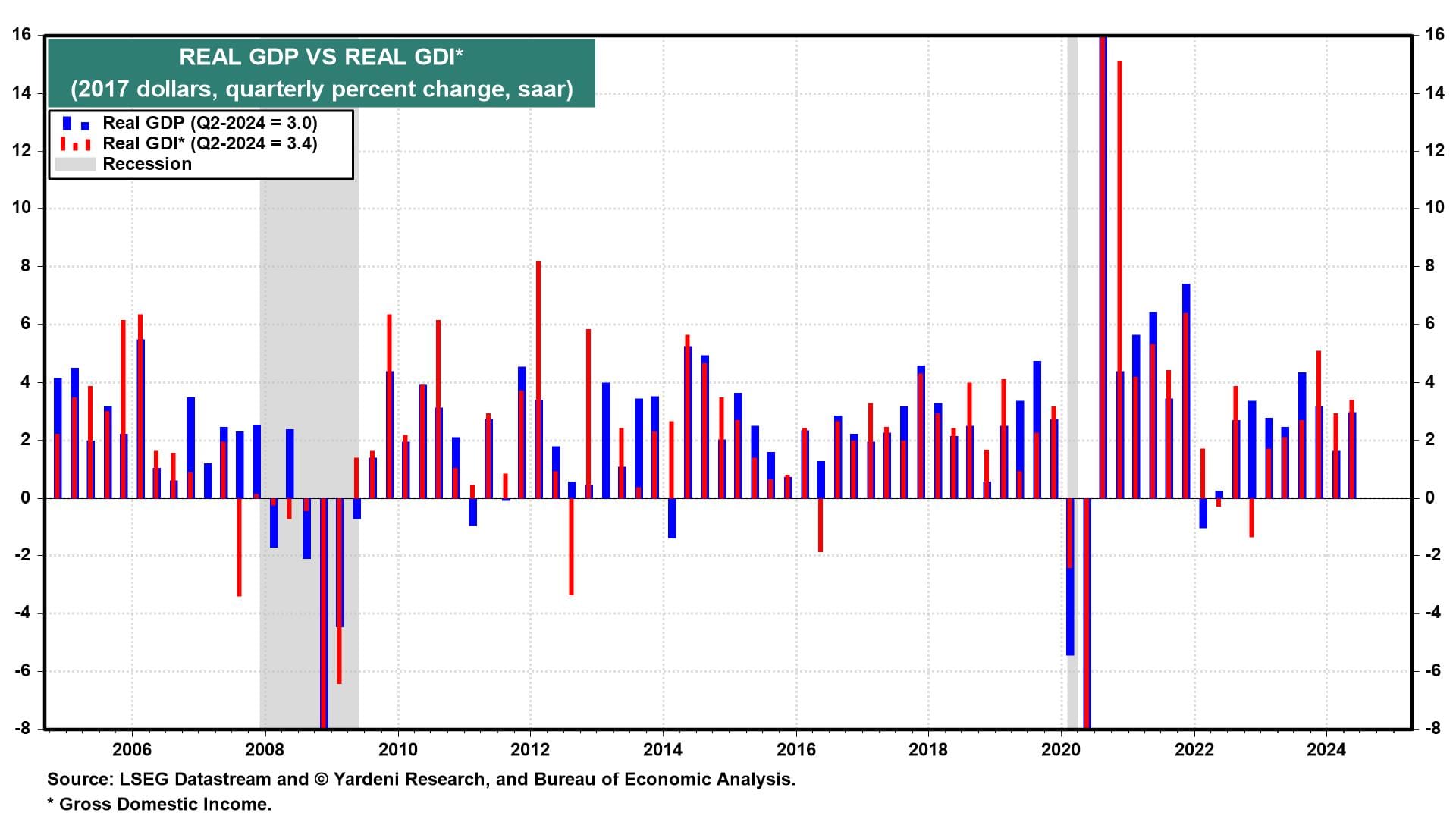

(1) GDP versus GDI. Some of the hard-landers expected GDP to be revised lower after a large gap between GDP (which measures output) and Gross Domestic Income (GDI) (which measures economic activity via wages and profits) emerged over the past few quarters. Over time, GDI closely tracks GDP, but discrepancies tend to be revised in favor of the weaker indicator when the economy is slowing. Today, an update from the Bureau of Economic Analysis (BEA) showed that GDI has actually been understated. Higher incomes drove the upward revision.

The previous estimate of Q2 real GDP showed it rose 3.0% (saar), while real GDI increased by 1.3%. That created the largest gap between the two since 1993. The BEA's final estimate of Q2 real GDI raised it to 3.4%. GDI was also revised higher in Q1, from 1.3% to 3.0% (chart). Real GDP growth remained at 3.0% during Q2 and was revised up slightly to 1.6% in Q1.

Furthermore, the technical recession from two-straight quarters of negative real GDP growth in H1-2022 was revised away as well.

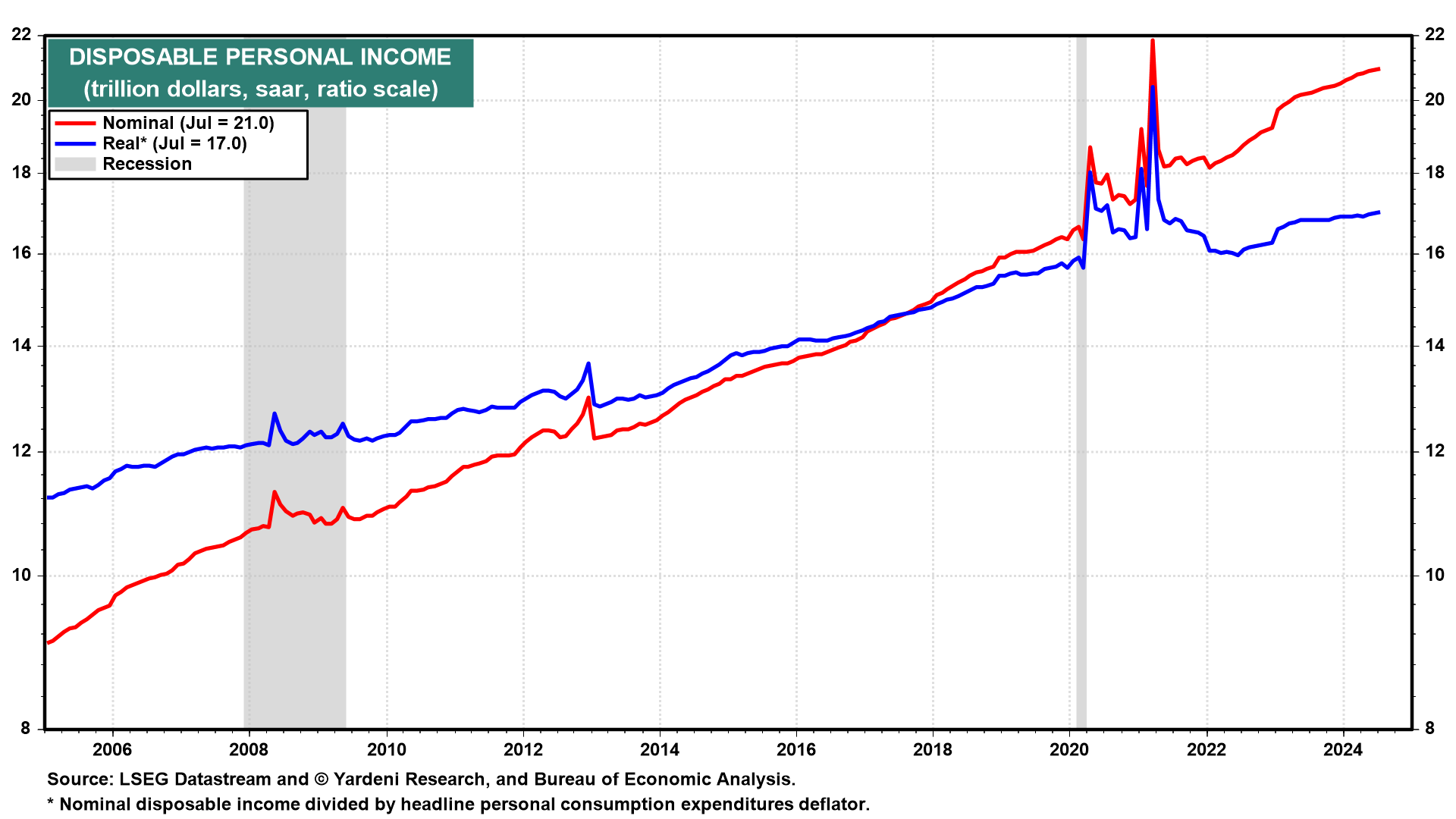

(2) Wages & salaries. Much of the increase in GDI was due to increased worker compensation. Real disposable personal income growth was raised from 1.0% to 2.4% (chart).

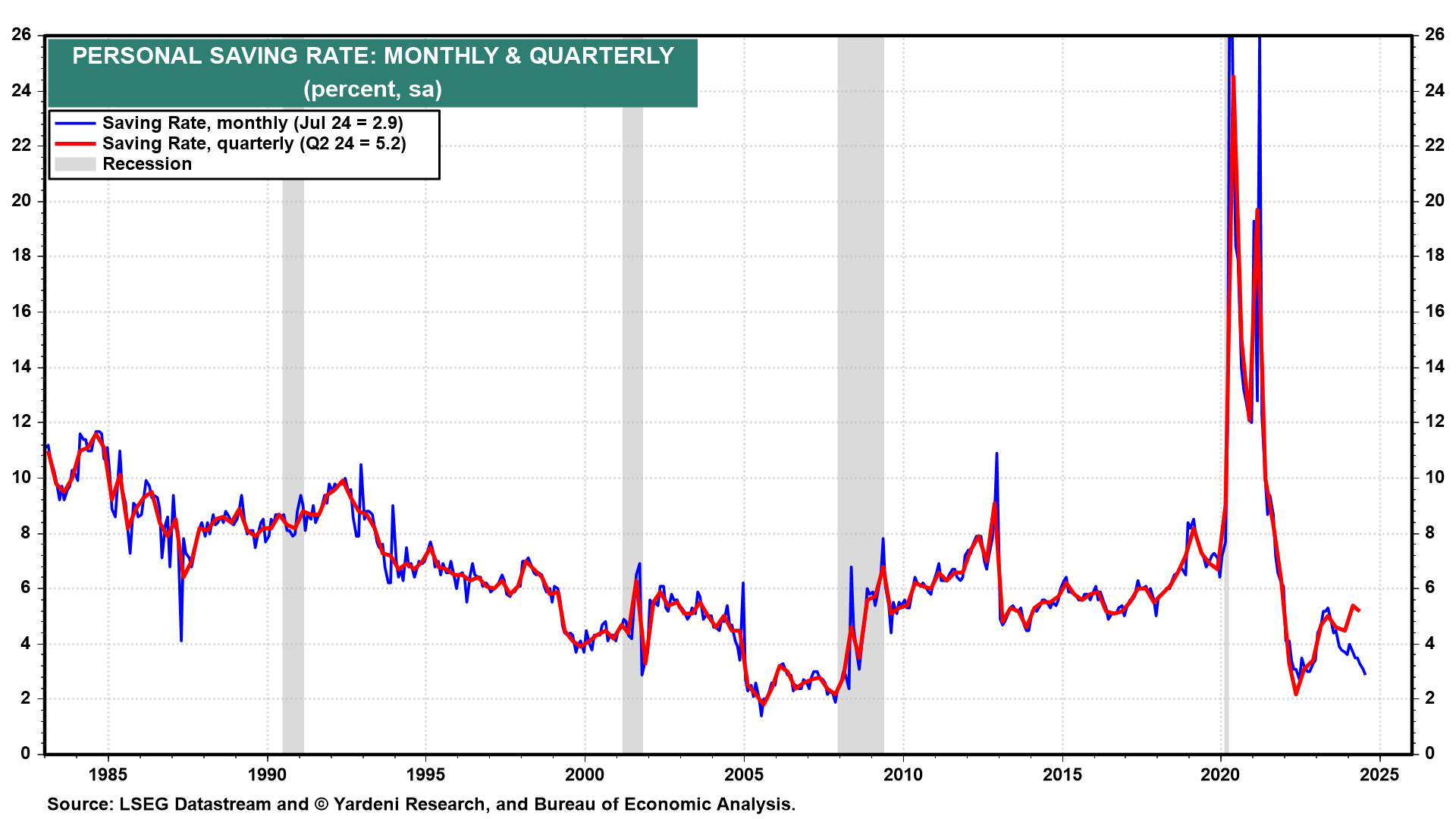

(3) Personal saving rate. The upward revision in personal income during H1-2024 resulted in significant upward revisions in the personal saving rate during the first two quarters of this year (chart). The monthly data will be revised upwards in tomorrow's personal income release.

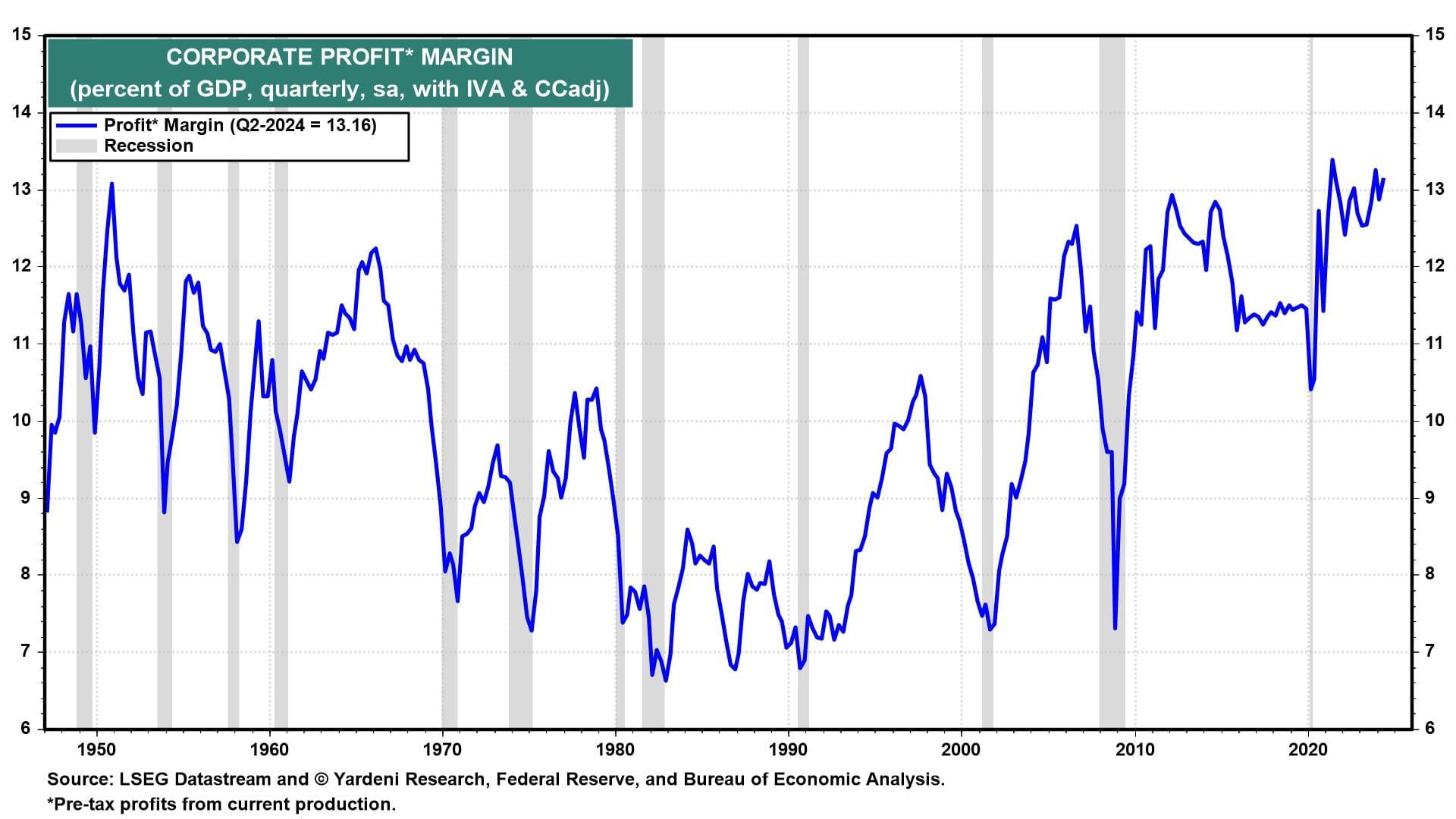

(4) Corporate profits. Corporate profits was also revised higher in Q2. The pre-tax profit margin has now been above 13% for much of the post-pandemic period, only previously seen once in 1950 (chart). We're bullish on productivity growth fueling wider margins in our Roaring 2020s outlook. We also expect strong GDP growth again during the current quarter.

(5) Unemployment claims. There are still very few layoffs. Initial unemployment claims fell 1,000 to 218,000 (sa) in the week ended September 21. Continuing claims rose 5,000 to 1.834 million.

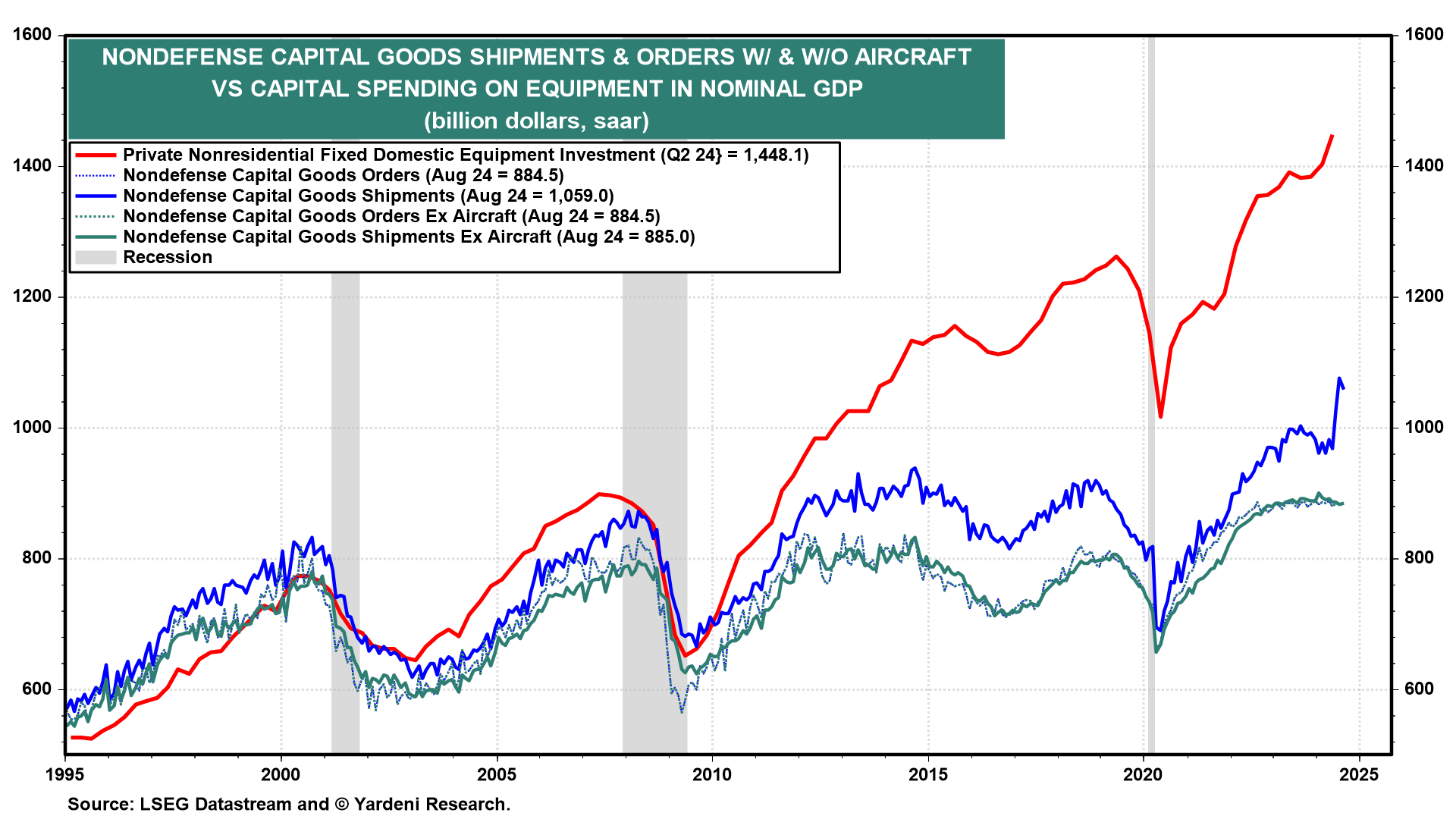

(6) Durable goods. August's shipments of capital goods fell 1.6% m/m, as Boeing's big July faded a bit last month (chart). Nondefense capital goods orders excluding aircraft rose 0.2% m/m after falling in July. In any case, durable goods orders and shipments haven't been a good indicator of equipment investment in GDP for several years.

(7) Regional manufacturing. The hard-landers received a bread crumb today as the Kansas City Fed's regional manufacturing survey slipped to -8 from -3 in September. We expect the goods-producing sector will rebound in Q4.

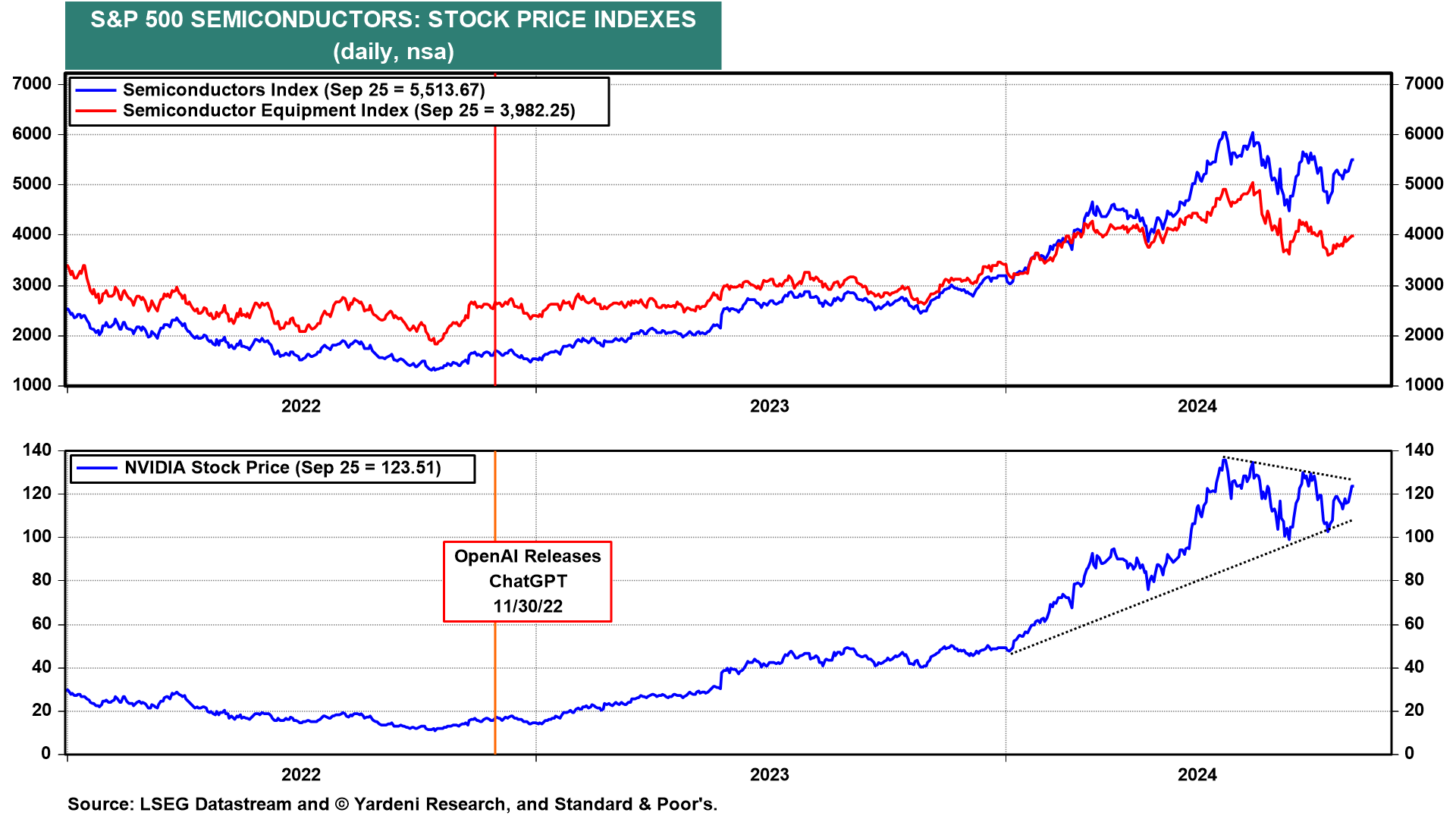

(8) Semiconductors. Micron Technology rose 15% this morning after earnings beat expectations. The semiconductor trade continues to consolidate while the rest of the market rises, consistent with a broadening bull market (chart).