The strength of the US dollar has been a key feature of the post-pandemic bull market. Approaching Jackson Hole, the greenback has been falling. It is now up just 0.5% ytd versus 4.6% seven weeks ago (chart). Is this the start of a new weaker dollar regime? Unlikely. The DXY is still up 10% over the past three years, and it wouldn't surprise us if the dollar rebounded in the coming weeks and months. Here's why:

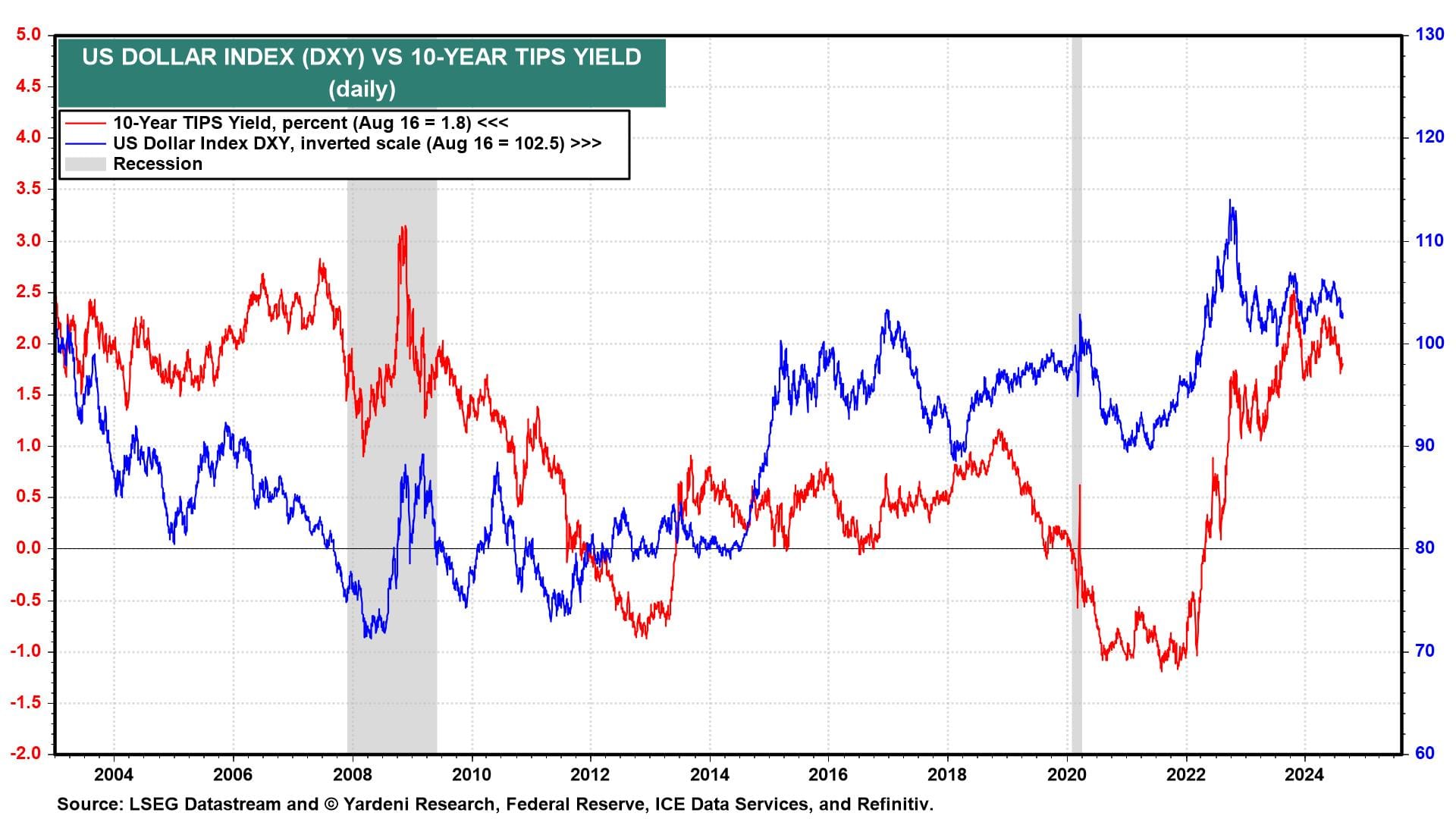

(1) Monetary policy. The dollar has declined alongside the 10-year TIPS yield, which fell below 1.8% on Monday (chart). Elevated expectations of 100-125bps cuts in the federal funds rate (FFR) over the coming six months have helped sink the entire Treasury yield curve. We expect Fed officials to push back against these expectations if the next batch of economic indicators beat expectations, as we expect, giving a lift to real interest rates.