April's national survey of manufacturing purchasing managers will be out on Monday. We expect that the M-PMI composite index is likely to remain around its March reading of 57.1

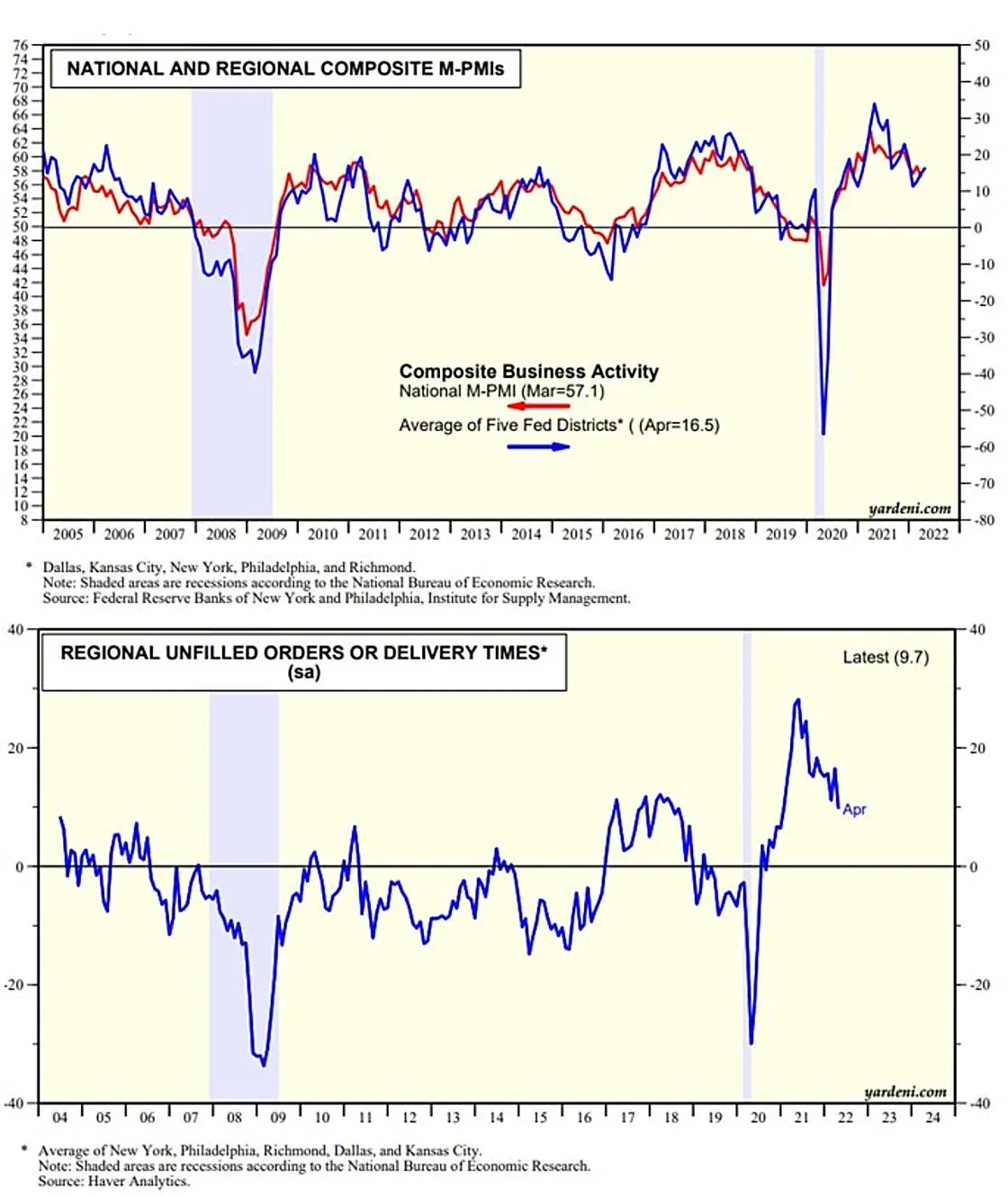

April's national survey of manufacturing purchasing managers will be out on Monday. We expect that the M-PMI composite index is likely to remain around its March reading of 57.1 given the uptick in the average of the regional business activity indexes compiled by the five Federal Reserve district banks that produce them based on regional surveys.

The average of the five regional indexes for unfilled orders and delivery times continued to fall in April, suggesting that supply-chain disruptions are easing. However, the impact of pandemic-related lockdowns in China could soon be a setback to this improvement. The bad news is that the averages of the Fed banks’ prices-paid and prices-received indexes remained elevated around recent record highs.

This is consistent with our stagflationary economic outlook for this year. However, this is mostly good news for corporate revenues and probably for corporate earnings too, just as long as companies can continue to pass their costs onto their customers.