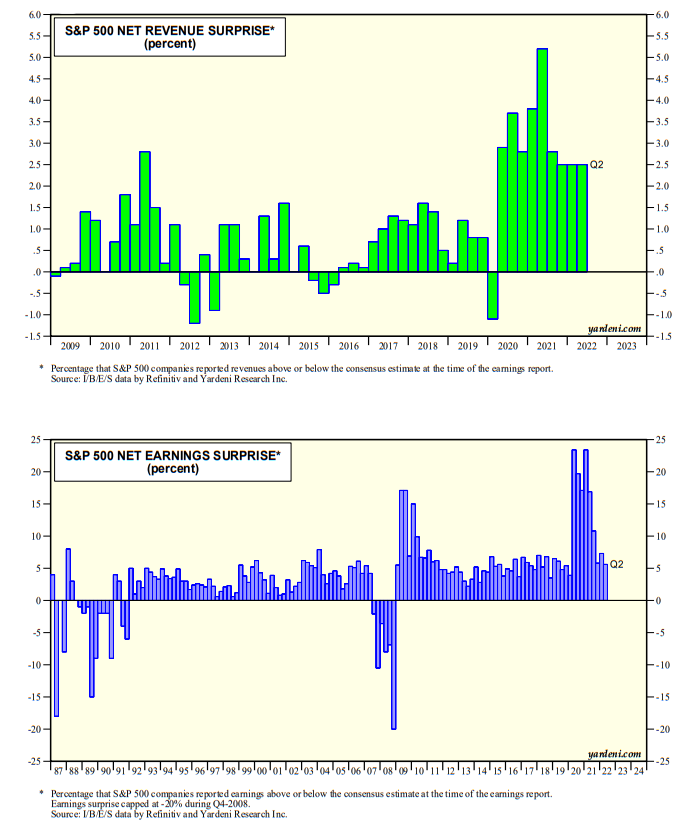

As of mid-day Wednesday, 356 (or 71%) of the S&P 500 companies reported their Q2 results. Both the revenues and earnings surprises were positive, but relatively low for the third quarter in a row:

(1) Revenues are beating the consensus forecast by 2.5%, and earnings have exceeded estimates by 5.6% so far (chart below).

(2) Collectively, the companies have a y/y revenue gain of 15.0% and an earnings gain of 10.9%. Those growth rates have been slowing since Q1-2021.

(3) So far, 68% of the Q2 reporters have reported a positive revenue surprise, while 77% have beaten earnings forecasts.

(4) These figures are bound to change as more Q2 results are reported in the coming weeks, particularly from the struggling retailers. While we expect y/y growth rates to remain positive in Q2, we think revenue and earnings surprises will be moderate due to the slowing economy, rising inventories, and higher costs.