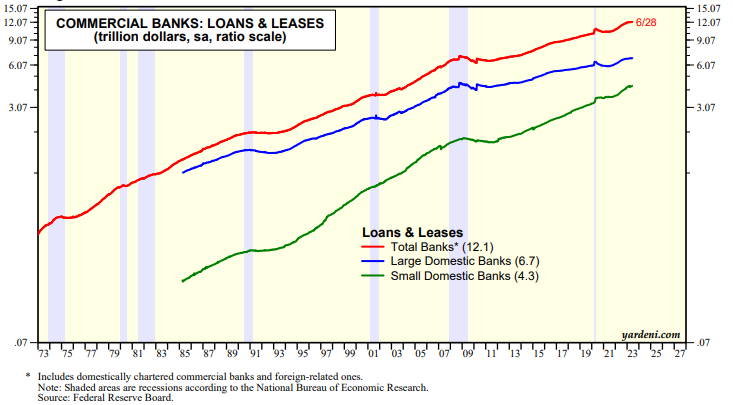

The Q2 earnings season starts off this week with the major banks reporting their results. Based on weekly data provided by the Fed, we know that loans and leases at the large domestic banks rose modestly by 3.0% y/y through the end of June (chart). There's no sign of a credit crunch so far following March's banking crisis, which was quickly contained by the Fed.

We also know that allowances for losses increased 16.9% over the same period (chart). Banks undoubtedly responded to the banking crisis in early March by raising their deposit rates. That probably squeezed their net interest margins.