Fed officials often have said that they want to make sure that inflation is “well anchored.” In other words, they want to see that inflationary expectations are low. So it was a bit unsettling that Friday’s release of the consumer sentiment survey for the first half of November showed the one-year expected inflation rate jumped from 3.2% in September to 4.2% in October and 4.4% in early November. The survey’s five-years-ahead inflationary expectations rose from 2.8% to 3.2% over this same interval.

On the other hand, on Monday, we learned that the comparable readings for October’s consumer survey conducted by the Federal Reserve Bank of New York were 3.6% over the coming year and 2.7% over the next five years (chart). So they show that inflationary expectations remain reasonably well anchored.

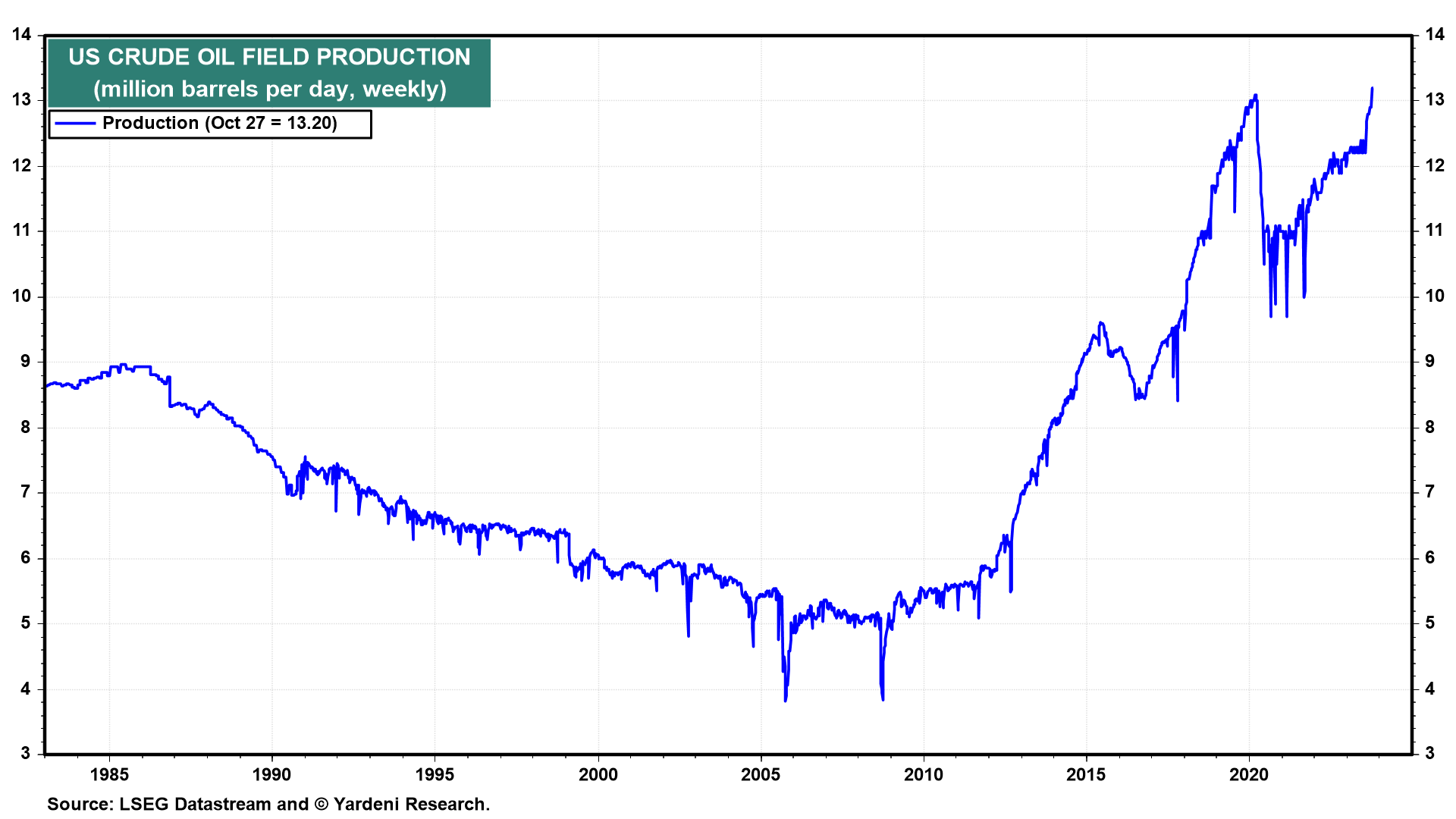

The increase in the November consumer survey’s inflationary expectations seems odd given that its year-ahead response tends to be highly influenced by the price of gasoline, which has been falling since early October. The recent weakness in gasoline prices reflects record-high crude oil field production in the US (chart).

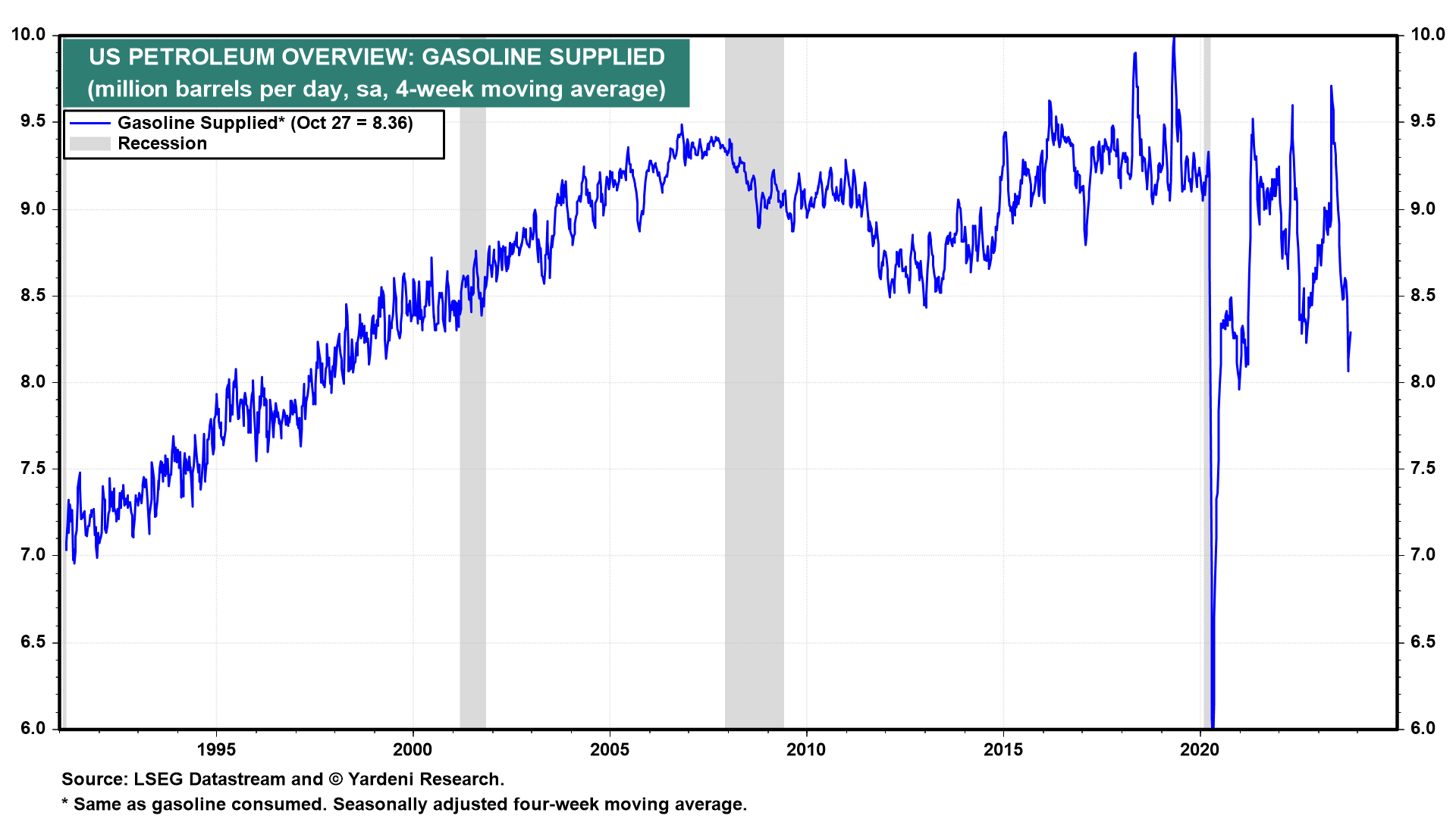

Furthermore, we seasonally adjusted the four-week moving average of gasoline consumed in the US (chart). It peaked this year at 9.7 million barrels per day (mbd) through May 1 and plunged to 8.4 mbd at the end of October.

Since the pandemic, consumer demand for gasoline has been more price elastic. That’s because more people are working from home. With less need to commute to work, more driving is discretionary now. So when gas prices go up, people have the option of consuming less gas by driving even less often to work and around their neighborhoods.