All of a sudden, we are hearing more chatter about deflation. Yes, that's right: deflation. The story line is that the regional banks will respond to the SVB debacle by lending less to lots of middle market businesses, especially if depositors move their funds to the money center banks or to the money markets. The result will be a credit crunch and a hard landing forcing companies to cut their prices and labor costs by cutting wages and payrolls.

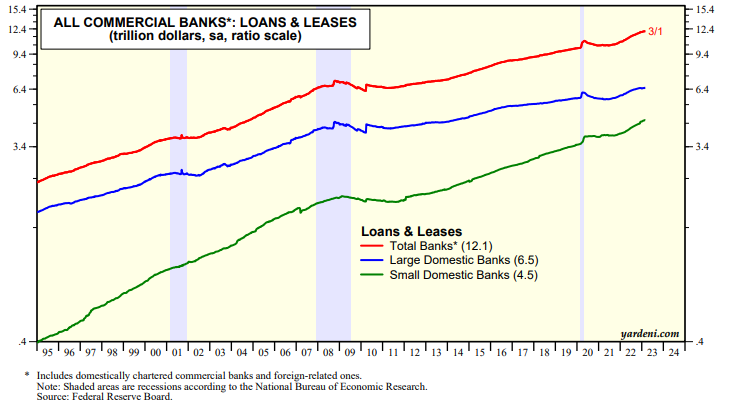

We've often observed that recessions are caused by financial crises triggered by the tightening of monetary policy that turn into credit crunches. We aren't convinced that the SVB crisis will morph into a credit crunch. But we will track the weekly data on loans on the books of large and small banks. During the March 1 week, loans and leases at the banks totaled $12.1 trillion, consisting of $6.5 trillion at large domestic banks and $4.5 trillion at small domestic ones (chart). They were all at record highs. There’s clearly no sign of a credit crunch in the loan data, so far.

By the way, our good friend Michael Brush, who is a regular contributor to MarketWatch, reports that banking insiders have stepped up in a "huge way" to buy the shares of regional banks, "the ones that are supposed to lose all their deposits to the big money center banks." Michael posits that regional depositors may diversify where they keep their bank deposits resulting in no significant loss for the regionals collectively. So we will also be tracking the weekly data on deposits at the large and small banks.

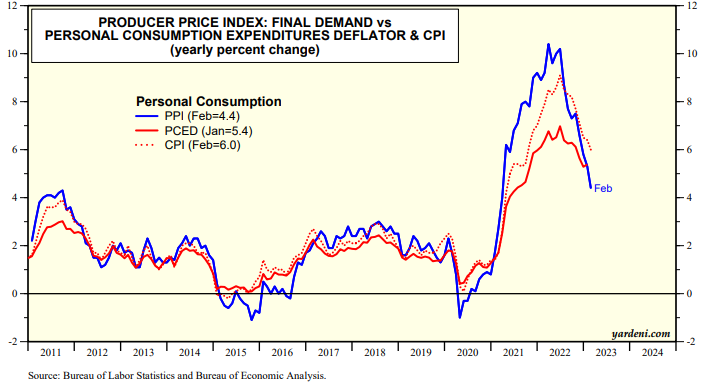

Meanwhile, February's PPI report released today showed a 0.1% decline, below the estimate for a 0.3% increase. That supports our disinflation forecast, but it also might have fanned fears of deflation, pushing bond yield lower today. The PPI for final demand fell to 4.6% y/y during February, the lowest since early 2021. The same can be said for the PPI for personal consumption, which fell to 4.4% (chart).

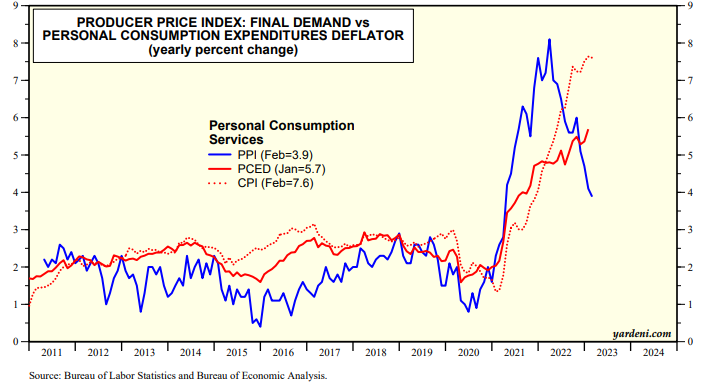

The PPI inflation rate for personal consumption on services is down from a peak of 8.1% early last year to 3.9% in February (chart). The services components of both the CPI and PCED are much higher at 7.6% and 5.7% because they include rent, which is likely to disinflate during H2-2023.