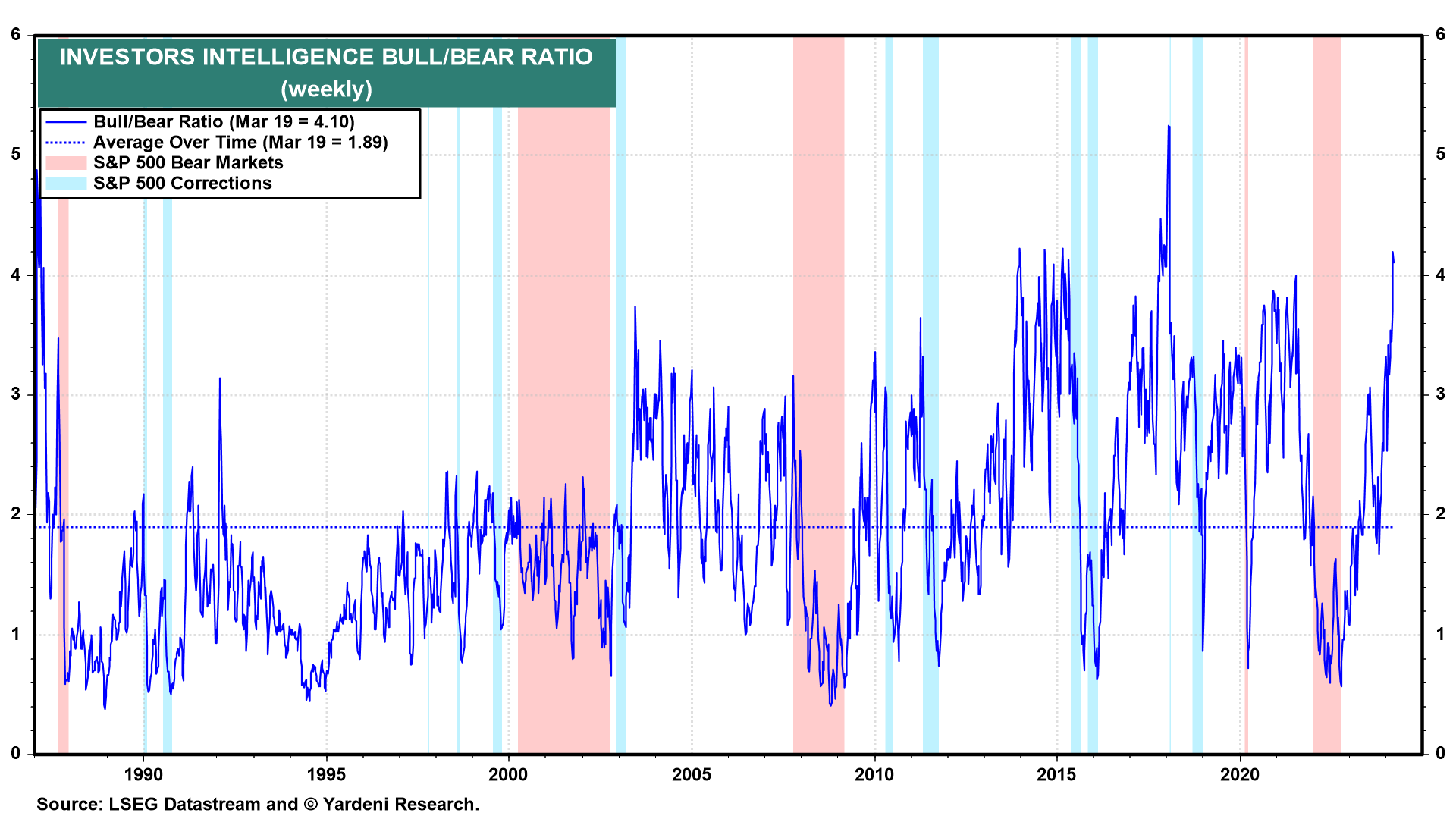

Powell & Co. were more dovish today than we (and stock investors) expected. The FOMC's Summary of Economic Projections (SEP) still implied three 25bps cuts in the federal funds rate (FFR) this year (table). That's the same projection as in December's SEP even though the median forecast was raised for real GDP growth (to 2.1% from 1.4%) and the core PCE inflation rate (to 2.6% from 2.4%). The FFR is expected to be lowered to 3.1% by 2026, above the longer-run rate of 2.6% (revised up from 2.5%), which is only 0.6% above the FOMC 2.0% projection of the longer-run inflation rate.

The S&P 500 rallied to a new record high as Fed Chair Jerome Powell confirmed the dovish posture of the FOMC during his presser today. The FOMC statement noted: "The Committee does not expect it will be appropriate to reduce the [FFR] target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent." However, two weeks ago in congressional testimony and during his presser today, Powell reiterated that "if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year."

We expected that he would dial back his "dialing back policy restraint" statement today, but he didn't do so. Nevertheless, he did say: "We are prepared to maintain the current target range for the federal funds rate for longer if appropriate."

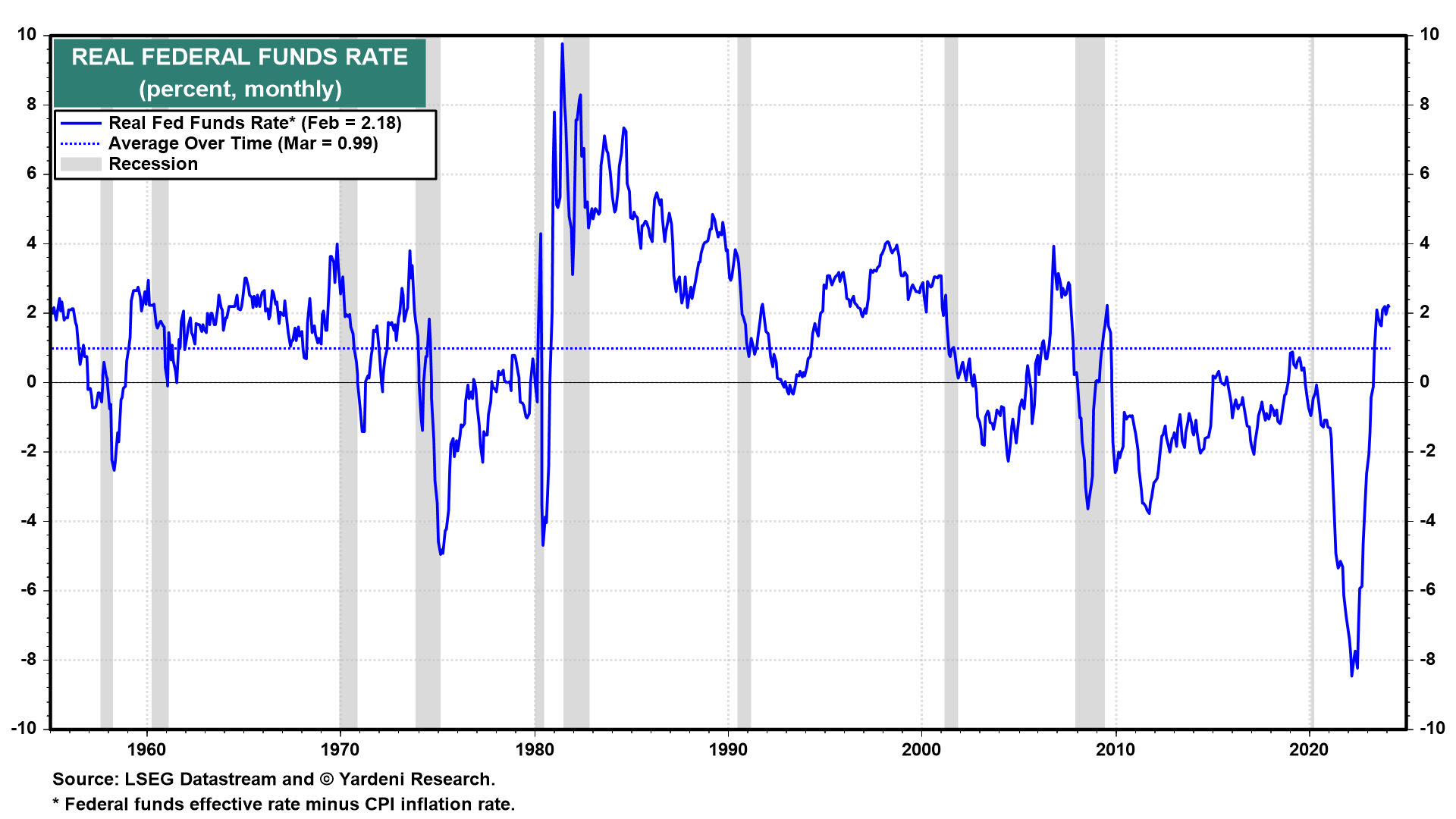

Powell and his colleagues seem to share the view that if inflation continues to moderate they will have to lower the FFR so it doesn't become too restrictive and cause a recession. If inflation falls to 2.0% and the FFR remains at 5.25%, the real FFR would be 3.25%. History shows that several previous recessions occurred after the FFR rose above 3.00% (chart).

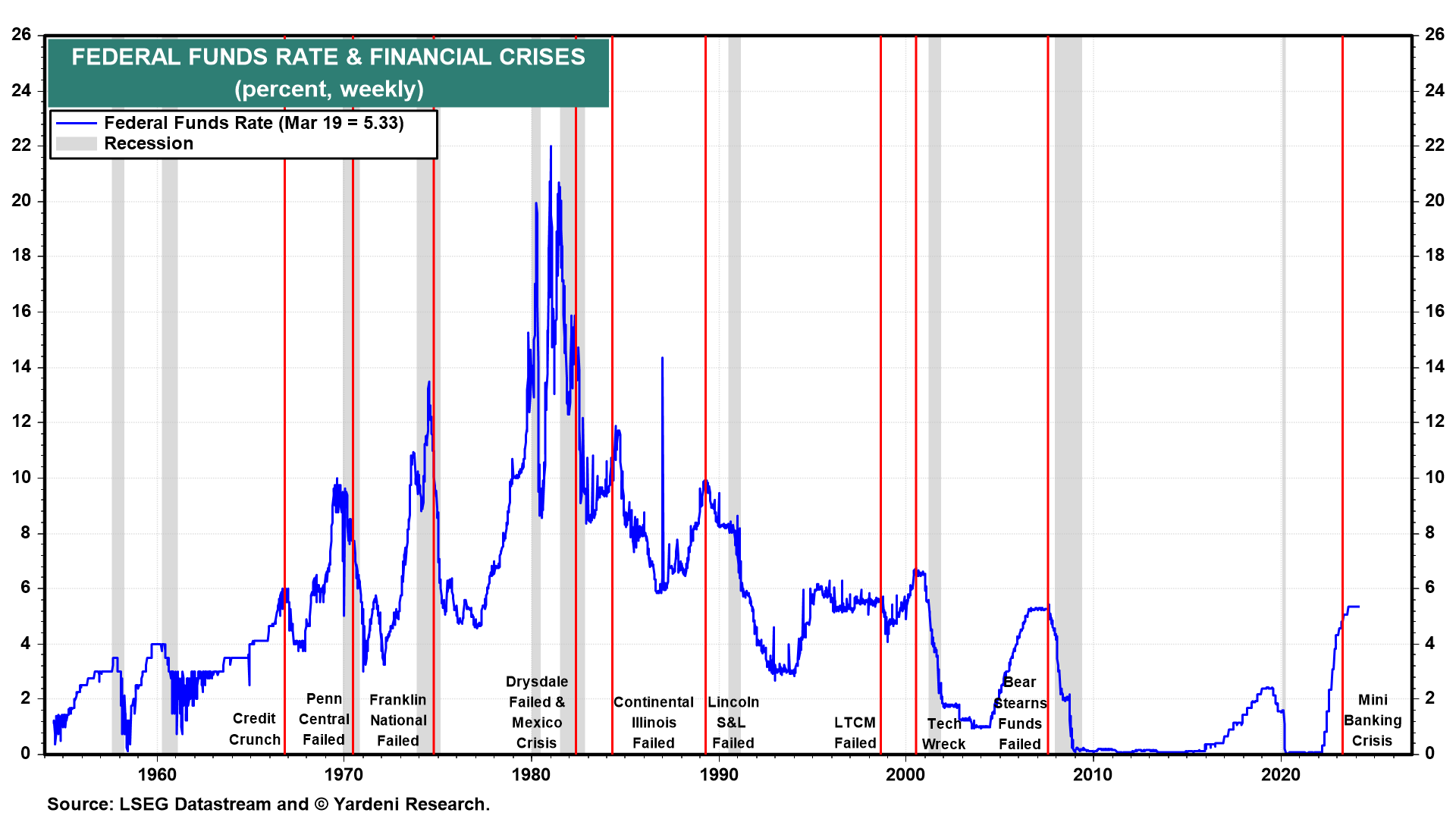

Then again, history also shows that recessions tend to be caused by the tightening of monetary policy until it triggers a financial crisis that is quickly followed by a credit crunch, which causes a recession (chart). It is financial crises that have caused the Fed to lower the nominal FFR in the past, not a perception that the real FFR was about to cause a recession.

We are still projecting either no rate cut this year or two at most after the presidential election on November 5. We are still targeting 5400 on the S&P 500 by yearend, but it could certainly happen much sooner given that it is only 3.5% above today's record close, and it is only March 20!

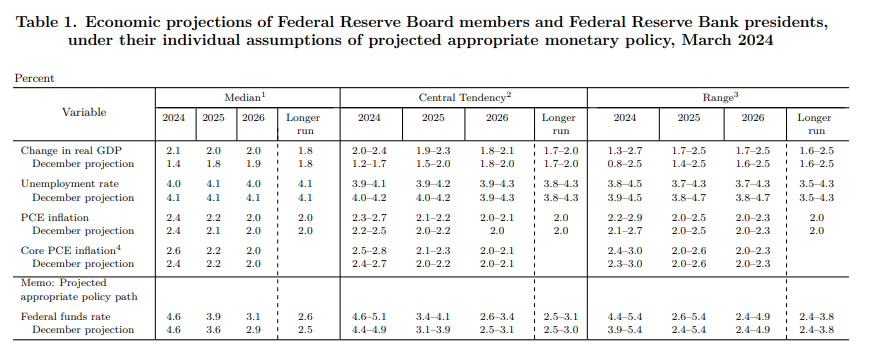

Meanwhile, almost everybody is bullish. The Investor Intelligence Bull/Bear Ratio was 4.1 this past week, the second week in a row above 4.0 (chart).