Fed Chair Jerome Powell's dovish congressional testimony yesterday and today stoked the hot trades in the financial markets from Nvidia to bitcoin to gold: "We're waiting to become more confident that inflation is moving sustainably at 2%. When we do get that confidence, and we're not far from it, it'll be appropriate to begin to dial back the level of restriction," Powell said in response to a question about rates and inflation in his testimony today. He said the easing of monetary policy would be needed so that the Fed doesn't drive the economy into recession rather than normalizing policy as the economy gets back to normal."

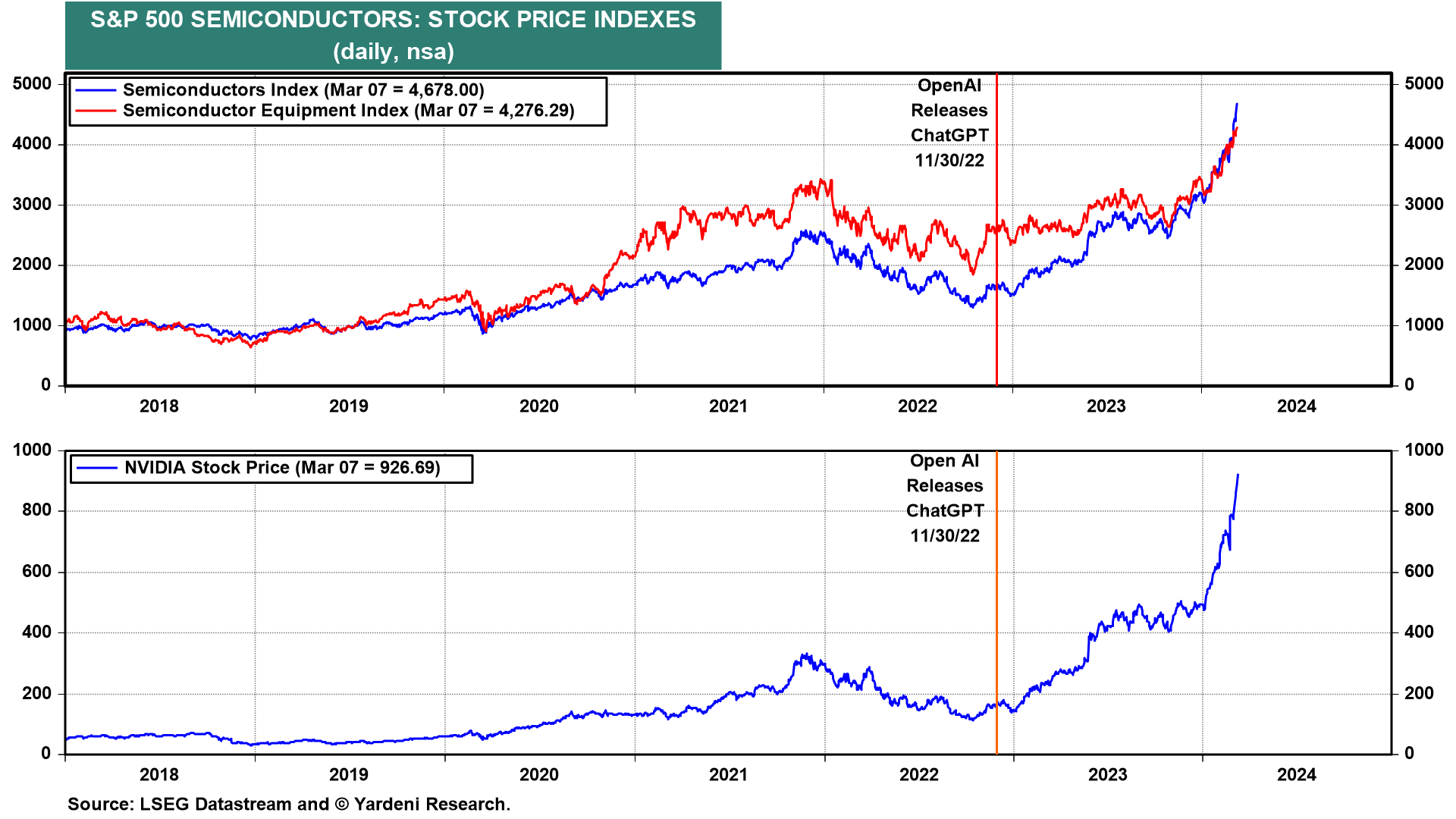

Rising to new record highs today were the S&P 500 (up 1.0%) and the Nasdaq (up 1.5%). Leading the way higher was the S&P 500 Semiconductor stock price index (up 3.9%), which in turn was led by Nvidia (up 4.5%) (chart).

Bitcoin ETFs were approved by the SEC on January 10 and started trading on January 11 (chart). The cryptocurrency is up more than 50% since then. Interestingly, the current bull market in bitcoin started on November 22, 2022. On November 30, OpenAI introduced ChatGPT triggering the "Roaring 2020s" AI gold rush.