The Federal Open Market Committee (FOMC) left the federal funds rate (FFR) unchanged between 5.25%-5.50% at today's meeting, as expected. Fed Chair Jerome Powell did signal that a 25bps rate cut is highly likely at the September meeting now that the labor market is "normalizing" and inflation is cooling.

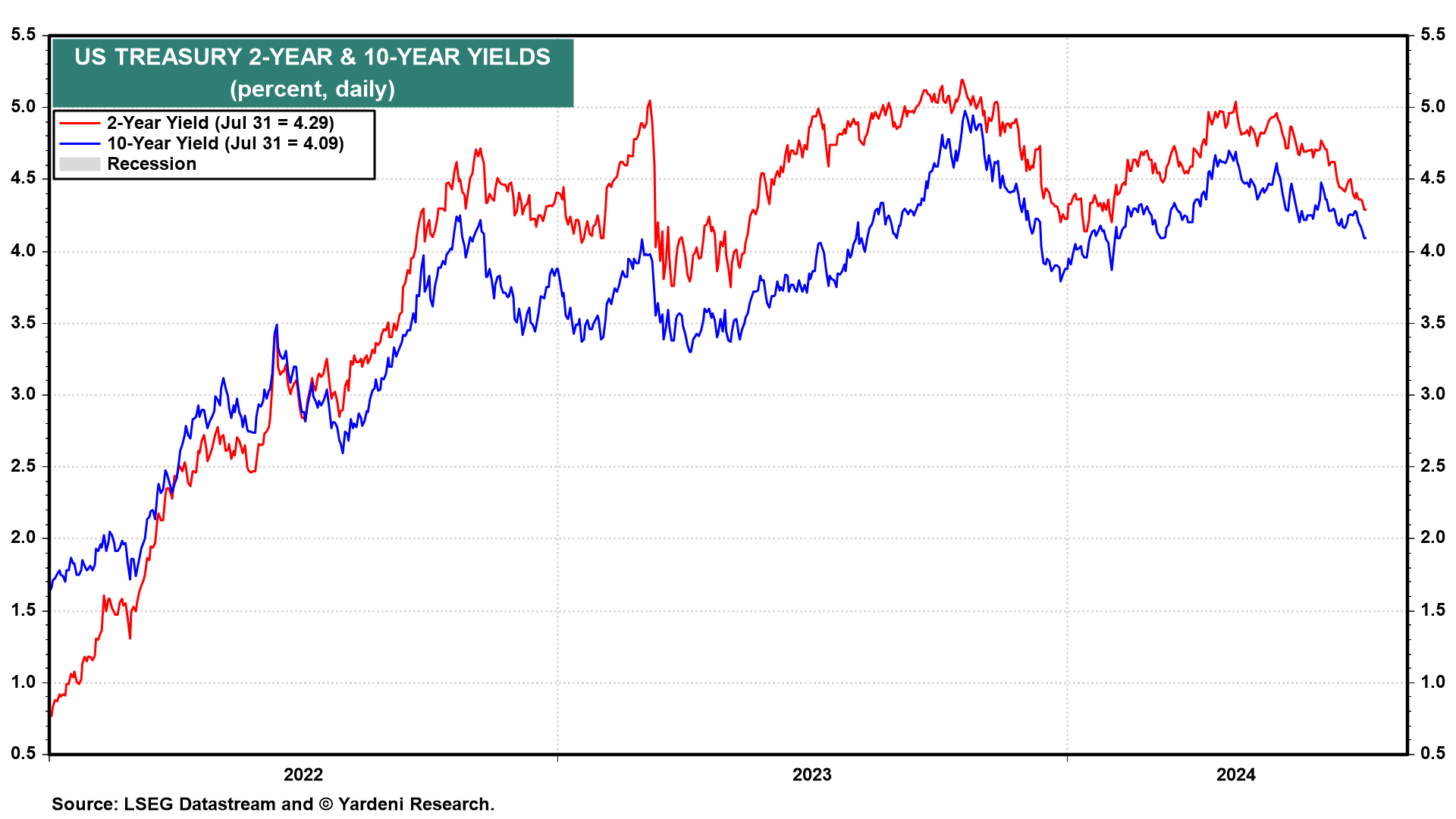

The 2-year and 10-year US Treasury yields slid by about 6 basis points during Powell's press conference today, with the 10-year ending the day around a 4-month low (chart). The bond market was also comforted by the Treasury Department's quarterly refunding announcement; the fiscal agent said it wouldn't be increasing the size of bond auctions for the foreseeable future. Tax revenues from the growing economy continue to boost the government's coffers.

The stock market liked what it heard from Powell, as well as the recent batch of Q2 earnings reports. The Roundhill Magnificent-Seven ETF (MAGS) rose 3.4% and the PHLX Semiconductor sector jumped 7.0%. Today's rally was a broadening rather than an unwinding of the rotation into interest rate-sensitive SMidCaps, as the Russell 2000 added 1.2% (chart).