The monetary policy hawks may be coming home to roost at the Fed's November 6-7 meeting. September's CPI was hotter-than-expected, thanks to sticky services inflation. Meanwhile, Fed Chair Jerome Powell and the other doves on the Federal Open Market Committee who worried about a weakening economy have less credibility since Friday's jobs report showed the unemployment rate fell further and payrolls reached a new record.

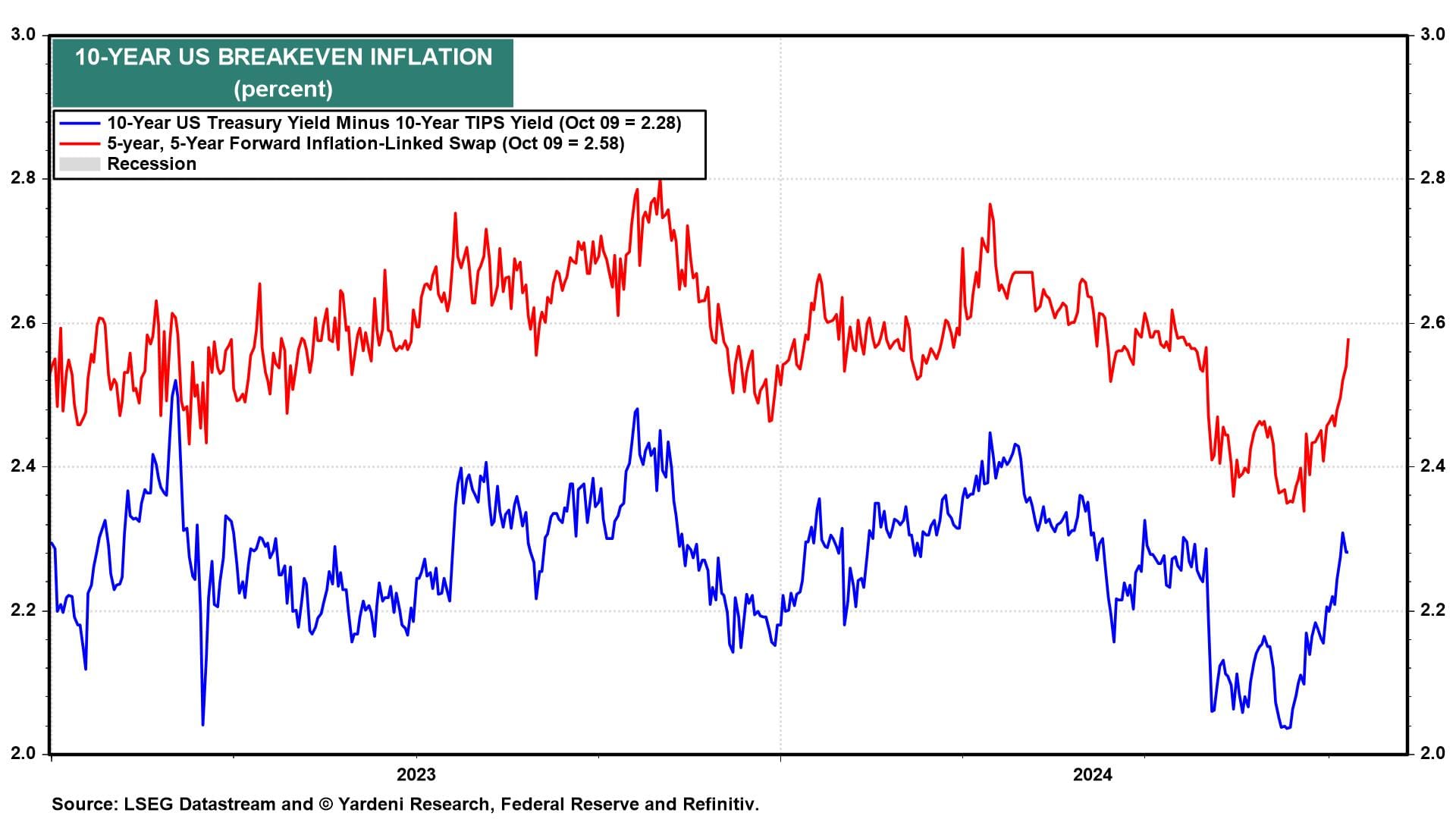

Today's CPI data support our story that the Fed shouldn't cut the federal funds rate (FFR) at its two remaining meetings this year. The bond market has been signaling the same since the Fed's 50-bps rate cut on September 18. The 10-year yield has risen from 3.63% to 4.11% today thanks to increasing inflation expectations (chart). Meanwhile, stocks edged only slightly lower off their new record highs set yesterday. Any additional rate cuts would increase the odds of a stock-market meltup. Here's more on today's data:

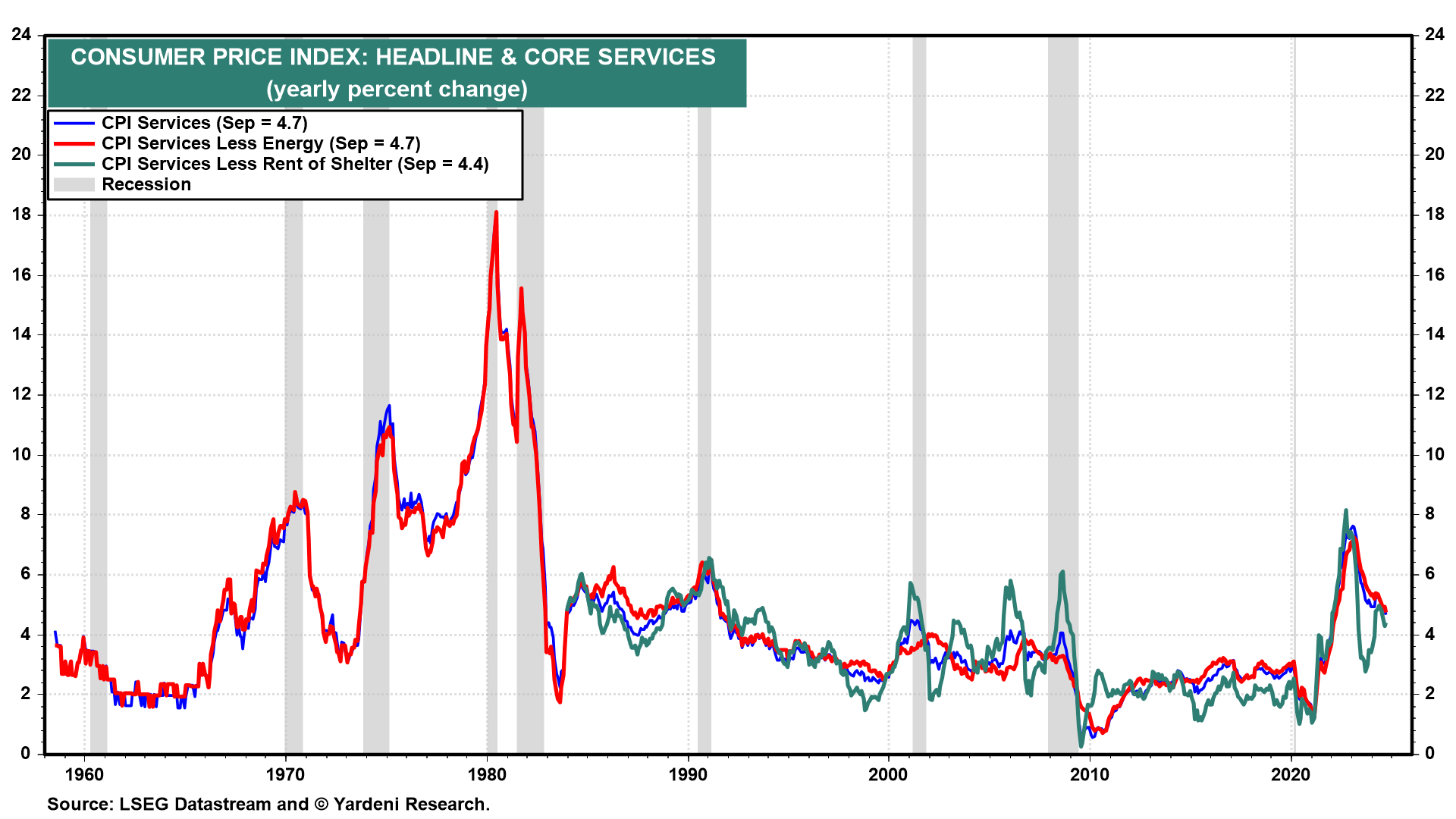

(1) Supercore inflation. In late 2022, Fed Chair Jerome Powell pointed to so-called supercore inflation (core services inflation, excluding housing) as possibly “the most important category for understanding the future evolution of core inflation.” Today, supercore CPI inflation ticked up from 4.3% to 4.4% y/y. That's a far cry from "mission accomplished."