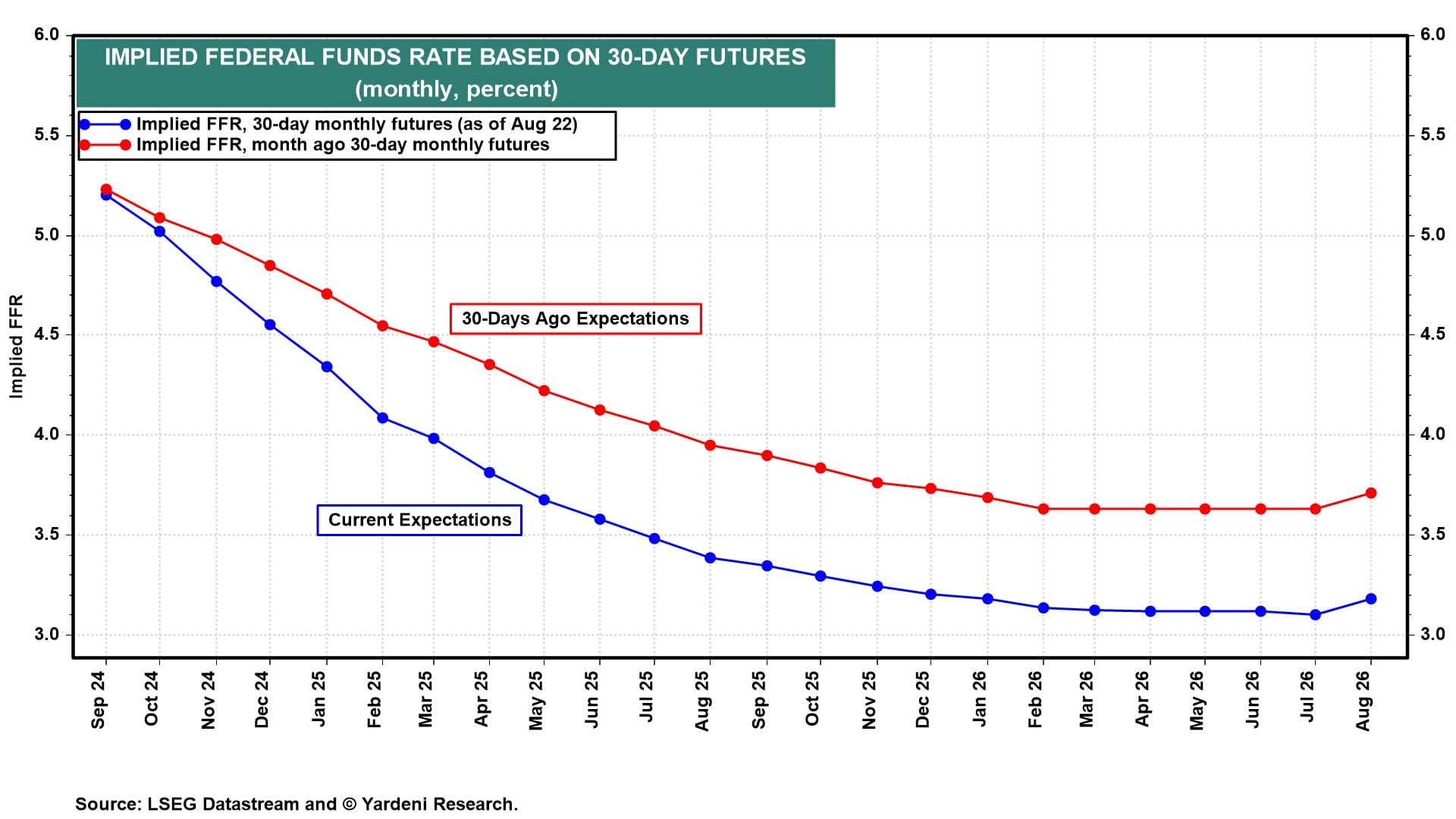

Fed Chair Jerome Powell was dovish in his Jackson Hole speech today. He didn't hedge. He didn't push back against market expectations of several rate cuts ahead as we anticipated he might. He wasn't more dovish than the market, but he didn't utter any hawkish views whatsoever to alter the market's dovish expectations for several rate cuts (chart).

Powell unambiguously declared that the Fed is now on course to lower interest rates: "The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks." So the only ambiguity about coming rate cuts is how many and how much.