Today and Monday were two good days for the bulls. The question is whether the 5.7% jump in the S&P 500 is just a mini relief rally in a major bear market, or a sign that the worst is over. We are inclined to sit on the fence with our trading-range outlook for the rest of the year.

We think that the range is between the August 16 high of 4305 and the June 16 low of 3666, which was briefly tested last week when the index fell to a new bear-market low of 3585 on Friday, September 30. We expect to be at the top end of the range by the end of the year as a result of the traditional yearend Santa Claus rally. After all, September, which is traditionally a bad month for stocks, was a really bad one this year.

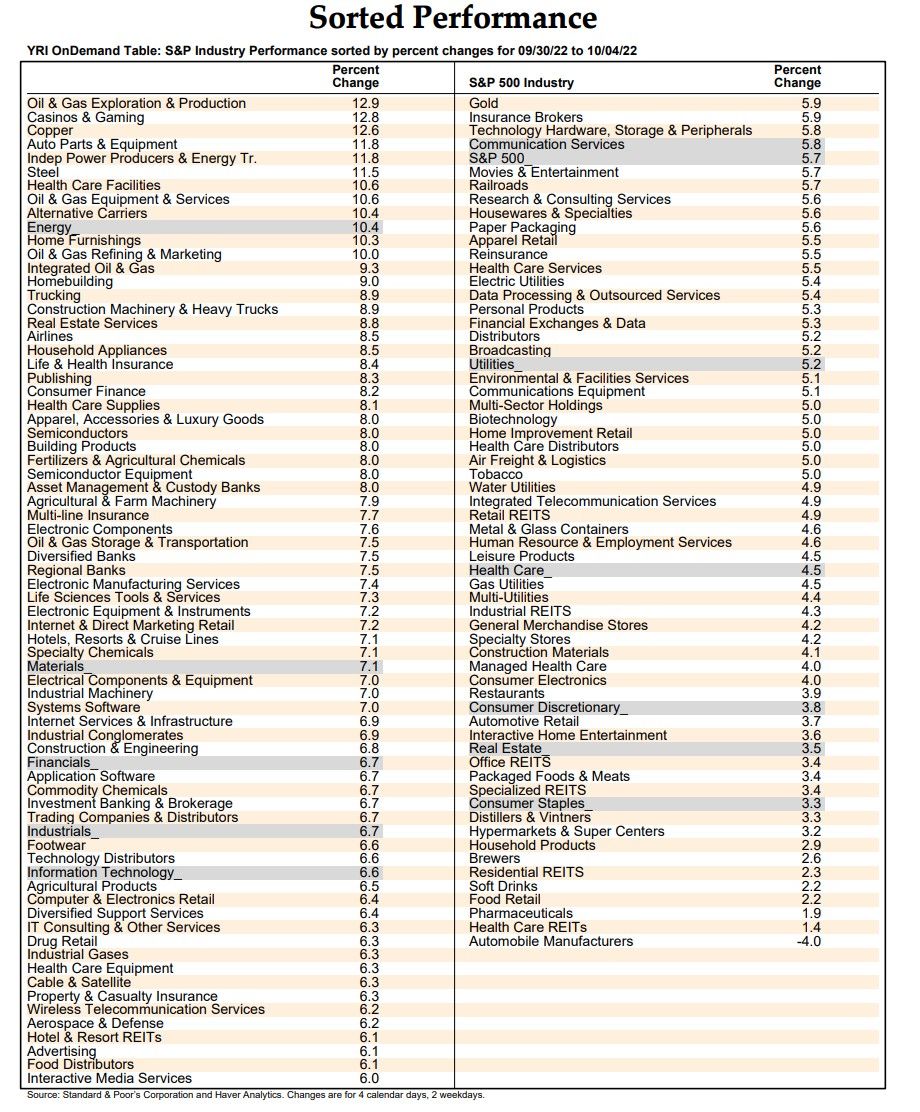

The two-day performance derby below shows that every S&P 500 sector and all but one S&P 500 industry (of the 100+ we track) were up. Last week was all about risk off. The past two days were all about risk on. The most cyclical sectors and industries outperformed the S&P 500, while the defensive ones lagged behind.

Maybe it was all just a short-covering rally, or maybe the economic and earnings outlook isn't as recessionary as widely feared.