The comedian Rodney Dangerfield often lamented during his hilarious monologues , "I don't get no respect." That applies to the stock market rally since October 12. The naysayers are saying that it is a bear market rally and that the S&P 500 will soon be falling below its October 12 low. They also claim that only the MegaCap-8 stocks have participated in the rally, while most everything else has been left behind.

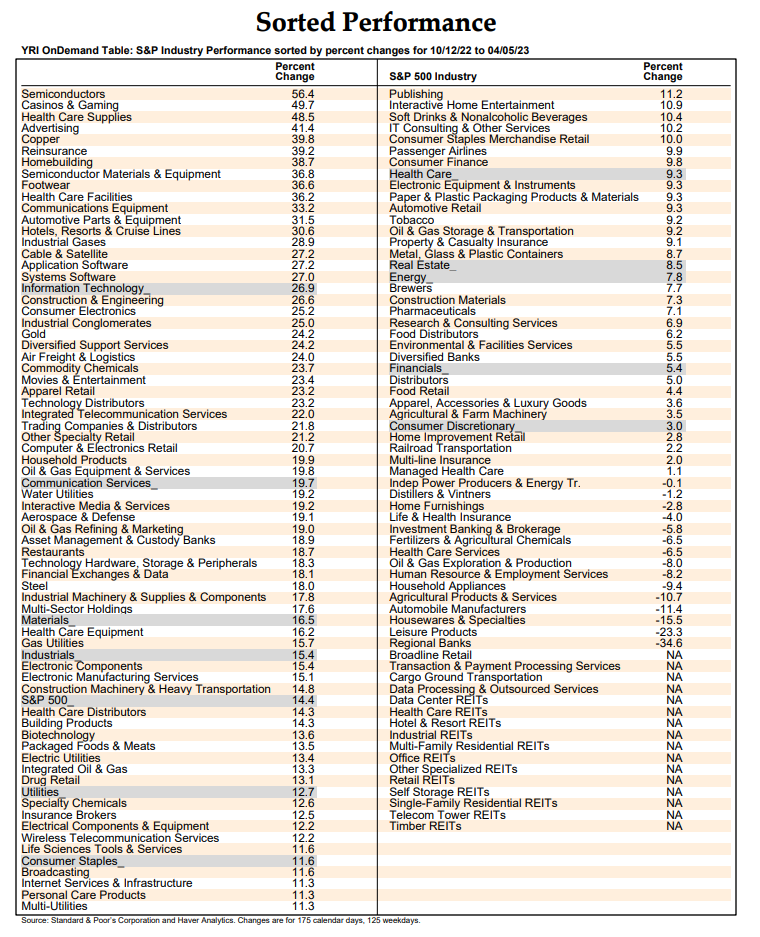

So we ran our performance derby for the S&P 500 along with its 11 sectors and 100+ industries since October 12 through today's close (table). All of the sectors are up since then. The S&P 500 Information Technology sector has led the 14.4% increase in the broad index with a gain of 26.9%. (The Nasdaq 100 is up 20.2% over this same period. Even the battered Financials sector is up 5.4% even though the S&P 500 Regional Bank industry is down 23.3%. There are numerous industries that don't include any of the MegaCap-8 that are up by at least 20%. Many more are up by at least 10%. Only a few are down during the rally since October 12.

The bears are betting that the banking crisis hasn't been contained and that a credit crunch is underway. We aren't convinced. Nevertheless, we will be tracking the weekly bank data released by the Fed on Thursdays at 4:30 pm on emergency borrowing by the banks and on Fridays at 4:00 pm on the assets and liabilities of the banks. Stay tuned.