Yesterday, we reduced the odds of our Roaring 2020s base-case scenario from 65% to 55% and raised the odds of a stagflationary scenario from 35% to 45%. The latter includes the possibility of a shallow recession later this year, following a buy-in-advance shopping spree during April and May. We did so because Trump's Reign of Tariffs imposed a 25% permanent tariff on imported autos and auto parts last week (effective April 3), the same rate as on imported steel and aluminum (effective March 12). That will raise auto-related prices and costs for consumers and depress auto sales (after a short buying binge). That's just one example of how Trump's tariffs are likely to be increasingly stagflationary later this year. The latest development in the Reign of Tariffs is that Trump wants a 20% tariff on all goods imported from all countries.

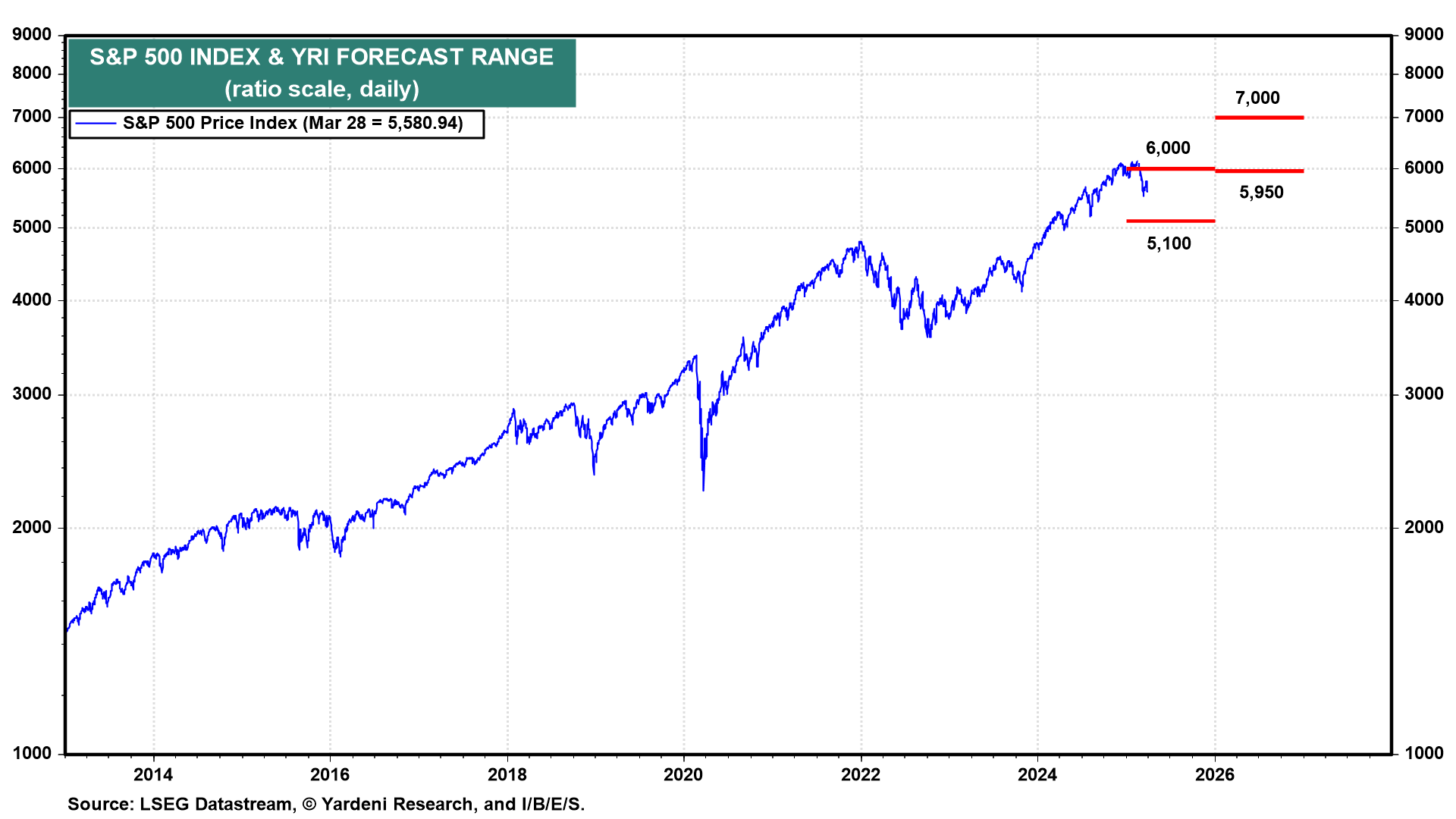

We still expect that the Roaring 2020s scenario will prevail over the remainder of the decade, as it has so far, but after six to 12 months of heightened stagflationary risks for now. So we are lowering our outlook for S&P 500 earnings per share and our S&P 500 stock price targets for 2025 and 2026. We are still targeting 10,000 for the S&P 500 by the end of the decade.

A happy outcome would be that the US would negotiate tariff reductions, but that won't happen if the US slaps a 20% tariff on all imports across-the-board just because Peter Navarro has convinced the President that tariffs will bring $6 trillion in revenue over the next 10 years.

Consider the following:

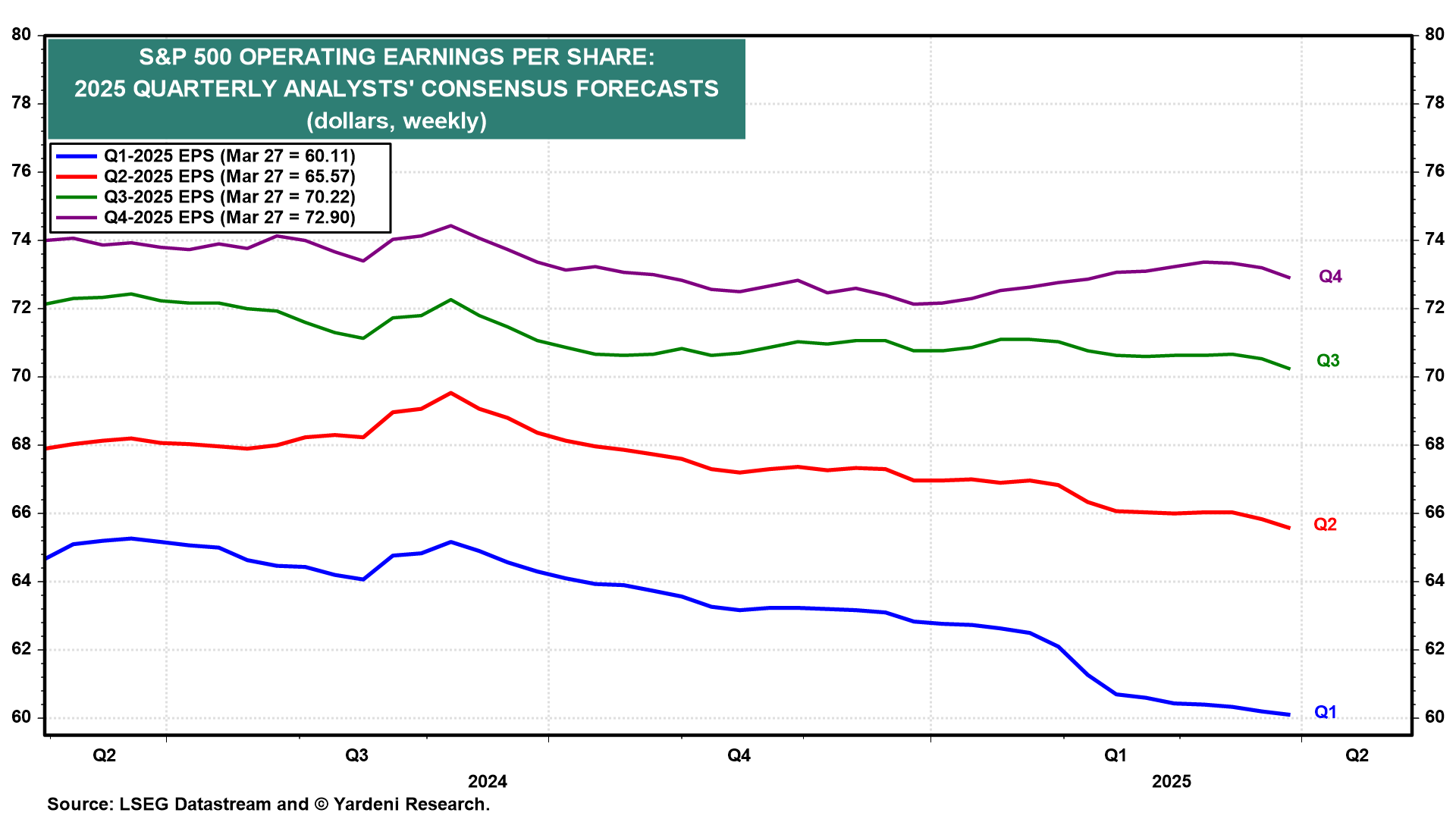

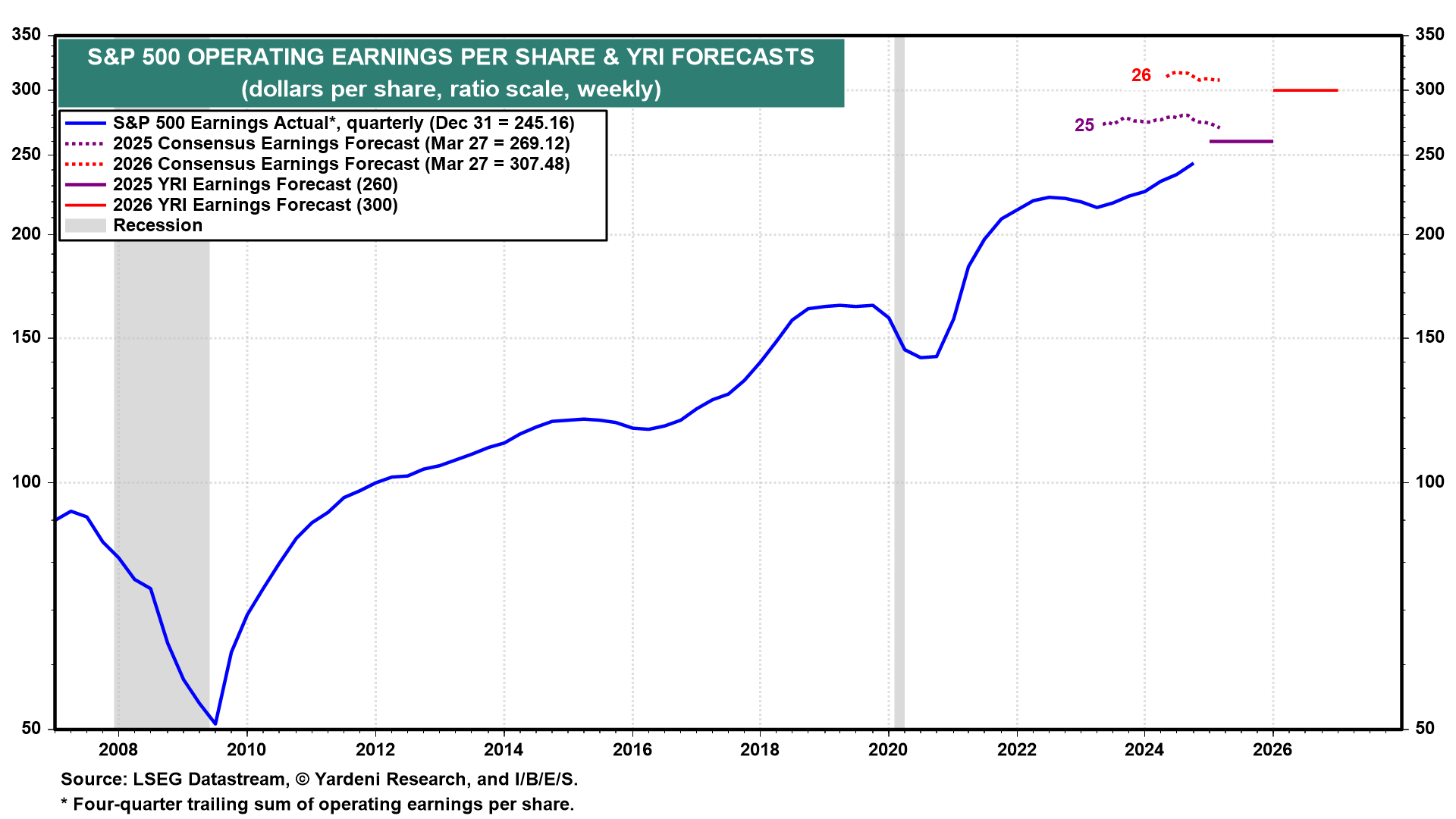

(1) Industry analysts following S&P 500 companies are scrambling to lower their quarterly earnings estimates for H1-2025 (chart). They might continue to do so and cut their H2-2025 estimates more aggressively after Wednesday, when the administration will roll out more tariffs and other countries will likely respond in kind.

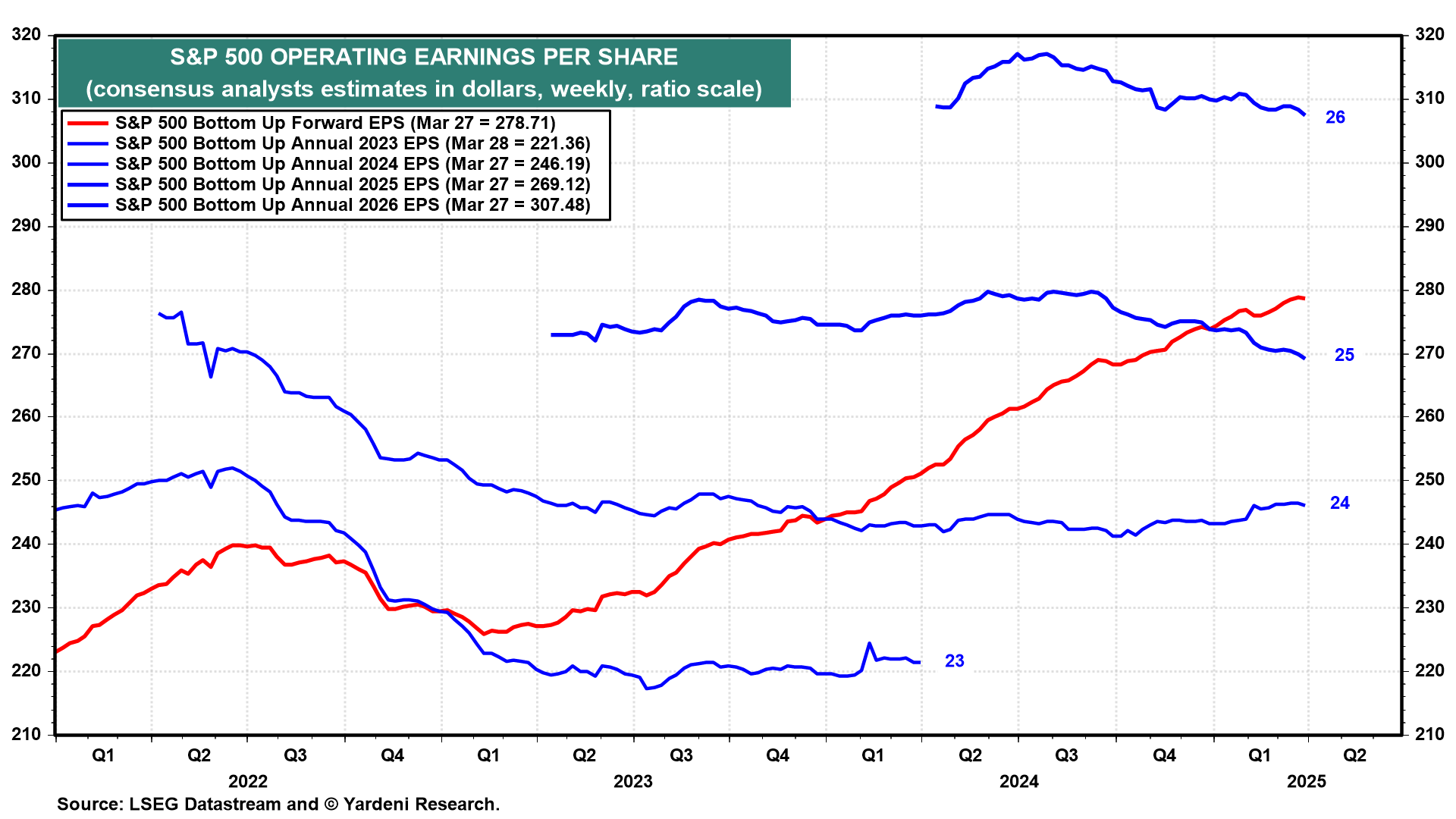

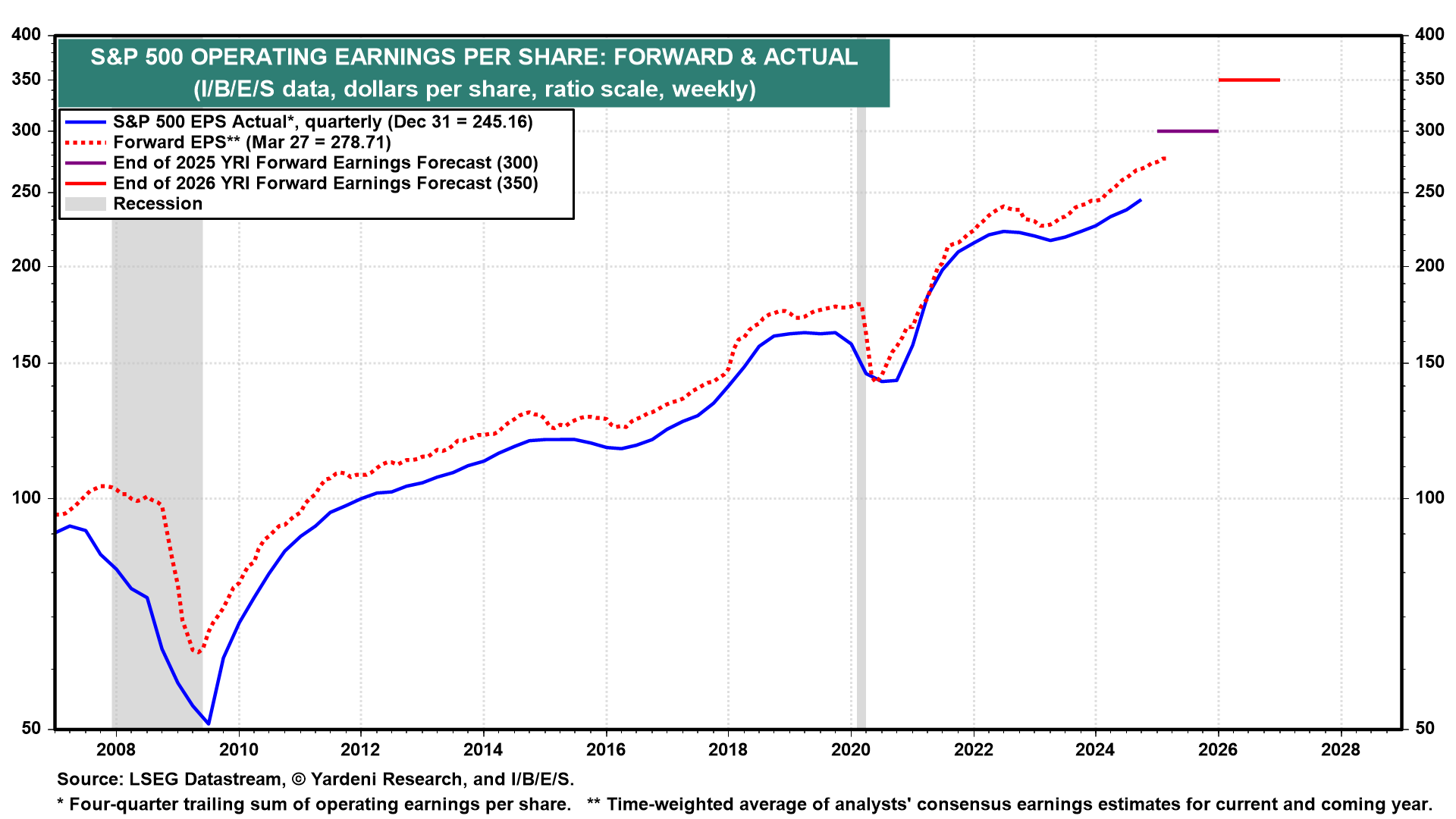

(2) S&P 500 forward earnings has risen to new record highs so far this year despite the downward trends in analysts' consensus earnings expectations for both 2025 and 2026. That's because forward earnings always converges toward the following year’s estimate as the current year progresses, and the 2026 estimate is higher (chart). However, the pace of increase may be starting to slow.

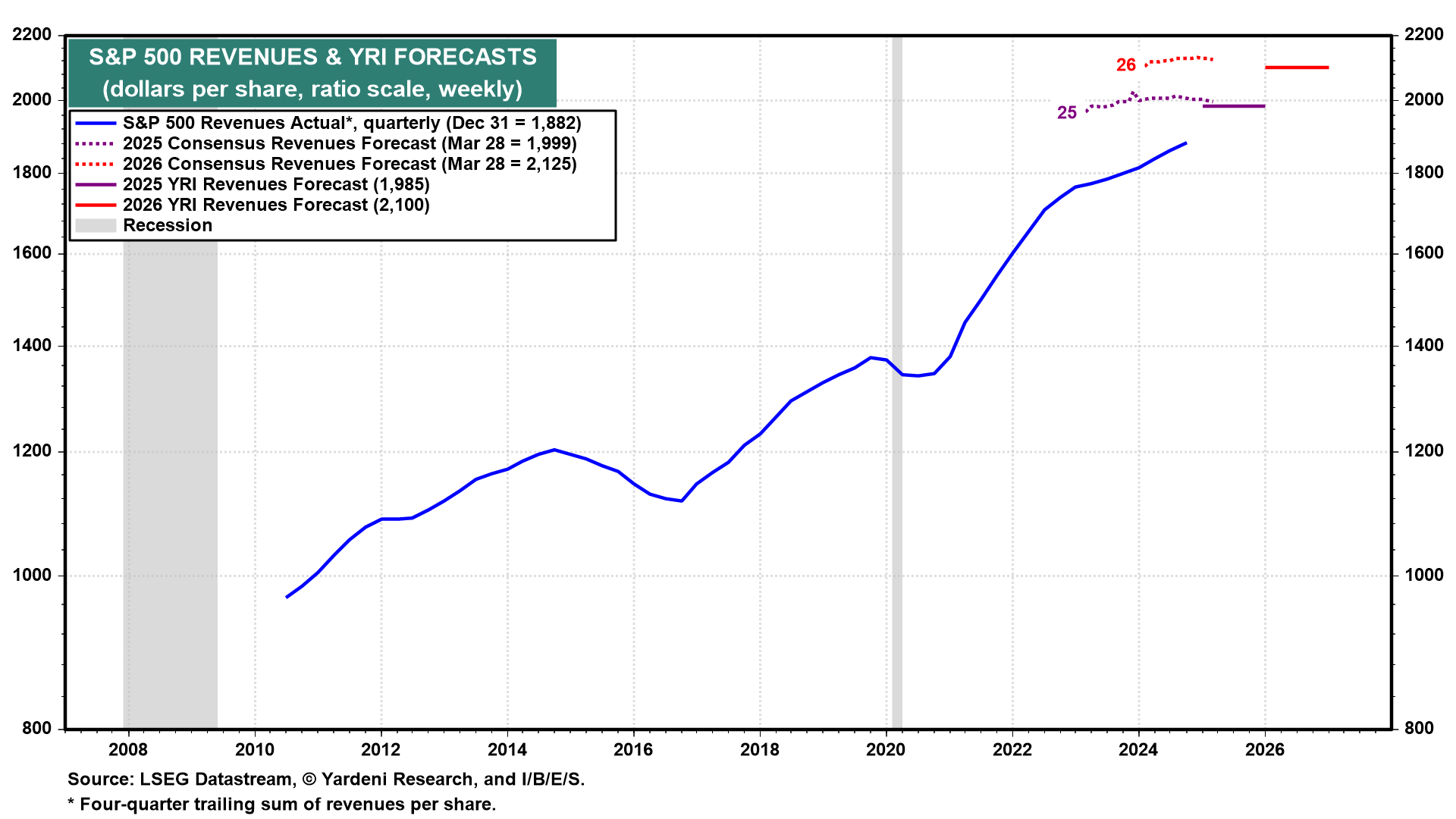

(3) In our base-case scenario, S&P 500 revenues continue to grow solidly (chart). The risk, of course, is that they won't do so if Trump's Reign of Tariffs results in stagflation.

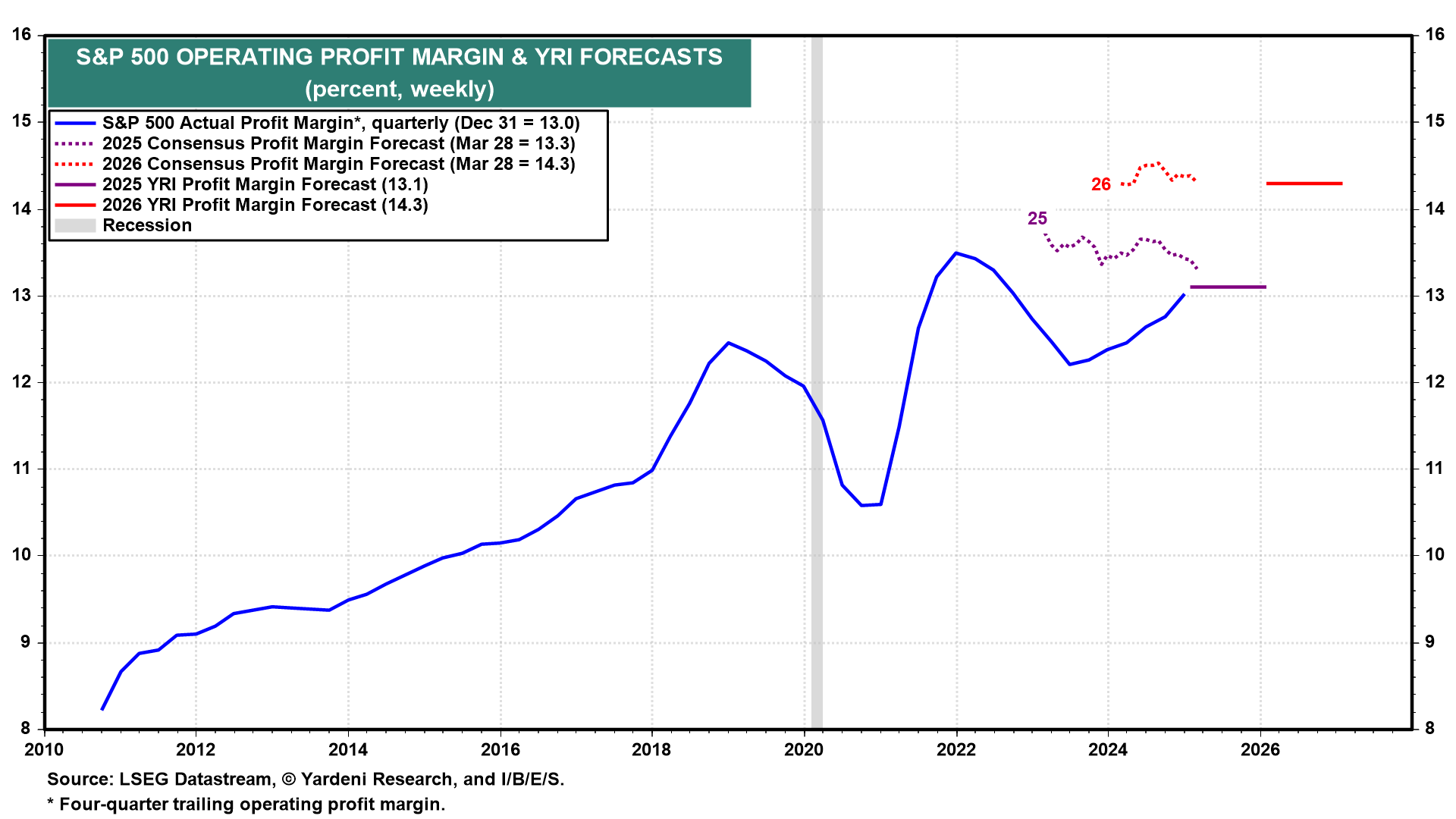

(4) While we aren't lowering our outlook for revenues (yet), we are lowering our estimates for S&P earnings per share from $275 to $260 this year and from $320 to $300 next year (chart). We are doing so to reflect the rising risks of stagflation, which would entail a growth recession and squeezed profit margins.

(5) Our revenues and earnings projections produce estimates of the S&P 500 profit margin at 13.1% this year (about the same as 2024) and 14.3% next year, assuming that the Roaring 2020s scenario makes a comeback in 2026.

(6) Our earnings estimates above lead us to forecast that S&P 500 forward earnings per share will be $300 at the end of this year and $350 at the end of 2026 (chart).

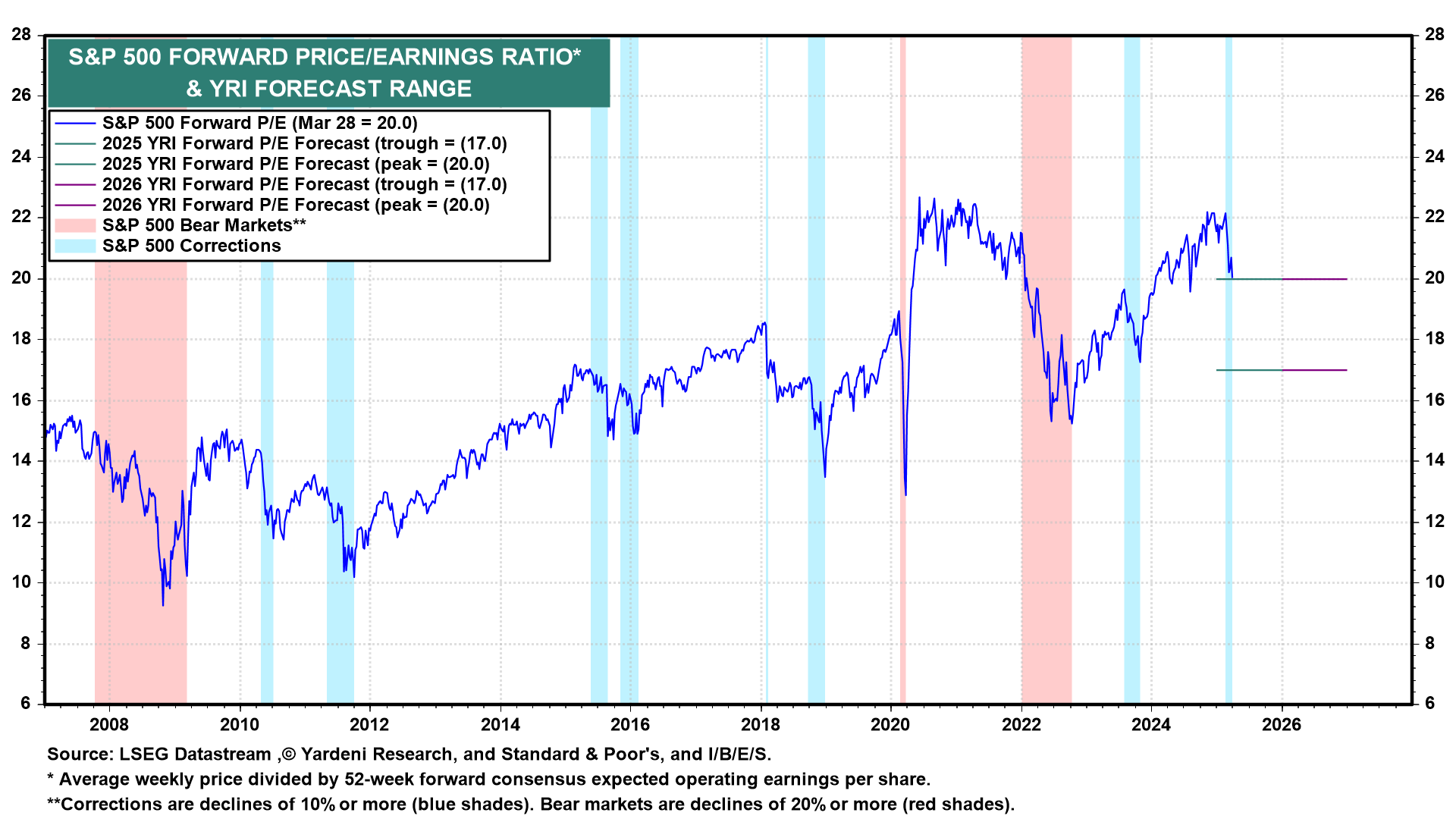

(7) We are projecting a forward P/E range of 17-20 for this year and next year (chart). The top of the range reflects our base-case scenario remaining intact even this year, while the bottom of the range is more consistent with the risks that could thwart that. If a recession occurs, the forward P/E would be lower than 17.

(8) Our S&P 500 stock price targets are simply equal to our estimates of forward earnings times forward P/Es. So we are currently targeting S&P 500 ranges of 5100-6000 this year and 5950-7000 next year. In our base-case, the S&P 500 would end the year at 6000, a small gain on a year-over-year basis and 7000 at the end of next year.