As a result of the AI gold rush, billions of dollars are being spent on Nvidia’s GPUs. They seem to be the only game in town. Huge investments in AI-related hardware and software are likely, eventually, to boost productivity significantly. That’s great for our Roaring 2020s scenario. We simply don’t know at this time how long “eventually” will turn out to be. The lack of numerous suppliers of GPUs may be stimulating a feeding frenzy among users, who may be ordering and hoarding more of Nvidia’s chips than they really need. Double ordering followed by cancellations is a recurring cyclical problem in the semiconductor industry.

But for now, it’s hard to argue with success. Nvidia is enjoying monopoly power in a market that is hungry for its red-hot chips. Consider the following:

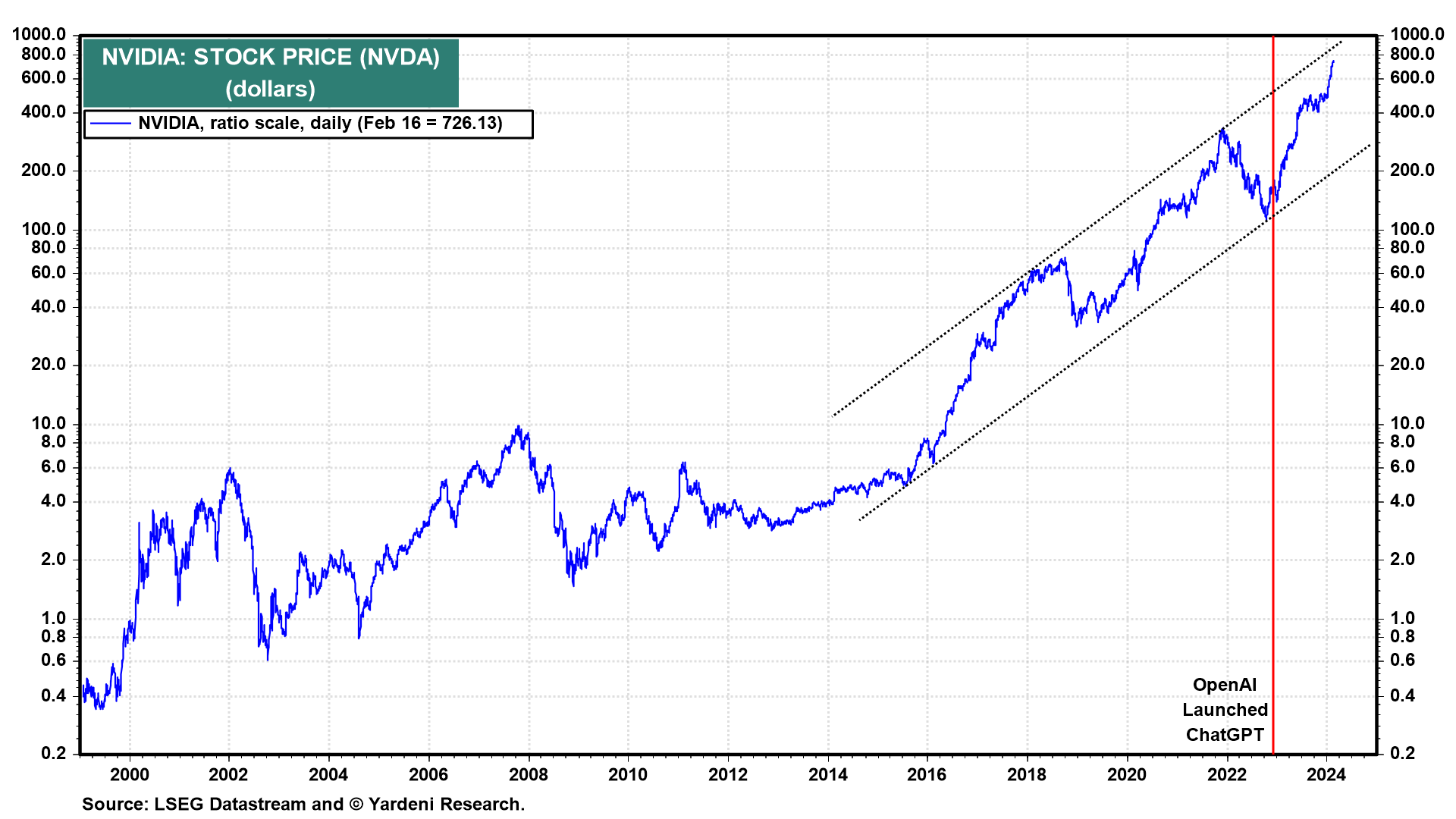

(1) Nvidia’s stock price has soared 329% since November 30, 2022, when ChatGPT was launched, through Friday’s close (chart). Over this period, it is up from $169.23 per share to $726.13.