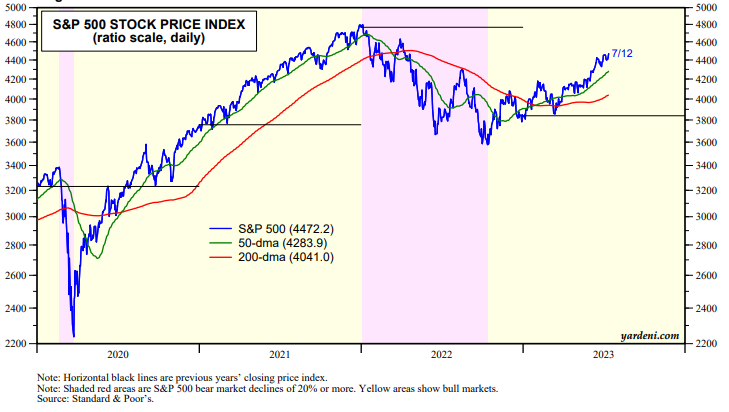

The S&P 500 climbed to a new bull market high today of 4472 (chart). It is now 10.6% above its 200-day moving average. It is climbing along the upper end of its bull-market channel. Today's CPI news helped to alleviate fears that persistent inflation might force the Fed to persist with rate hiking resulting in a recession. Inflation seems to be more transitory than was feared last year and even just before June's disinflationary CPI report today.

Investors have turned from fearful to fearless in recent months as the economy has proven to be resilient to the Fed's tightening of monetary policy while inflation has continued to moderate. We can see their fearlessness in the S&P 500 VIX, which is highly correlated with the percentage of bears in the Investors Intelligence weekly survey of stock market sentiment (chart). Both are down to pre-pandemic lows.