Have the S&P 500’s eight largest-capitalization stocks, the so-called MegaCap-8, been eating all the jellybeans, starving the other 492 in the S&P 500 LargeCap index during the current bull market? No. While the eight heavyweights have been on a sugar high in this bull market, they’ve left plenty of sweets for the rest of the stock market.

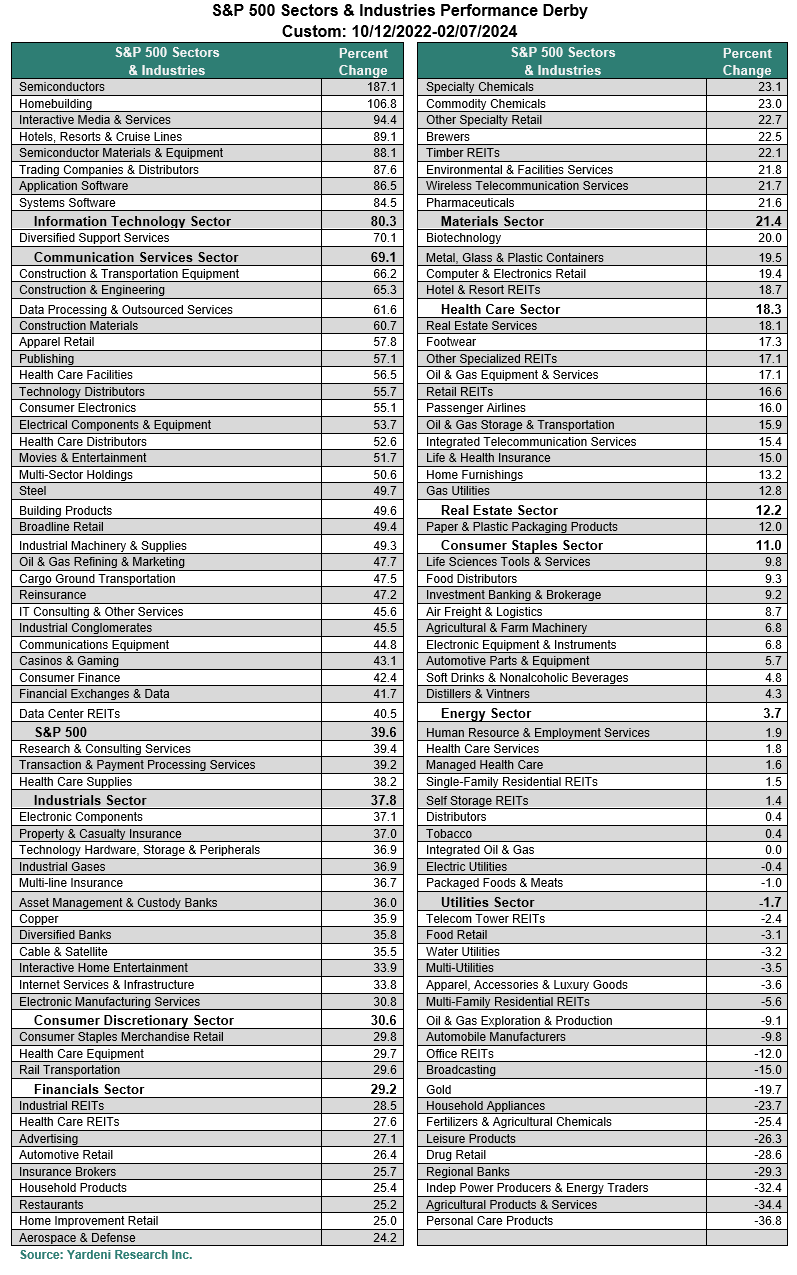

Since October 12, 2022, when the bull market started, the S&P 500 is up 39.6% through yesterday's close (table). Only two of its 11 sectors have outperformed the index, namely Information Technology (80.3%) and Communication Services (69.1). Those sectors are home to six of the MegaCap-8.

However, more than half of the 100+ industries that we track in the S&P 500 are up by 20% or more. Here are the other sectors with gains of 20% or more during the current bull market: Industrials (37.8), Consumer Discretionary (30.6), Financials (29.2), and Materials (21.4). Two others are up in the low double-digits: Health Care (18.3) and Real Estate (12.2). There are only two clunkers: Energy (3.7) and Utilities (-1.7).

In other words, breadth measures aren't reflecting the fact that it has been a broad bull market: A few stocks have greatly outperformed the laggards, but many of the laggards likewise have done very well—just not as well!