Investors are rooting for "divine disinflation." We all want inflation to come down without a painful recession. We want the Fed to tighten one more time by 75bps and then to pause for a while. This morning's release of August's survey of non-manufacturing purchasing managers was consistent with this wishful thinking. That might explain why the S&P 500 rallied after the report was released at 10 a.m. despite the bad news out of Europe, with Russia shutting down a major natural gas pipeline to the region. Here are the details:

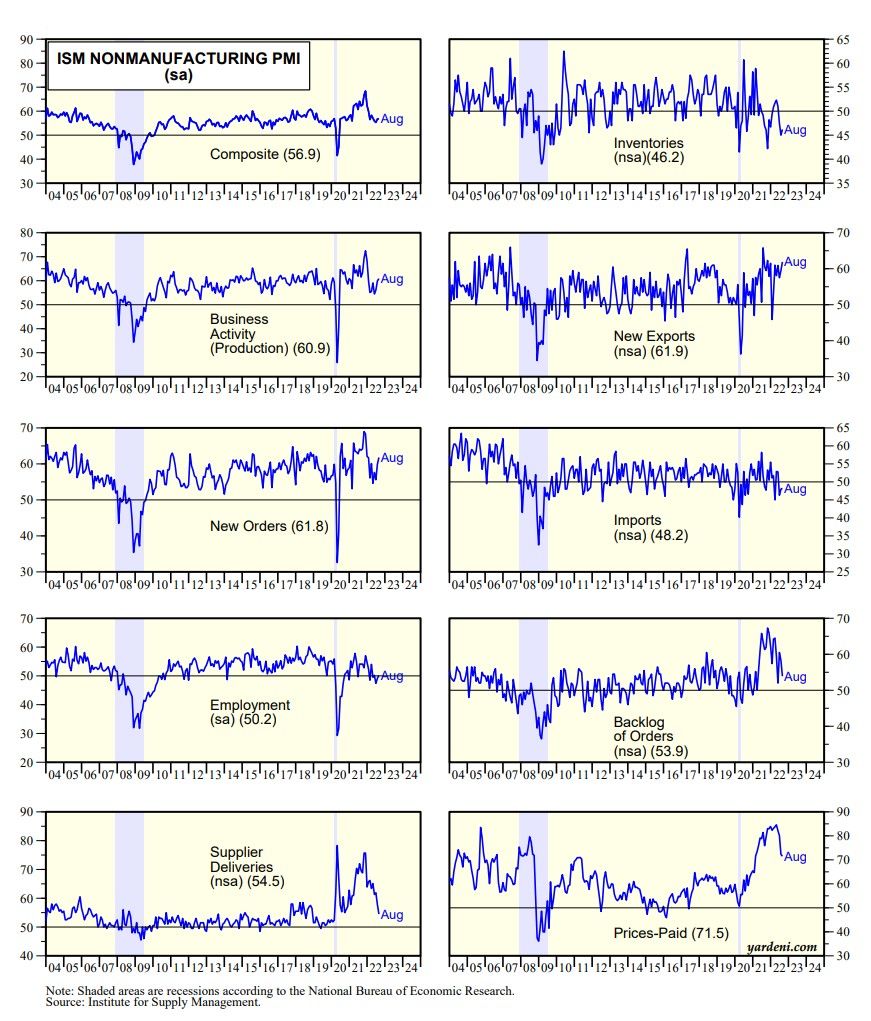

(1) The NM-PMI climbed for the second month, to 56.9, after easing steadily from 58.3 in March to 55.3 in June; the index was at a record high of 68.4 in November (chart below).

(2) Of the index's components, the new orders (61.8) and business activity (60.9) measures were both the strongest since December. Meanwhile, the employment (50.2) gauge continues to bounce around the breakeven level of 50.0.

(3) Supply bottlenecks continued to ease, with the supplier deliveries’ measure dropping precipitously from 75.7 in November 2021 to a 30-month low of 54.5 in August. The price index eased for the fourth month since reaching a record-high 84.6 in April, dropping to a 19-month low of 71.5 in August.