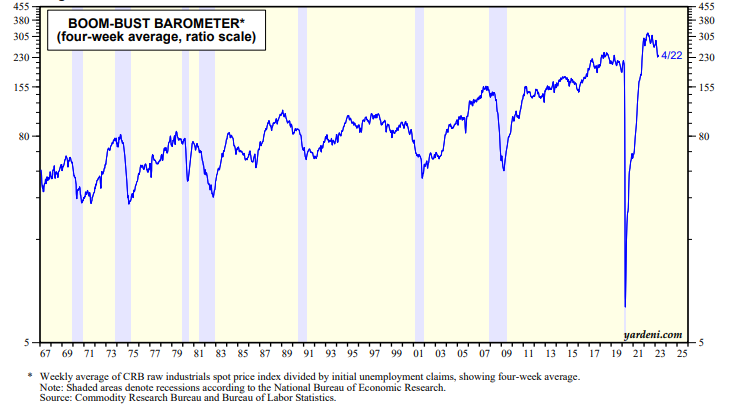

Our Boom-Bust Barometer (BBB) fell into an unprecedented abyss during the pandemic lockdown in early 2020 (chart). Our BBB is the ratio of the CRB raw industrials spot price index to initial unemployment claims on a weekly basis. It is a very useful high-frequency business cycle indicator. Like the Index of Coincident Economic Indicators (CEI), it tends to peak at the tail end of booms and to bottom at the end of recessions. However, the CEI is available only monthly with a lag of about three weeks. So, for example, April's CEI will be released on May 18. We already have the BBB reading for the April 22 week.

The remarkable rebound in the BBB following the lockdowns during the spring of 2020 is one of the main reasons that we predicted a V-shaped economic recovery, which was a minority view at the time. It peaked at a record high during late 2021 and has been falling since then, but it remains above its pre-pandemic high. Hence, so far, our conclusion is that our BBB is consistent with our "rolling recession" outlook (a.k.a., a soft landing).