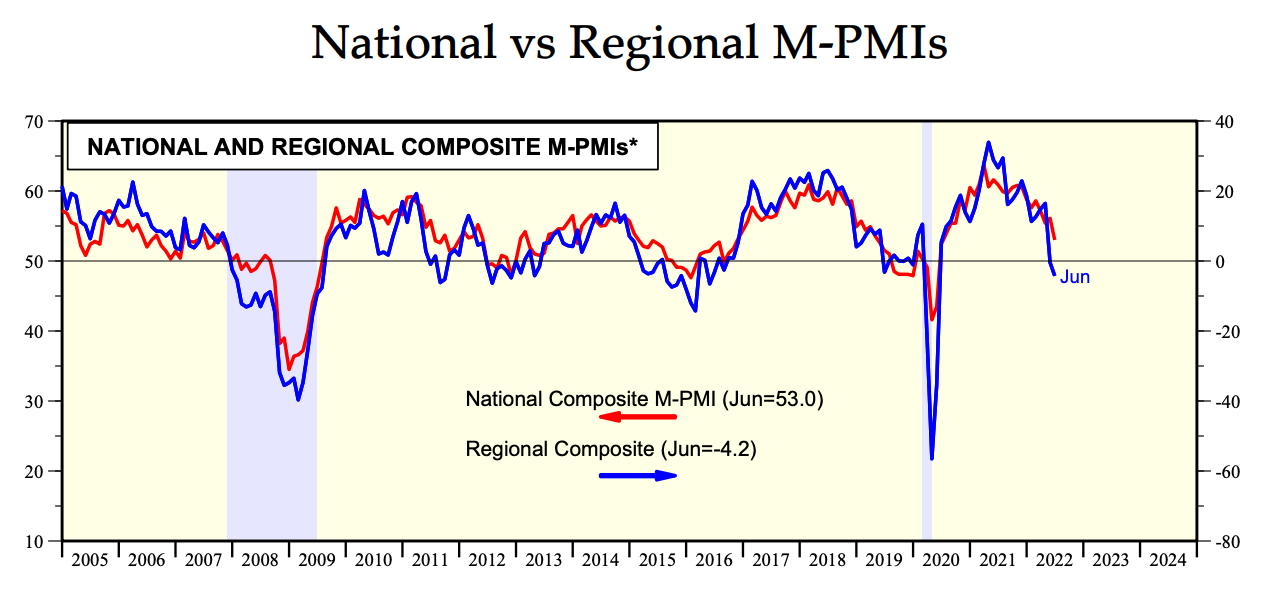

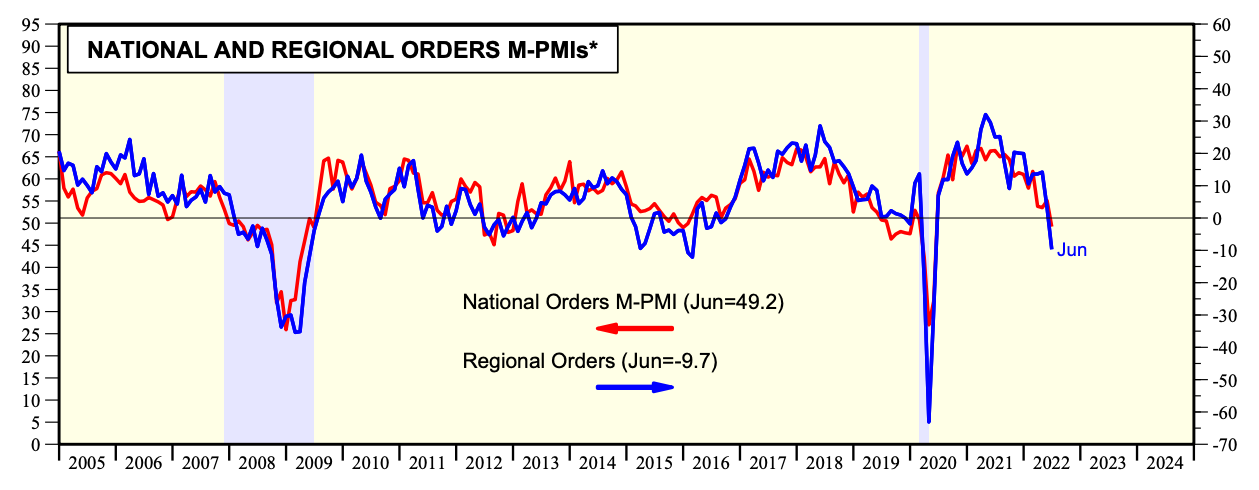

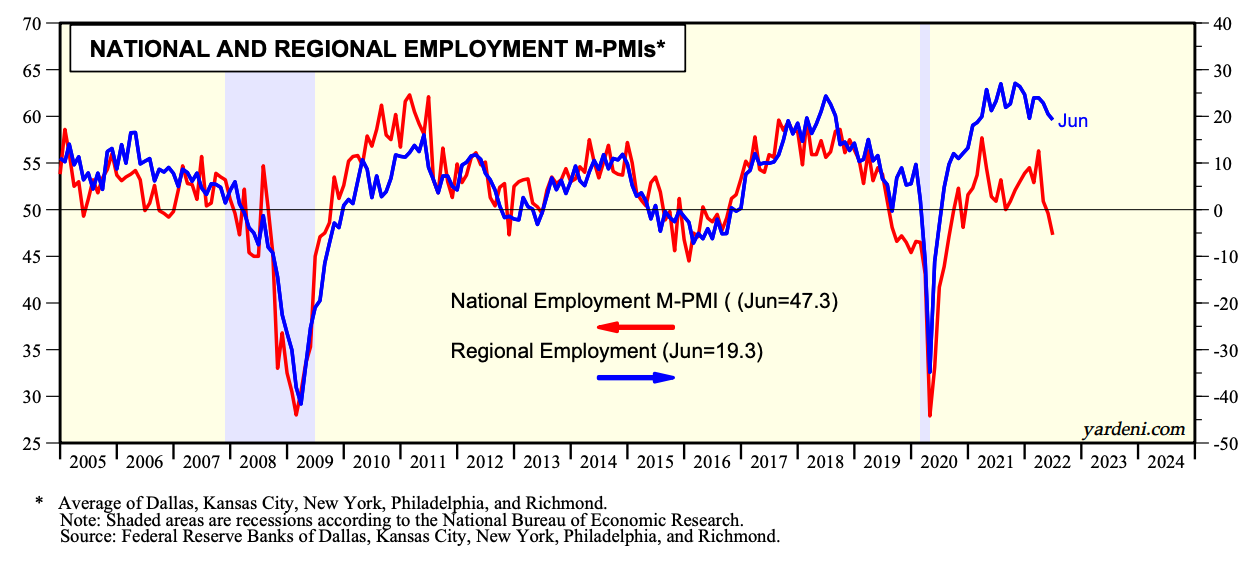

June’s national M-PMI was reported this morning, and it wasn’t as weak as suggested by the regional business surveys conducted by 5 of the 12 district Federal Reserve Banks. However, the new orders component of the national index was almost as weak as suggested by the comparable regional average index (charts below).

Here are some quick takeaways from the national survey of manufacturing purchasing managers:

(1) June’s M-PMI was down from May’s 56.1 to 53.0, the lowest since June 2020. The report stated: “This figure indicates expansion in the overall economy for the 25th month in a row after a contraction in April and May 2020.” (Anything above 48.7 indicates expansion according to the report.)

(2) However, the new orders index dropped sharply from May’s 55.1, to 49.2. The report stated: “This indicates that new order volumes contracted after growing for 24 consecutive months.”

(3) Inflationary pressures remained elevated in June but moderated a bit. The prices-paid index was 78.5 compared to the May reading of 82.2, indicating that raw materials prices increased for the 25th consecutive month. This index has exceeded 70.0 in 18 out of the past 19 months and has been above 60.0 for 22 straight months. The report noted: “Continued oil and fuel price increases, packaging supplies (including corrugate), food ingredients, and petroleum-based products and petrochemicals were the primary causes of prices growth.”