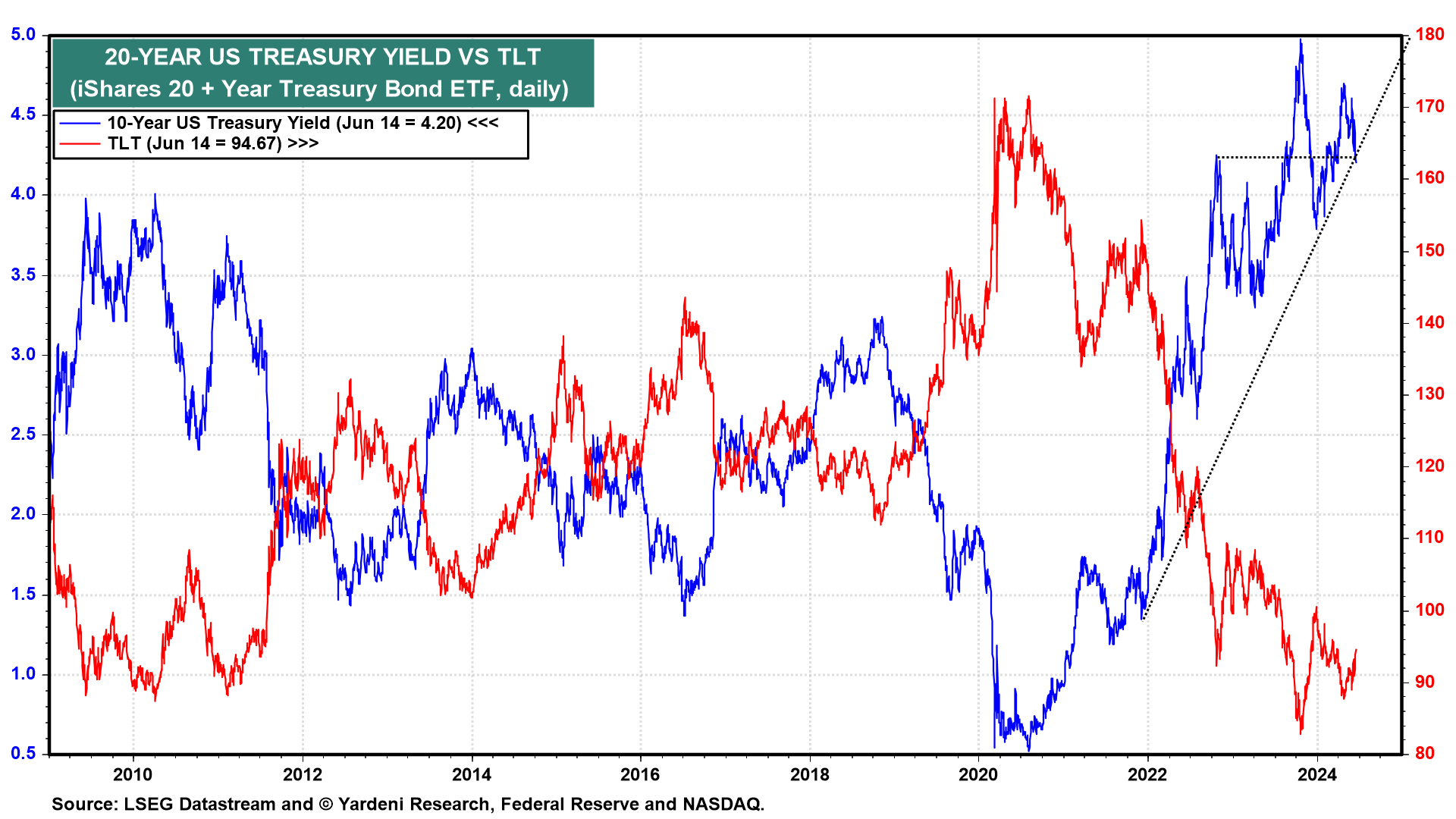

Consumer price disinflation is raising expectations for a Fed rate cut, which is fueling a meltup in stock prices. This morning on CBS' "Face the Nation," Minneapolis Fed President Neel Kashkari said that a rate cut by year-end is a “reasonable prediction.” On Friday, the 10-year Treasury bond yield fell below 4.25% to 4.20%. The technical picture is signaling that it might continue to fall down to 4.00% in coming days (chart).

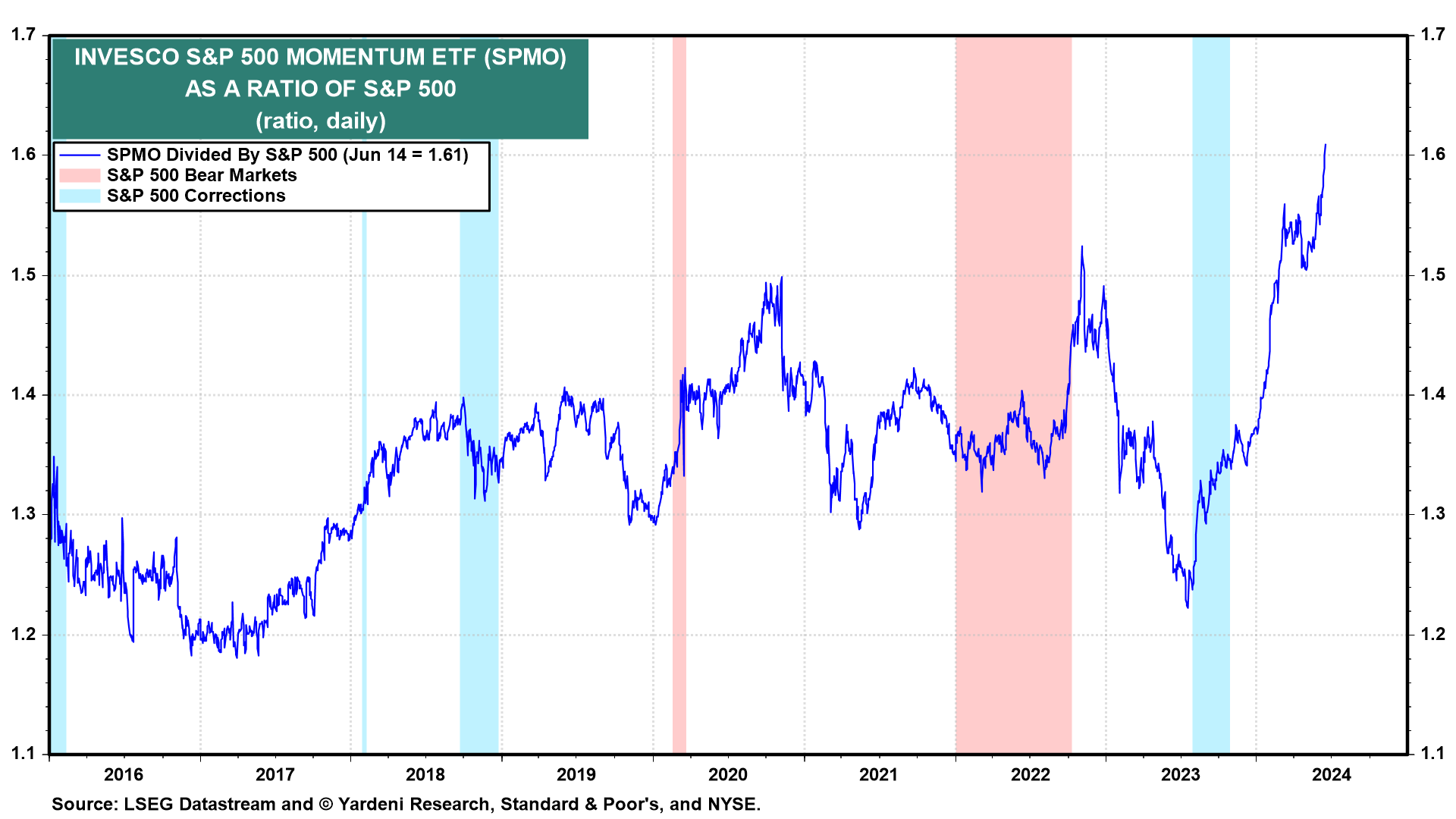

The prospect of lower interest rates is fueling momentum investing (chart). Leading the momentum meltup are technology companies that are associated with artificial intelligence.

The S&P 500 rose 1.6% last week, led by an astonishing 6.4% increase in the S&P 500 Information Technology sector (chart). It was the only sector to beat the S&P 500 this week. Joe Abbott, YRI's Chief Quantitative Strategist, reports that this has happened only four times before since January 1991.