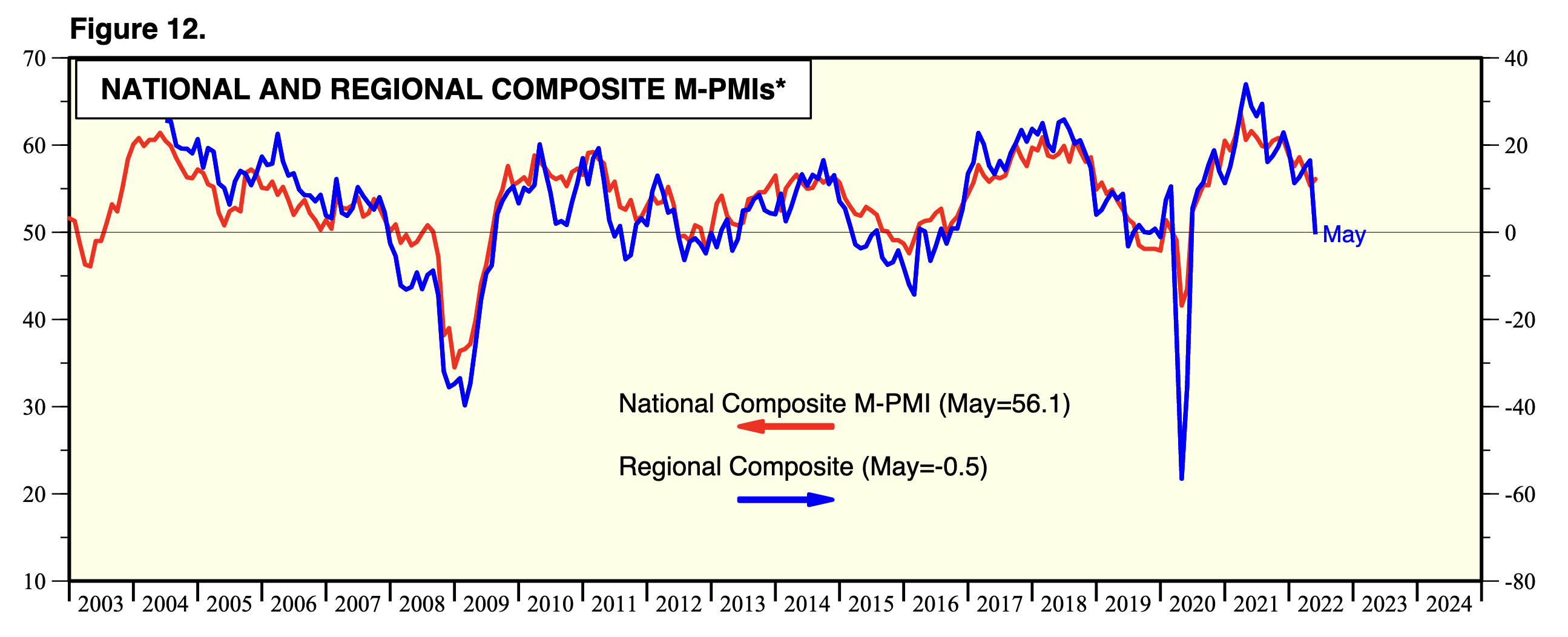

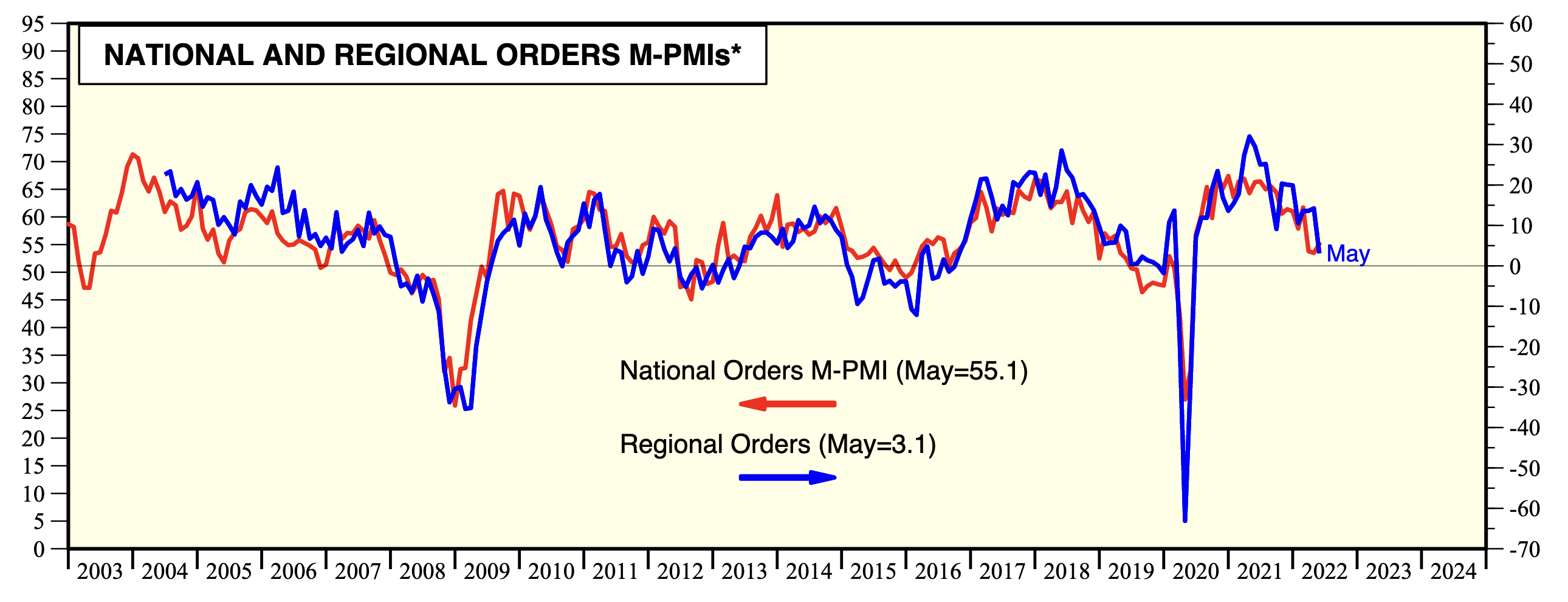

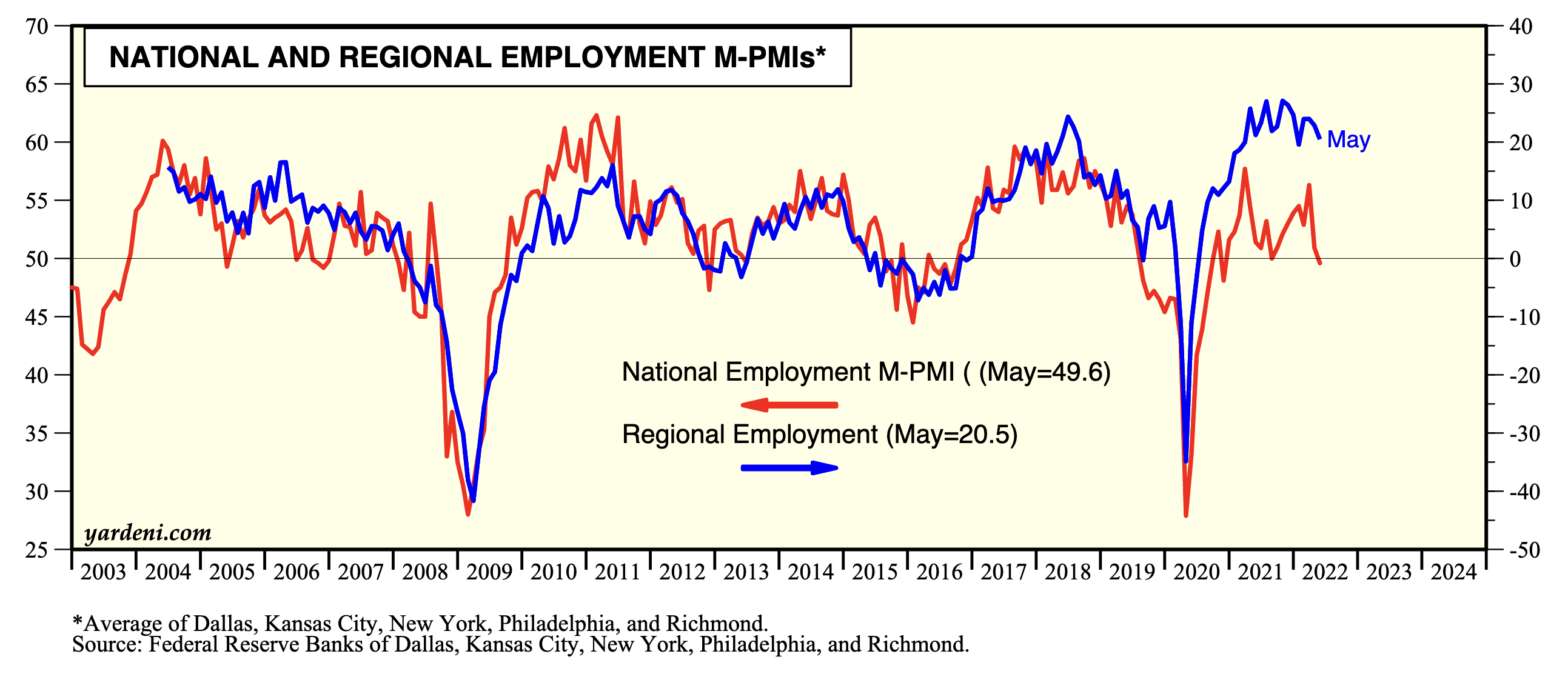

We are seeing some very odd divergencies between the averages of the regional business surveys conducted by five Federal Reserve Banks and the national survey of manufacturing purchasing managers conducted by the Institute for Supply Management. In the past, the regional and national indexes for overall business, new orders, and employment tracked one another very closely.

Now, not so much:

(1) During May, the regional composite index fell to 0.5%, a very weak reading. However, the national M-PMI remained relatively strong at 56.1. The regional employment index was much stronger in May (at 20.5) than was the national M-PMI’s employment index (at 49.6).

(2) On the other hand, regional and national new orders indexes remained highly correlated through May. They have been weakening but still signaling slow economic growth.

(3) Today, ADP reported that private payrolls rose just 128,000 during May. However, yesterday’s JOLTS report showed that the jobs market remained tight in April. Even though the number of job openings fell, there were still more than two for every unemployed worker—i.e., 11.4 million jobs versus 5.5 million unemployed workers.

(4) The Atlanta Fed’s GDPNow estimate for Q1’s real GDP was revised down to 1.3% on June 1 from 1.9% on May 27.