The Minutes from January's FOMC meeting was released today. On balance, it confirmed that the Fed is on hold but still leaning toward lowering the federal funds rate some more if and when inflation falls closer to 2%. It's a dovish pause, which is supportive of both stocks and bonds. Consider a few key points, as well as recent economic data:

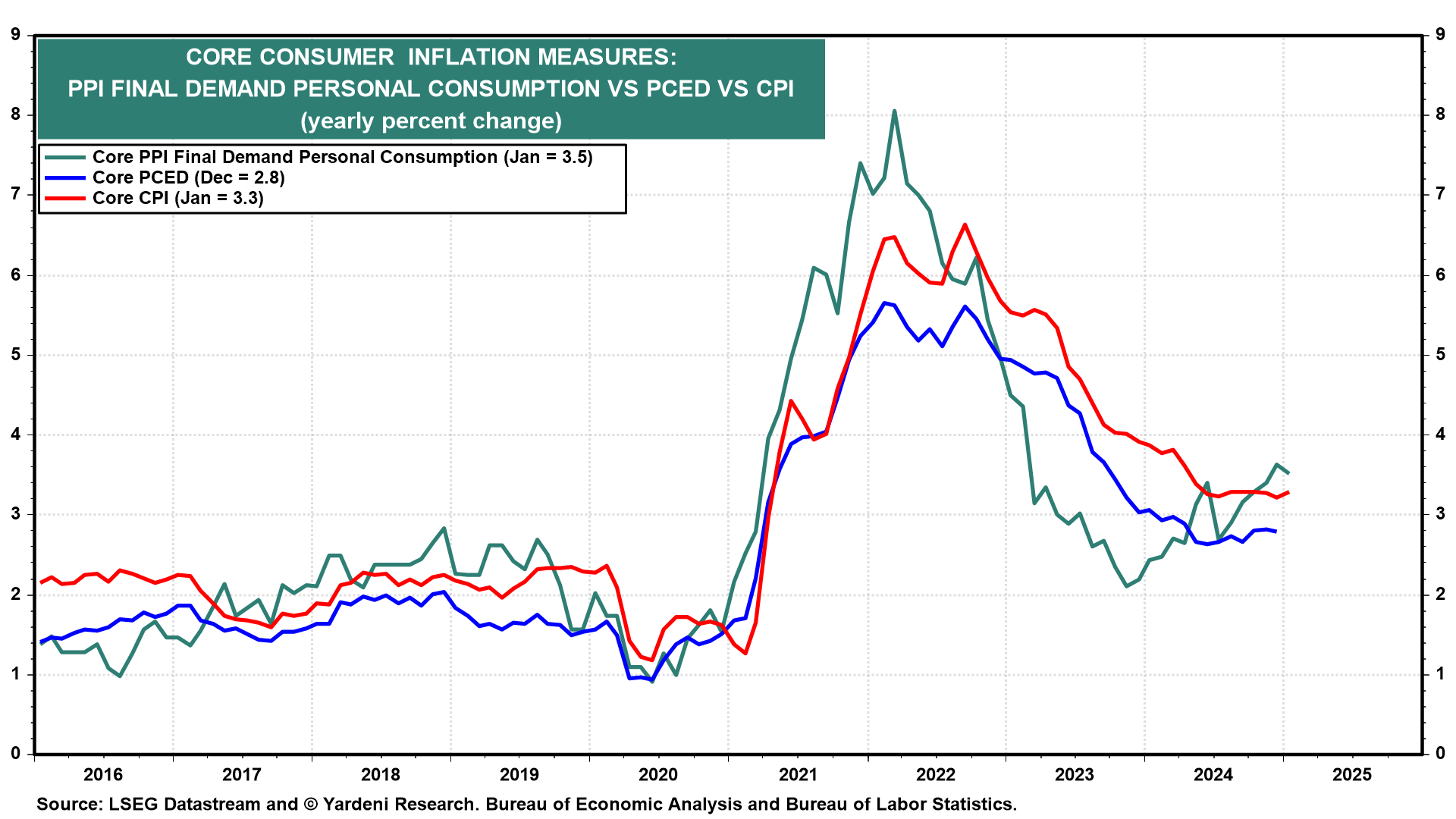

(1) Inflation outlook. FOMC participants expressed concern that Trump 2.0's trade and immigration policies increase the risk of higher inflation. On the other hand, FOMC participants said that high January inflation should be followed by lower prints in coming months.