In Tuesday's QuickTakes, we observed that since 1928, the S&P 500 fell 1.1% on average during September, by far the worst performance of any month. October, November, and December were up 0.5%, 0.6%, and 1.4% on average. We concluded: "Yes, Virginia, there really is a Santa Claus rally. Apparently, it tends to be even more likely during mid-term election years."

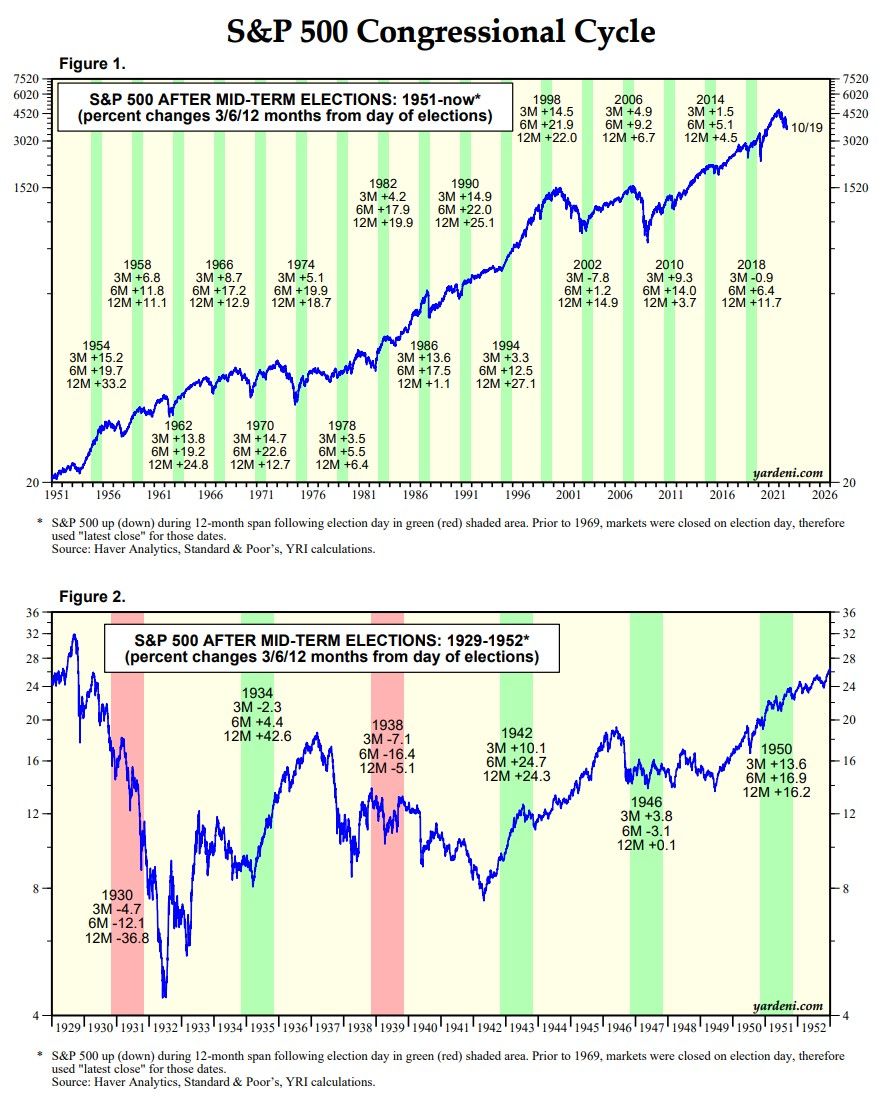

The data show that since 1942, during each of the 3-month, 6-month, and 12-month periods following each of the 20 mid-term elections the S&P 500 was up on average by 7.6%, 14.1%, and 14.9%. Of the 60 data sets over this period, only three were negative (chart). That's a remarkably consistent bullish record.

Of course, past performance is no guarantee of future results. The main bearish theme for stock investors this year has been the old adage: "Don't fight the Fed," especially when the Fed is fighting inflation. However, the market may be starting to anticipate a red wave in the mid-term congressional elections and a rapidly approaching terminal federal funds rate. Perhaps, another old adage is about to play out: "Don't fight Santa Claus after mid-term elections."