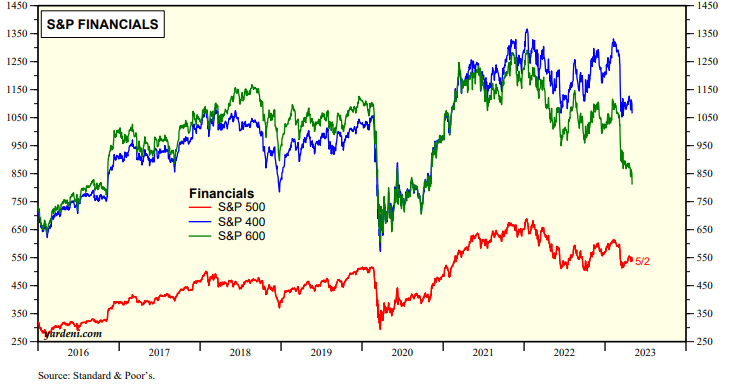

The stock market sent a message to the FOMC today: Cease and desist from any more rate hikes, please. The stock market selloff was led by another rout of the Financials sectors of the S&P 1500. Here is what they did today and since March 8, the day before SVB imploded: S&P 500 LargeCaps (-2.3%, -7.3%), S&P 400 MidCaps (-3.2, -14.1), and S&P 600 SmallCaps (-4.7, -20.8) (chart).

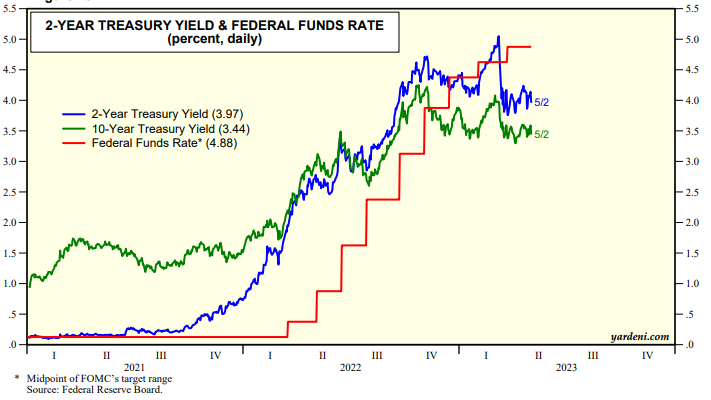

The 2-year Treasury note yield dropped 17bps today to 3.97% just as the FOMC is widely expected to raise the federal funds rate by 25bps t0 5.00%-5.25% tomorrow (chart). The markets are clearly signaling that the federal funds rate is already restrictive enough to slow economic growth and bring inflation down as evidenced by the banking crisis and the alarm bells ringing in the SMidCaps Financial sectors. By the way, the nearby futures price of a barrel of Nymex crude oil plunged $4 today.

The risk is that Fed officials remain hawkish partly because the economy continues to perform well. Auto sales rebounded in April to 16.2 million units despite Elon Musk's warning that it is getting tougher to get an auto loan (chart).