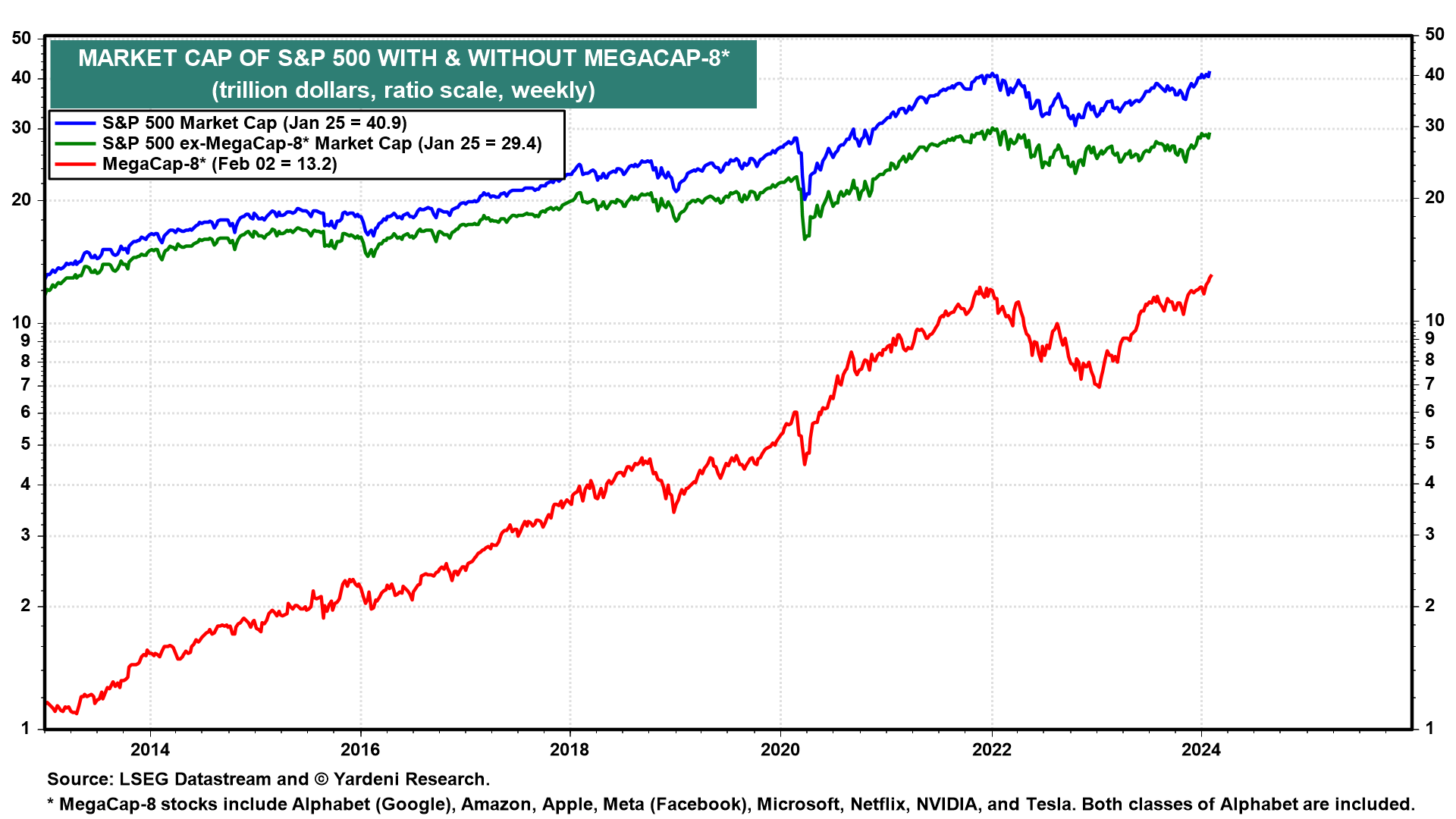

Through Friday’s close, the S&P 500 price index is up 4.0% ytd to a record high. The MegaCap-8 collectively has outperformed with a gain of 7.6%, also a record high (chart). Without the MegaCap-8 stocks, the S&P 500 would be up 2.5% ytd.

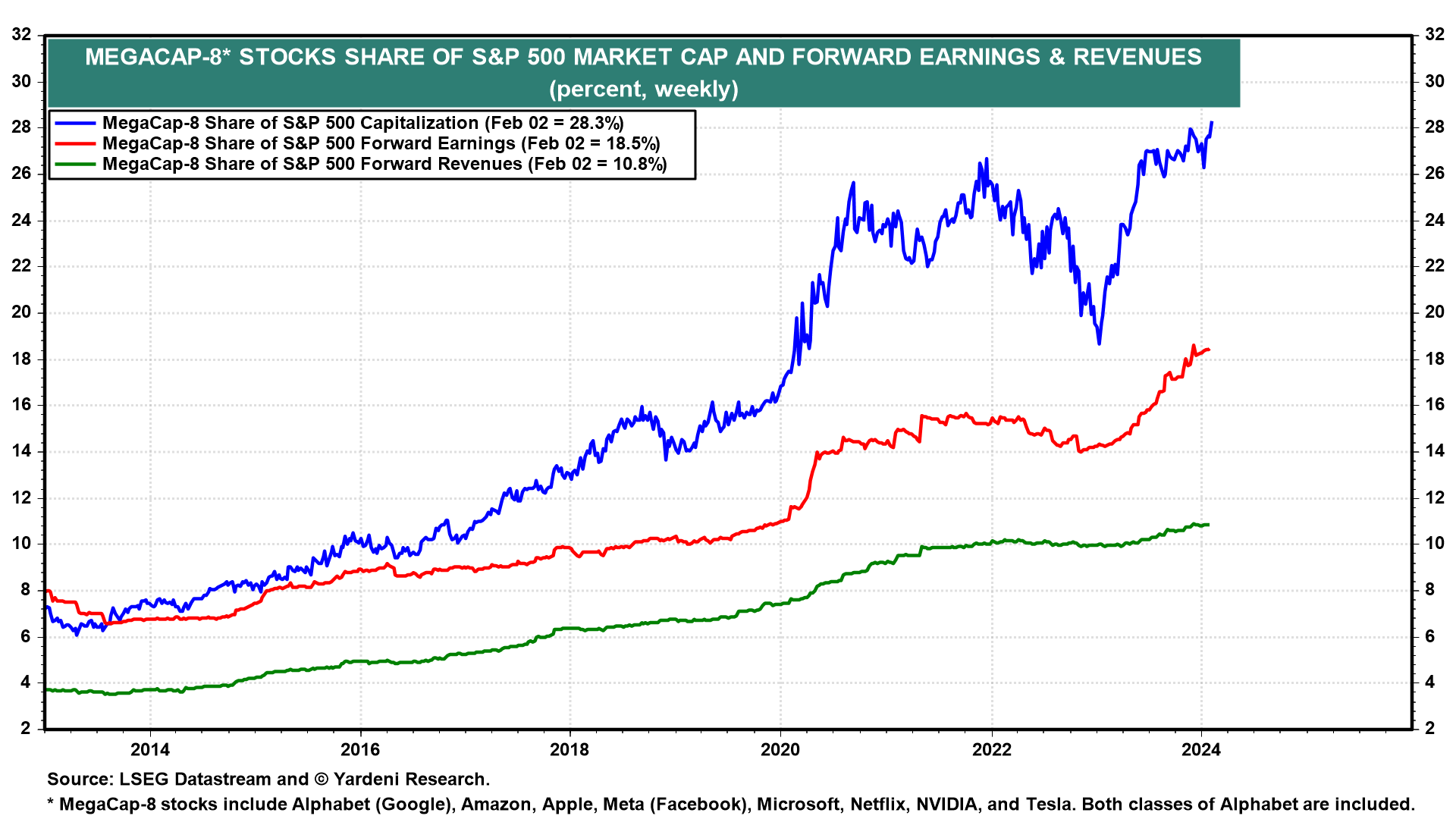

The MegaCap-8 now accounts for a record-high 28.3% of the S&P 500’s market capitalization (chart). They currently account for 18.5% of S&P 500 forward earnings and 10.8% of its forward revenues.

Among the MegaCap-8 companies, all but Nvidia have reported their Q4 earnings so far. These seven MegaCap-8 companies collectively recorded earnings growth of 44.7% y/y and revenues growth of 11.4% y/y. Analysts had been expecting earnings and revenues to rise 36.6% and 9.7%, respectively.

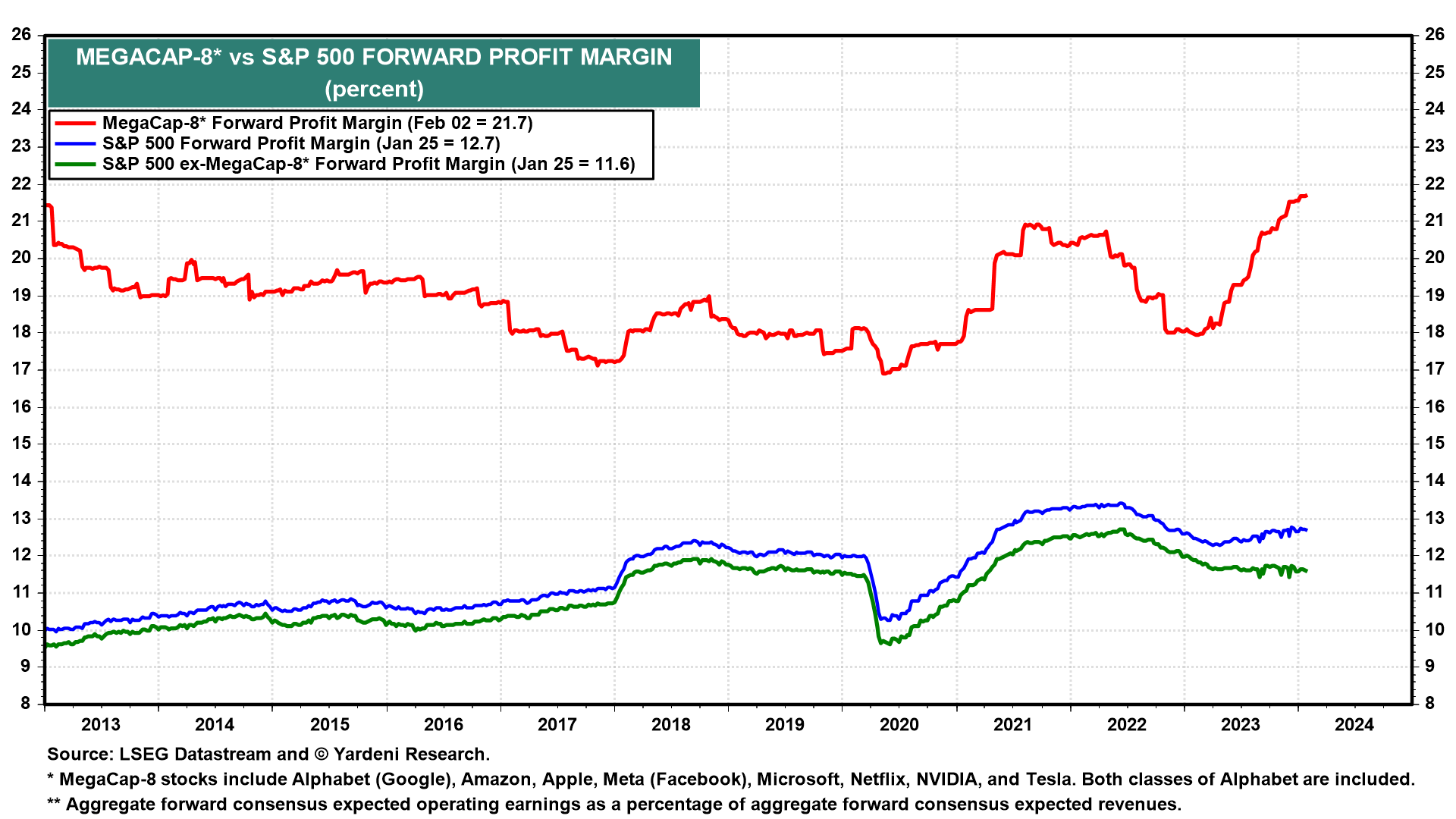

Back in early December, the MegaCap-8 had surpassed its prior record-high forward profit margin of 21.4%, registered nearly 12 years earlier on January 4, 2013! It has moved even higher since then to 21.7% in early February (chart).

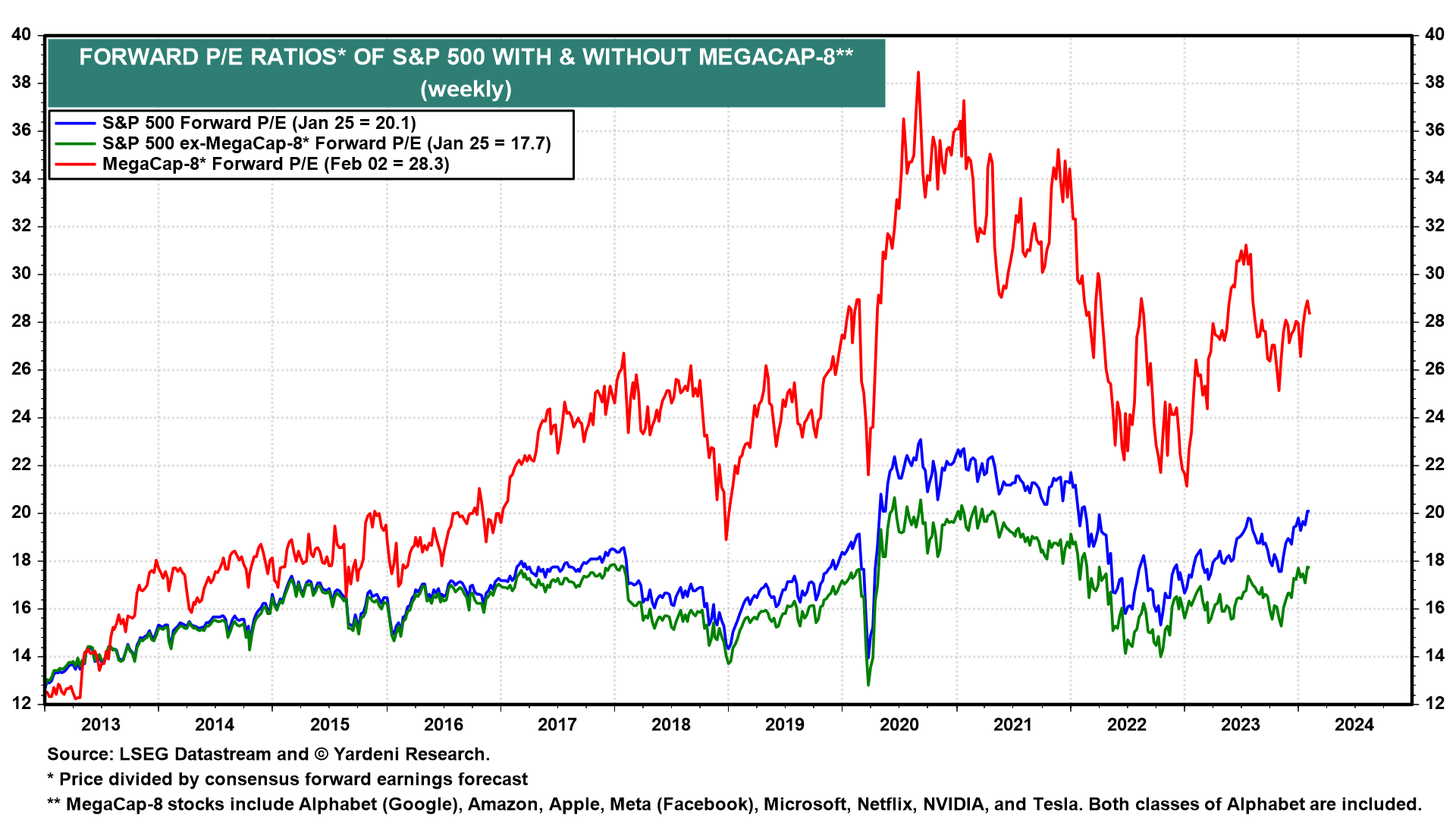

At a forward P/E of 28.3 currently, the MegaCap-8 aren't cheap, but they are cheaper than during the pandemic (chart). With and without them, the S&P 500 forward earnings is 20.1 and 17.7.

These and other charts on the MegaCap-8 are automatically updated here. Charts for the eight stocks are also available at Our Charts.