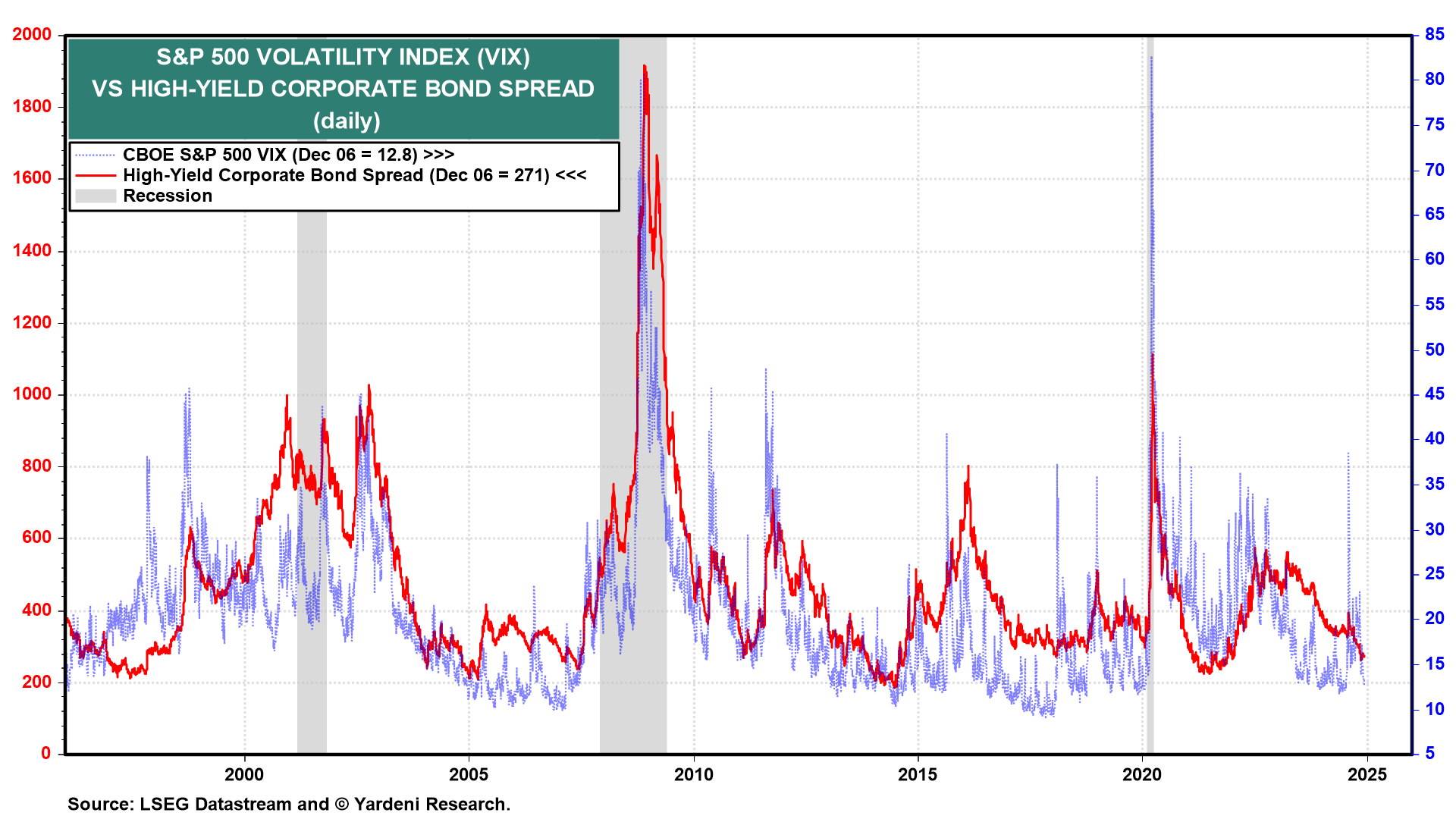

In recent conversations with our accounts, many of them said that the financial markets may be more volatile under Trump 2.0 over the next six months than they were over the past 12-18 months. In Thursday's QT, we observed that contrarian indicators are showing that there are too many bulls, which is bearish. A couple of prominent and vocal permabears recently conceded that the bulls have been right after all. That's bearish too. There is also too much complacency according to the low readings of the S&P 500 VIX and the high-yield corporate bond spread (chart).

Should we be even more contrary by ignoring the contrary indicators because everyone agrees that there are too many bulls and too much complacency? We aren't ready to do so. We are expecting a pullback early next year when investors with large gains might rebalance their portfolios to avoid paying taxes on those gains this year.