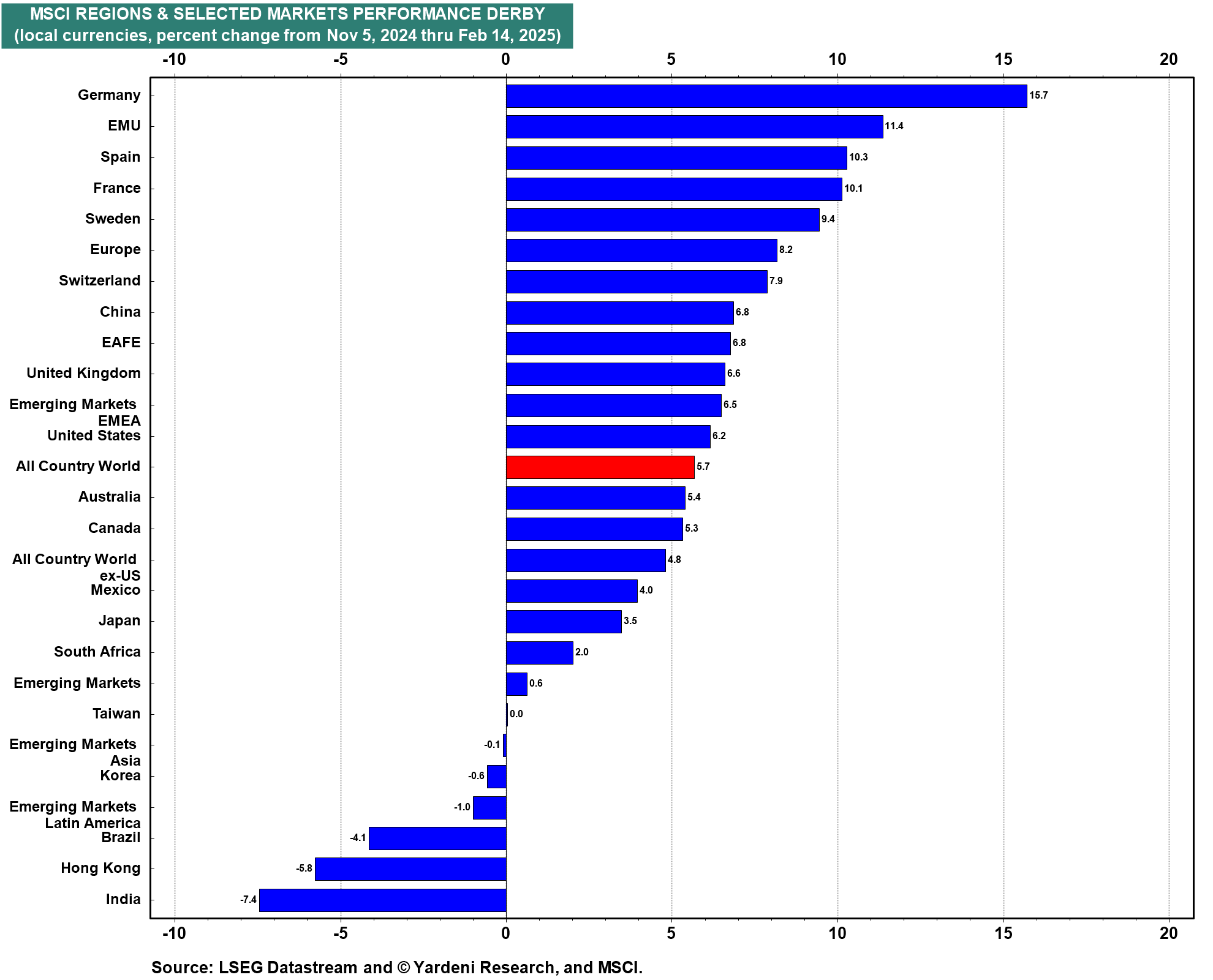

US stocks haven't been exceptional since Donald Trump won the presidential election on November 5, 2024. That's if the performances on the major country MSCI stock market indexes are measured in local currencies (chart). So far, Trump's tariff turmoil seems to be weighing more on the US, Canada, Mexico, and many other emerging markets than on China and most European countries. That could change once reciprocal tariffs are actually imposed by the US in early April, unless Trump changes his mind, again.

Let's consider why this relative performance alignment may be happening and whether it will continue: