A Tale of Two Cities by Charles Dickens famously begins, ''It was the best of times, it was the worst of times.'' Two weeks ago was the worst week for the stock market so far this year. Last week was the best week for the stock market so far this year.

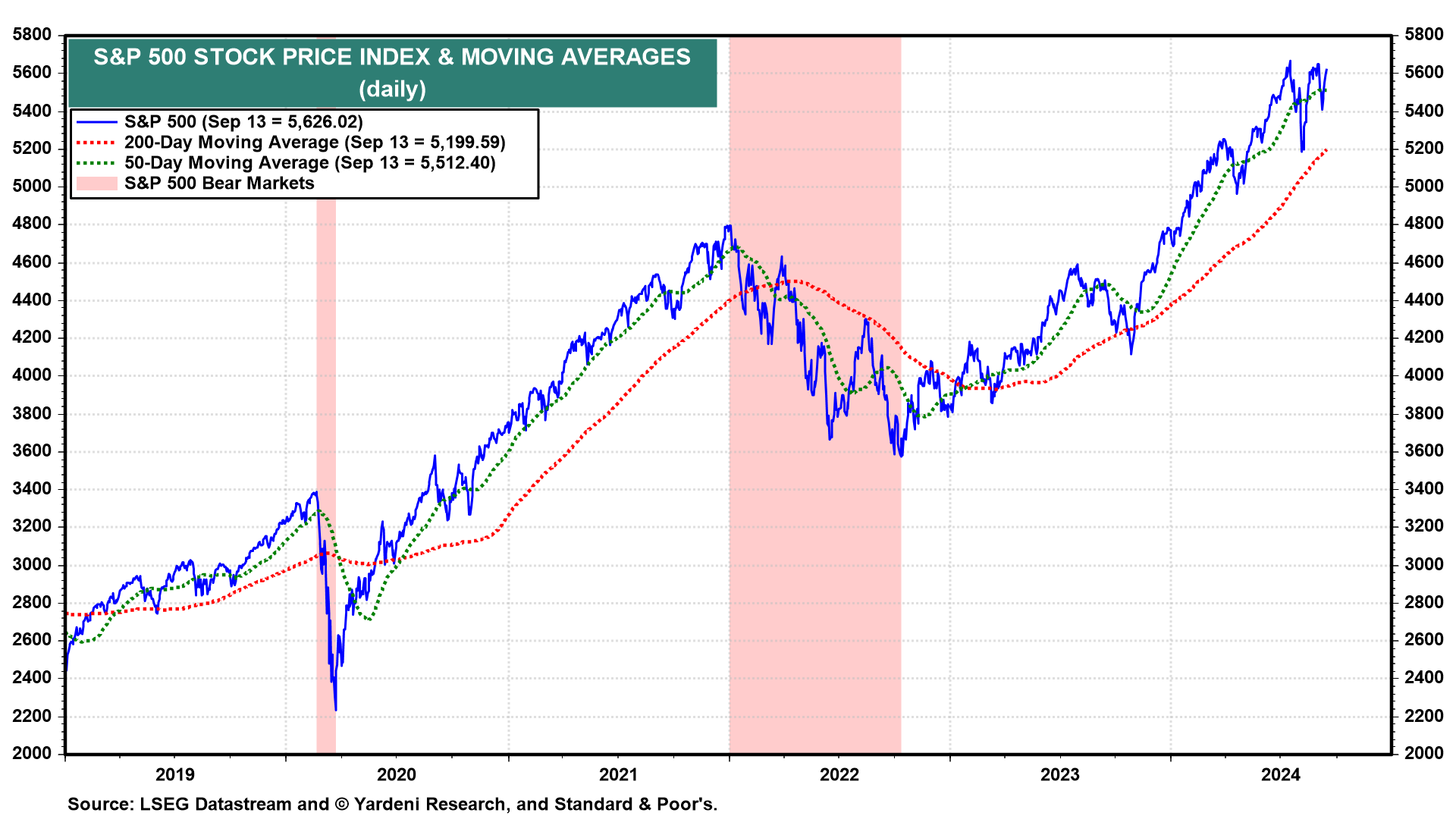

In the July 28 Quicktakes, we wrote: "Our hunch is that the stock market will continue to churn around current levels, rotating and remaining below its July 16 record high of 5667.20 through the presidential election. We expect a strong yearend rally to deliver a new record high." We anticipated that the market might be choppy, though not as much is it has been in the past two weeks (chart).

The S&P 500 is only 41 points below its July 16 record high. What could possibly stop the S&P 500 from making a new record high this week? Not much if the Fed cuts the federal funds rate by either 25bps or 50bps on Wednesday with Fed Chair Powell delivering a dovish presser that day. Then again, his August 23 Jackson Hole speech was so dovish that he might want to push back against financial markets' expectations for a slew of rate cuts.

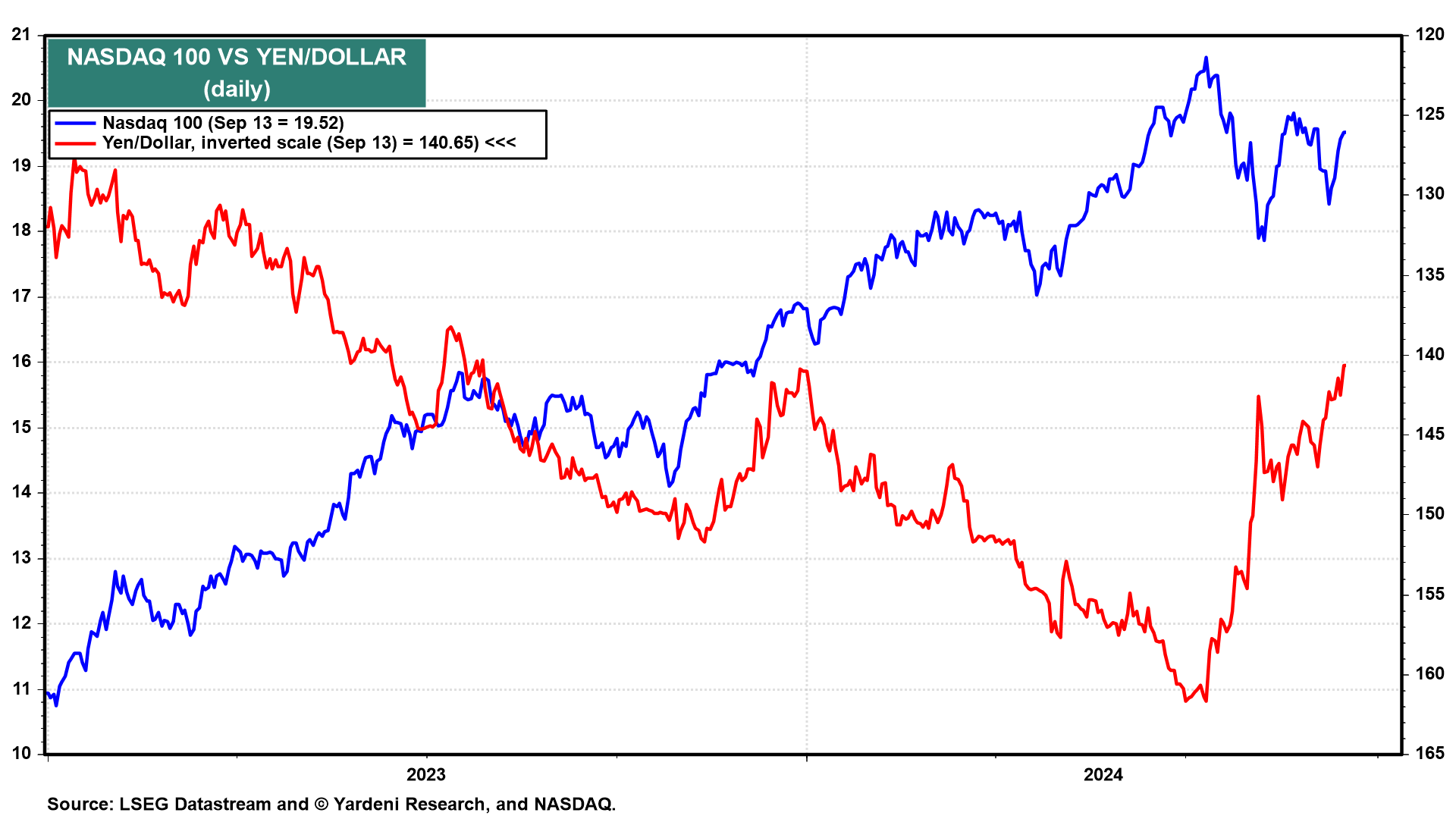

It's possible that the Fed's easing on Wednesday along with a dovish FOMC Summary of Economic Projections might trigger a third carry-trade unwind--which would be bearish for stocks as it was in early August and September--but we doubt it. We think the trade has been mostly unwound or hedged. The yen was strong last week, yet the Nasdaq 100 rallied solidly (chart).

The only significant economic indicator to be released before Powell's presser will be August's retail sales report on Tuesday, which we expect will be stronger than expected. That might sway the FOMC to cut by 25bps rather than 50bps, which might disappoint bond investors and traders. But for stock investors such good news should be greeted as good news.

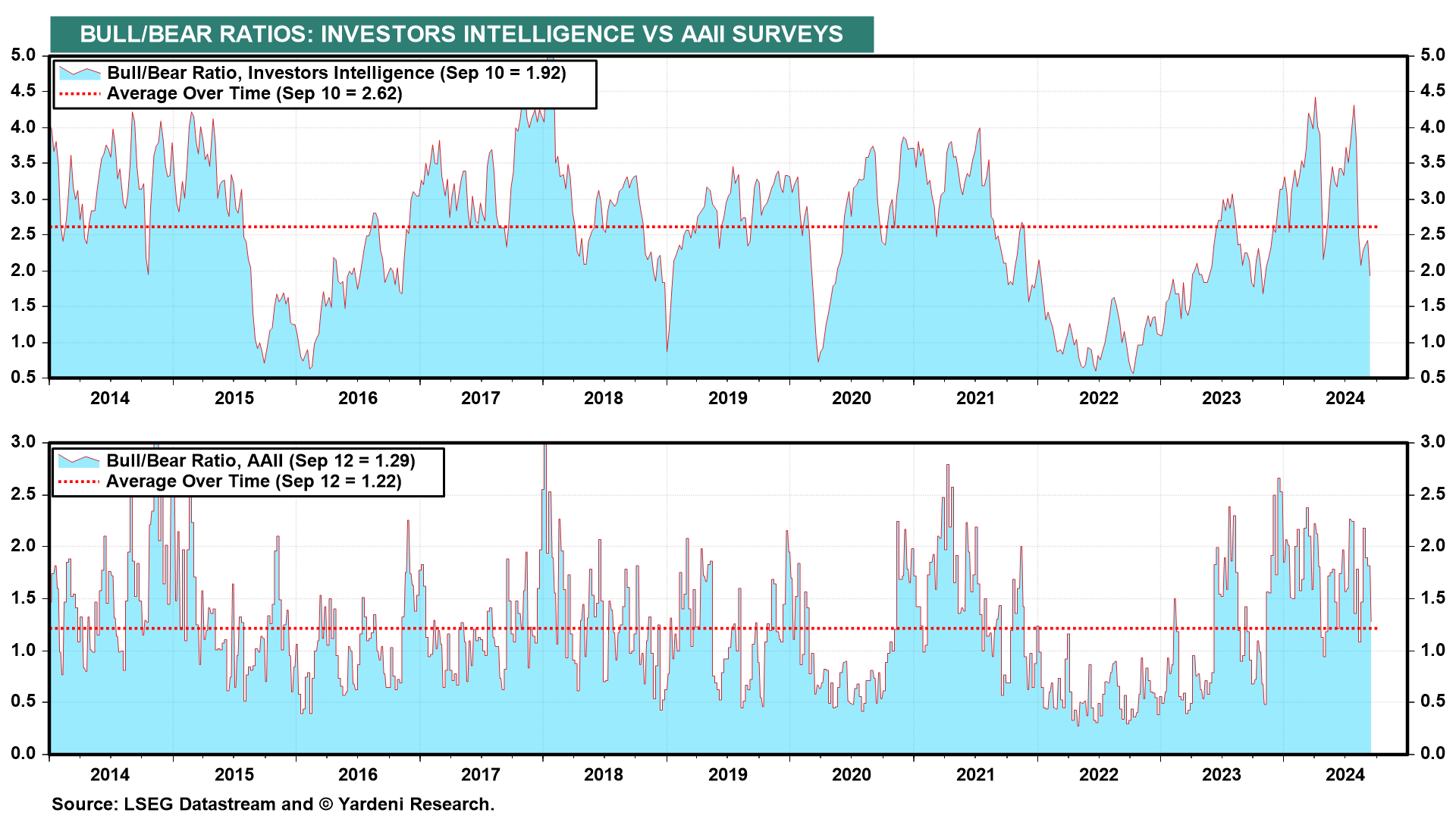

Meanwhile, the latest available weekly sentiment indicators are relatively low (chart). So, as contrarian indicators, they favor a continuation of last week's stock market rally. In the stock market, the best of times tend to last much longer than the worst of times.

We asked Michael Brush to weigh in on insider activity: "There was a moderate amount of insider buying overall last week but with a decided emphasis on energy stocks. Insiders are strongly suggesting the energy sector is a buy." Thanks, Michael.