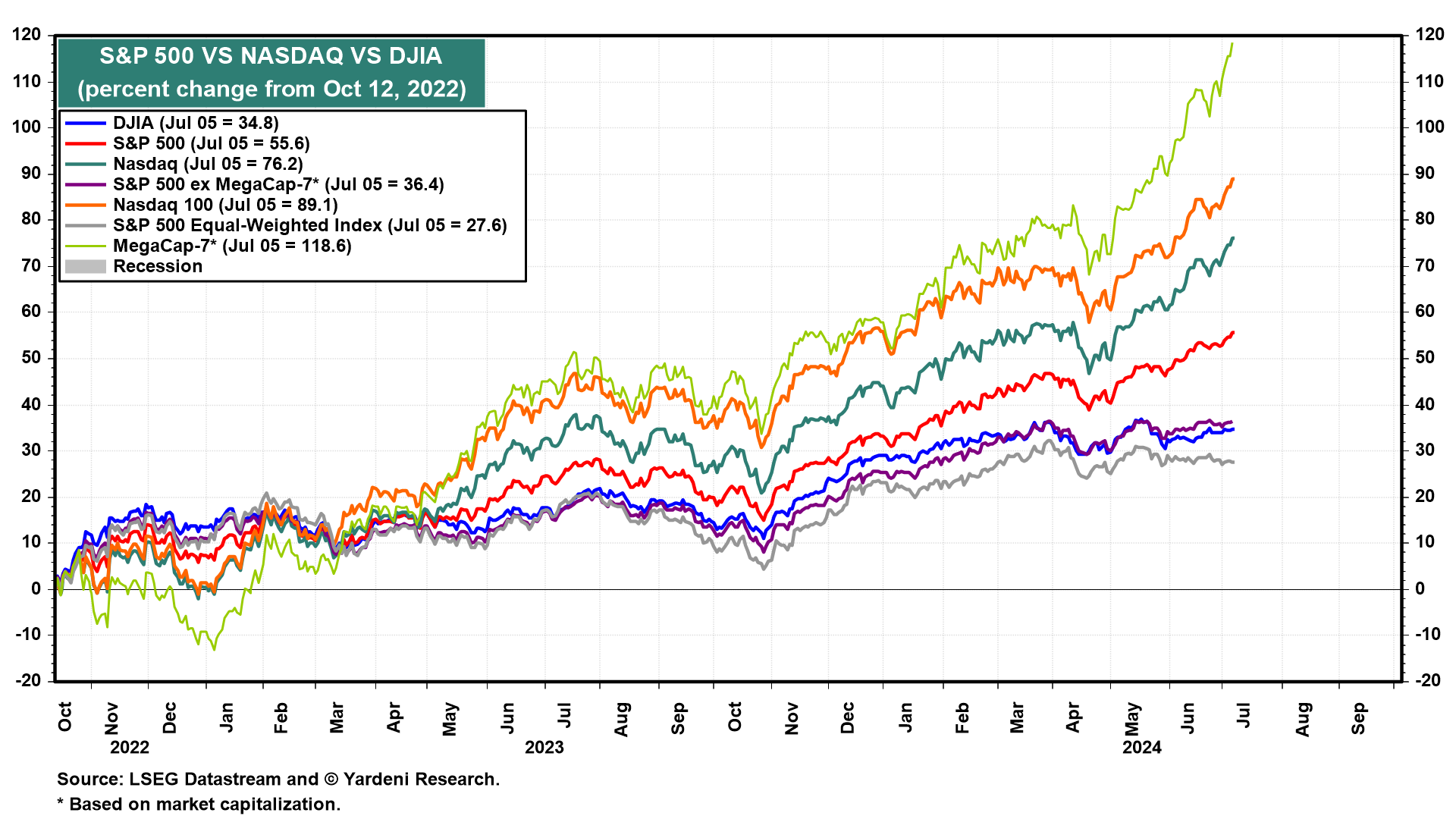

The stock market's bull run since October 12, 2022 has raised some concerns lately. According to the naysayers, earnings growth expectations may be too high because there are mounting signs of an economic slowdown that might lead to an economic recession. The breadth of the stock market rally continues to narrow, which may be confirming that the underlying fundamental support for the bull market is narrowing. If the Fed averts a possible recession by lowering interest rates, stocks could rally, but valuations are already stretched. Any blowoff rally could set the stage for a severe selloff.

These are all legitimate concerns. Here are a few reasons to be somewhat less concerned:

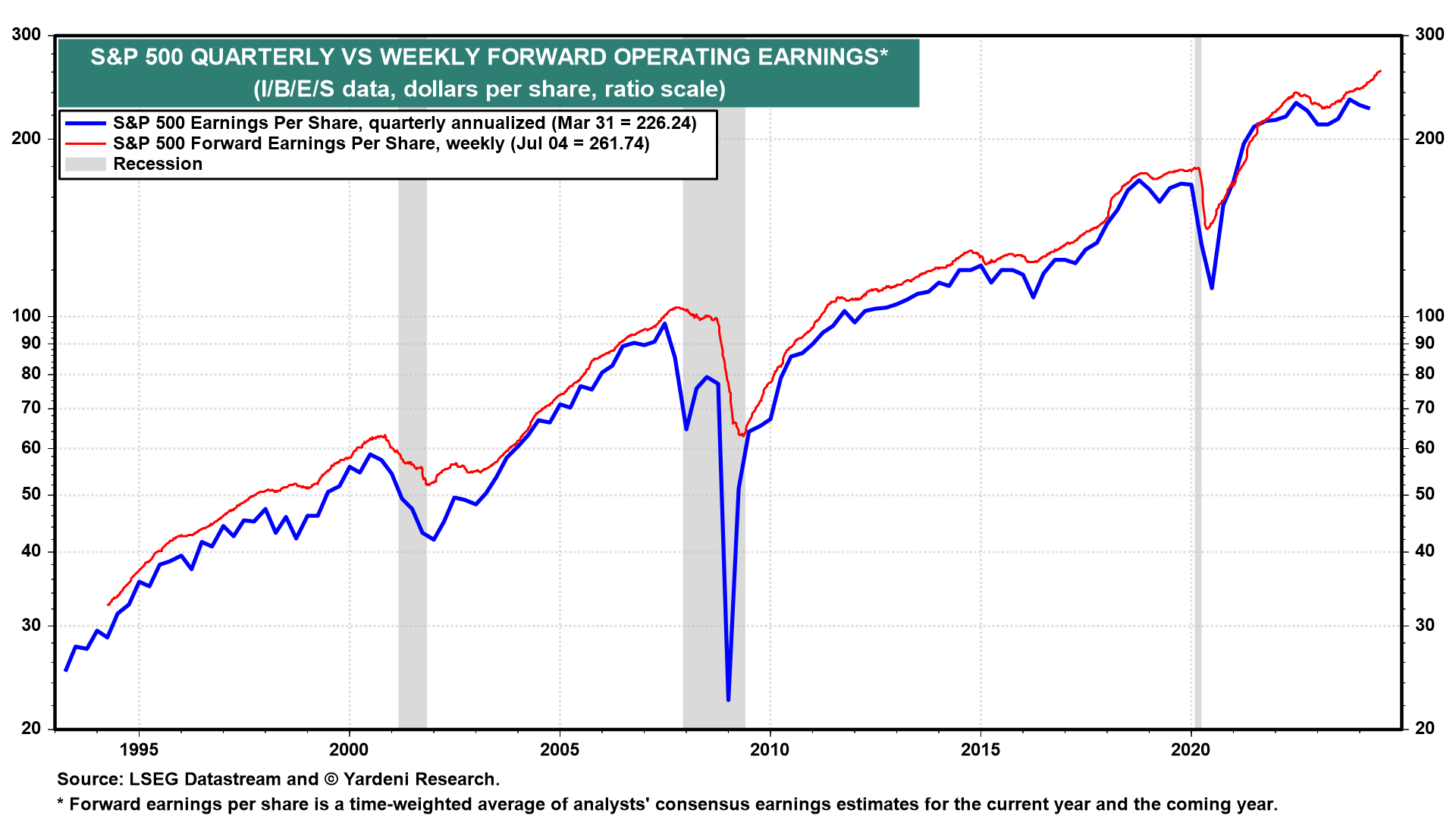

(1) Forward earnings. S&P 500 forward earnings rose to a new record high of $261.74 during the July 4 week (chart). The Q2-2024 earnings reporting season is starting and should go well. This all assumes, as we do, that a recession is unlikely anytime soon, especially since the Fed will lower interest rates to avert one if necessary.

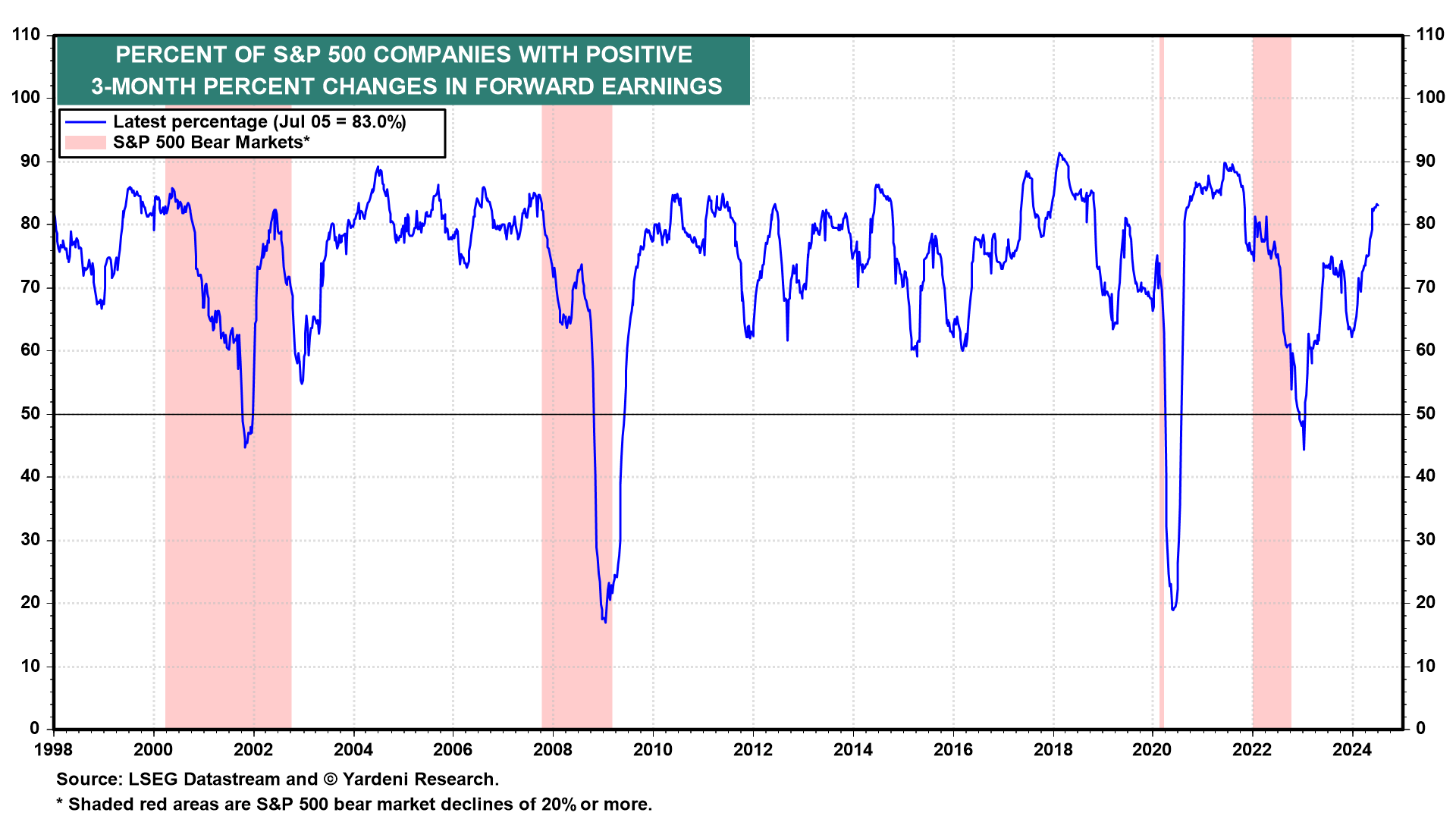

(2) Earnings & stock prices breadth. The percent of S&P 500 companies with positive three-month percent changes in forward earnings rose to a bull-market high of 83.0% during the July 5 week (chart). That argues for a broadening of the stock market's breadth.

Since the start of the bull market, the S&P 500 is up 55.6% led by the 118.6% increase in the S&P MegaCap-7 (a.k.a., the Magnificent-7) (chart). The S&P 500 excluding the MegaCap-7 is up 36.4% since the start of the bull market. So the S&P 493 have been in a bull market even without the MegaCap-7.

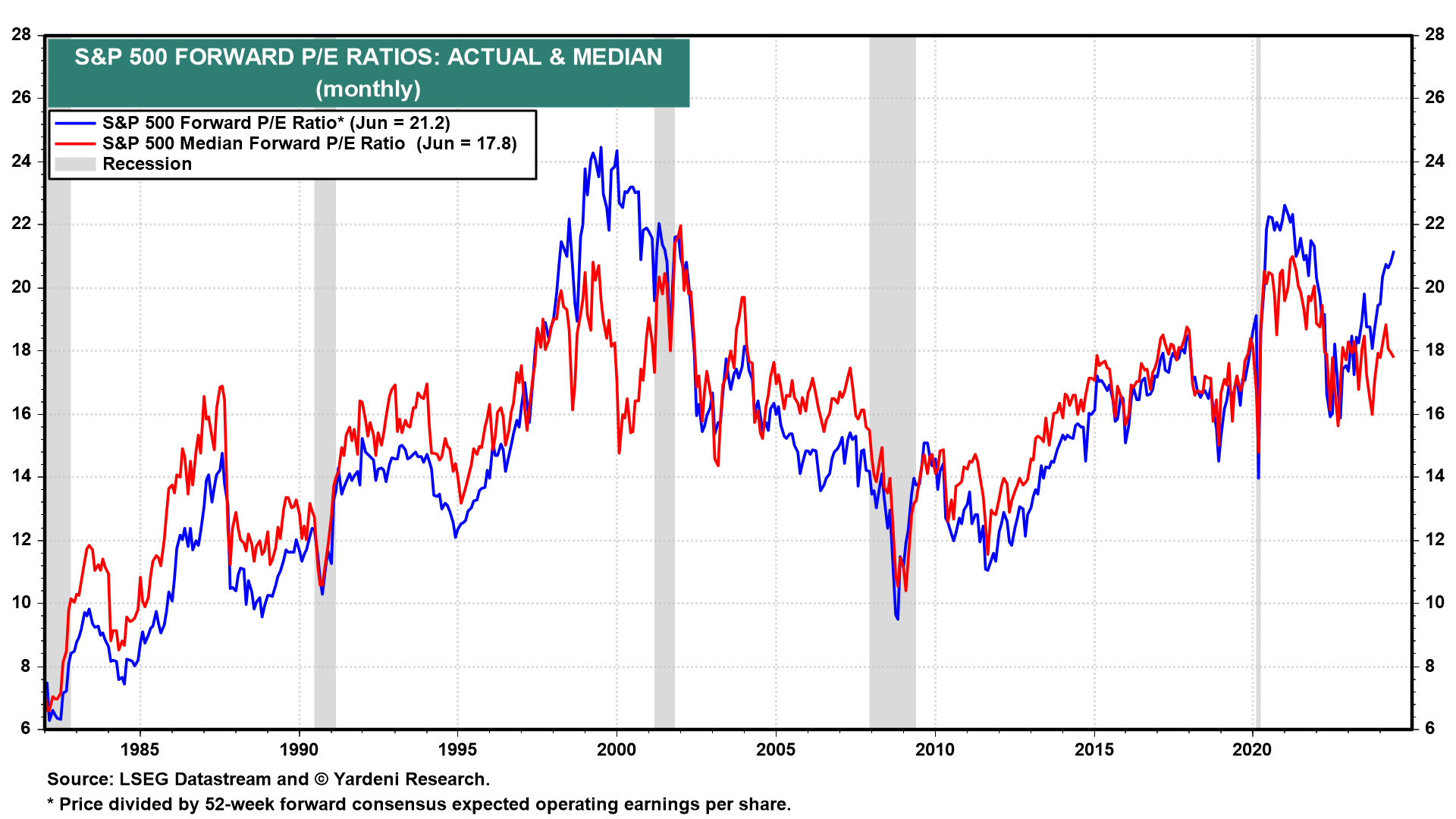

(3) Valuation. The S&P 500's forward P/E measure of valuation is stretched, though that's been largely attributable to the MegaCap-7. During June, the market-cap forward P/E was 21.2 while the median forward P/E was 17.8 (chart). The broad market is not overvalued, in our opinion and could go up on a combination of better earnings and a higher valuation multiple through the end of the decade.