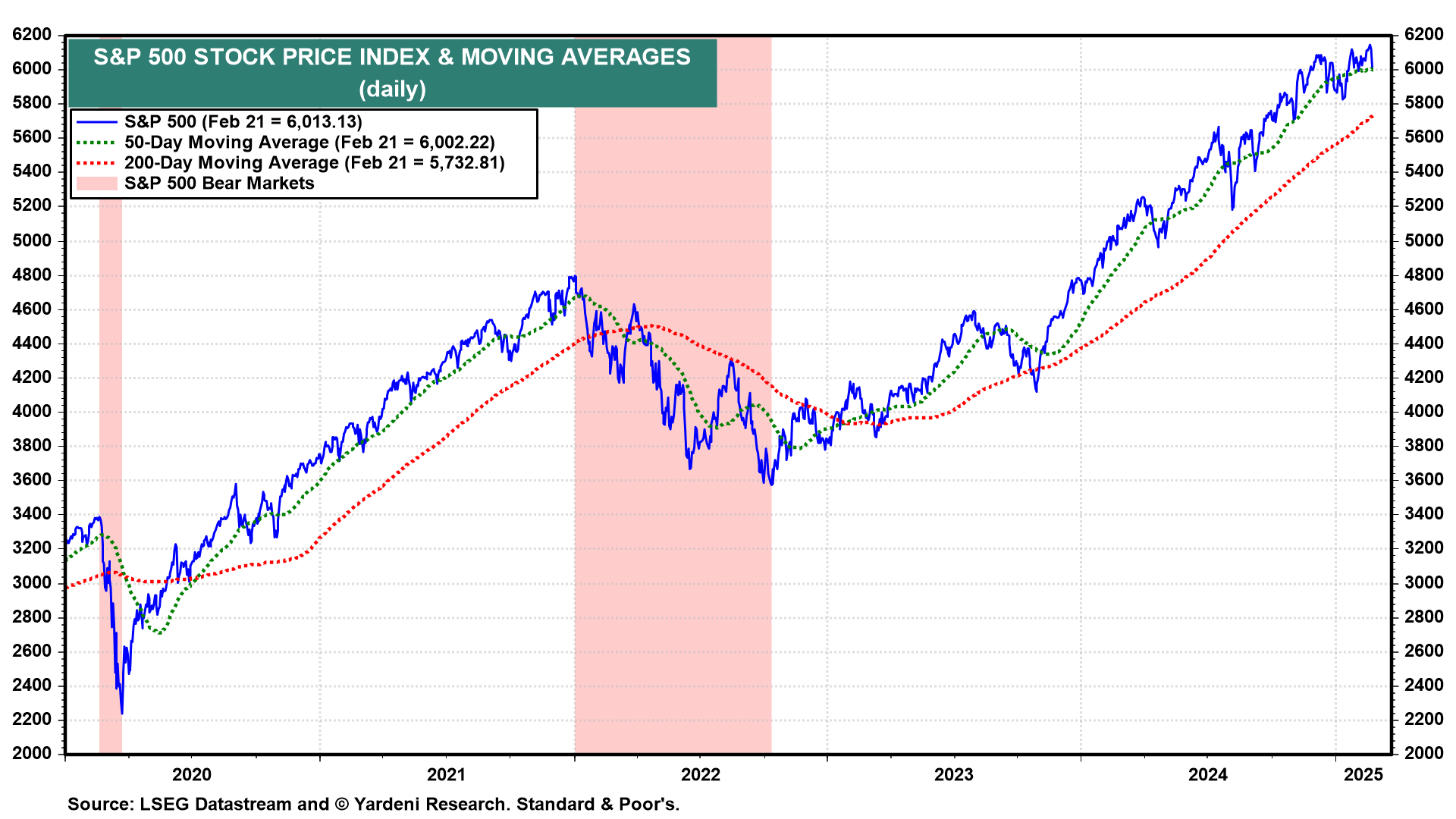

Our answer to the title's question is that the stock market is still in choppy waters. Admittedly, it felt more like a waterfall on Thursday and Friday. However, the S&P 500 was down only 2.1% and that was from a record high on Wednesday (chart). Our hunch is that sentiment turned very bearish very quickly at the end of last week because investors aren't as sure about the economy's resilience as we are. We remain impressed that it grew over the past three years notwithstanding a significant tightening of monetary policy, a mini-banking crisis, and lots of geopolitical turmoil. We continue to place our bets on its resilience.

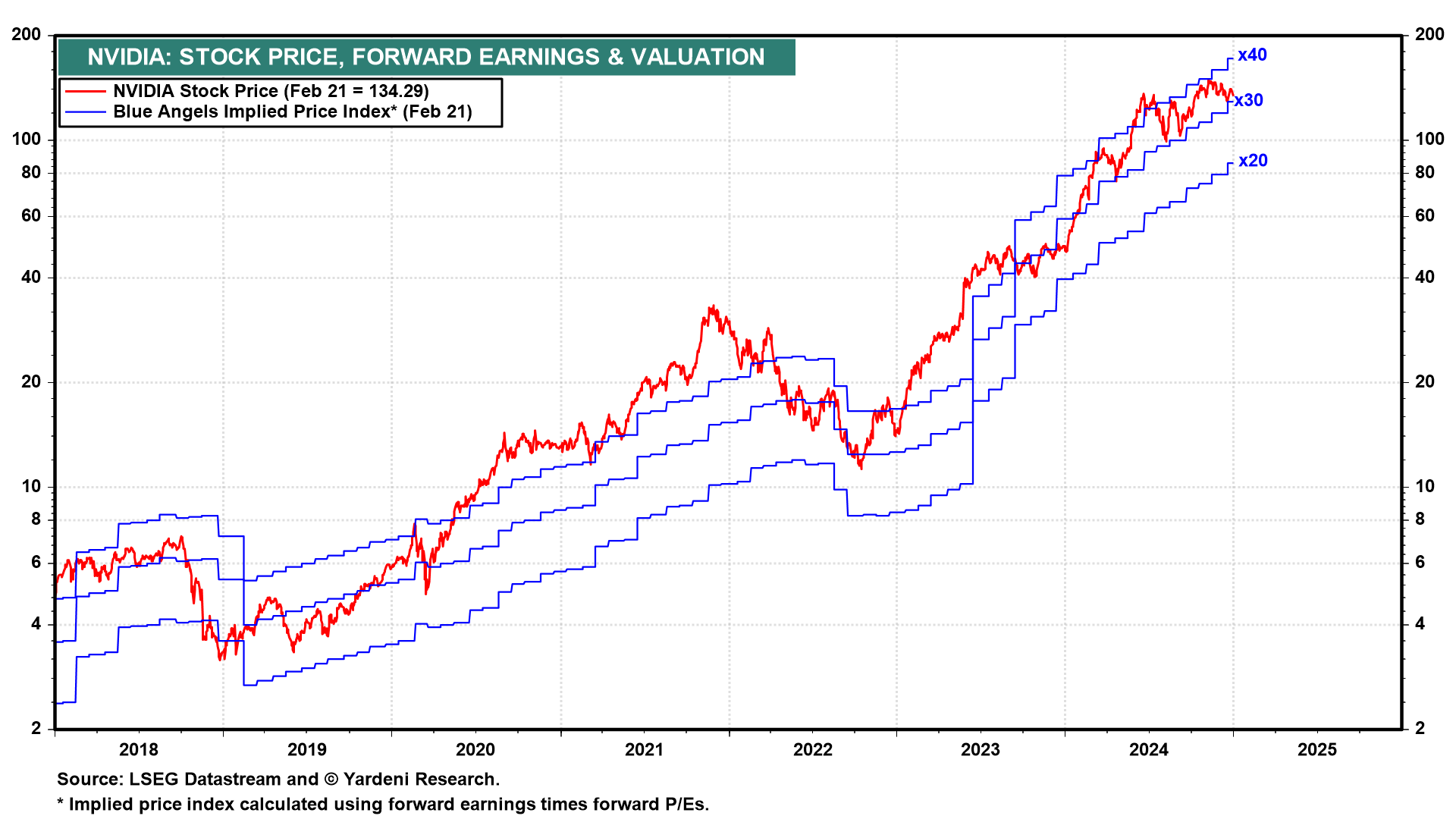

We expect that Nvidia's earnings report, coming Wednesday after the close of trading, will be stronger than expected, providing a boost to the market (chart). We expect to hear guidance that DeepSeek won't kill spending on AI infrastructure, including datacenters. Elon Musk's xAI project utilized 200,000 Nvidia H100 GPUs. The main risk is that Nvidia will announce yet another delay in its highly anticipated Blackwell GPU, which was first announced in March 2024.