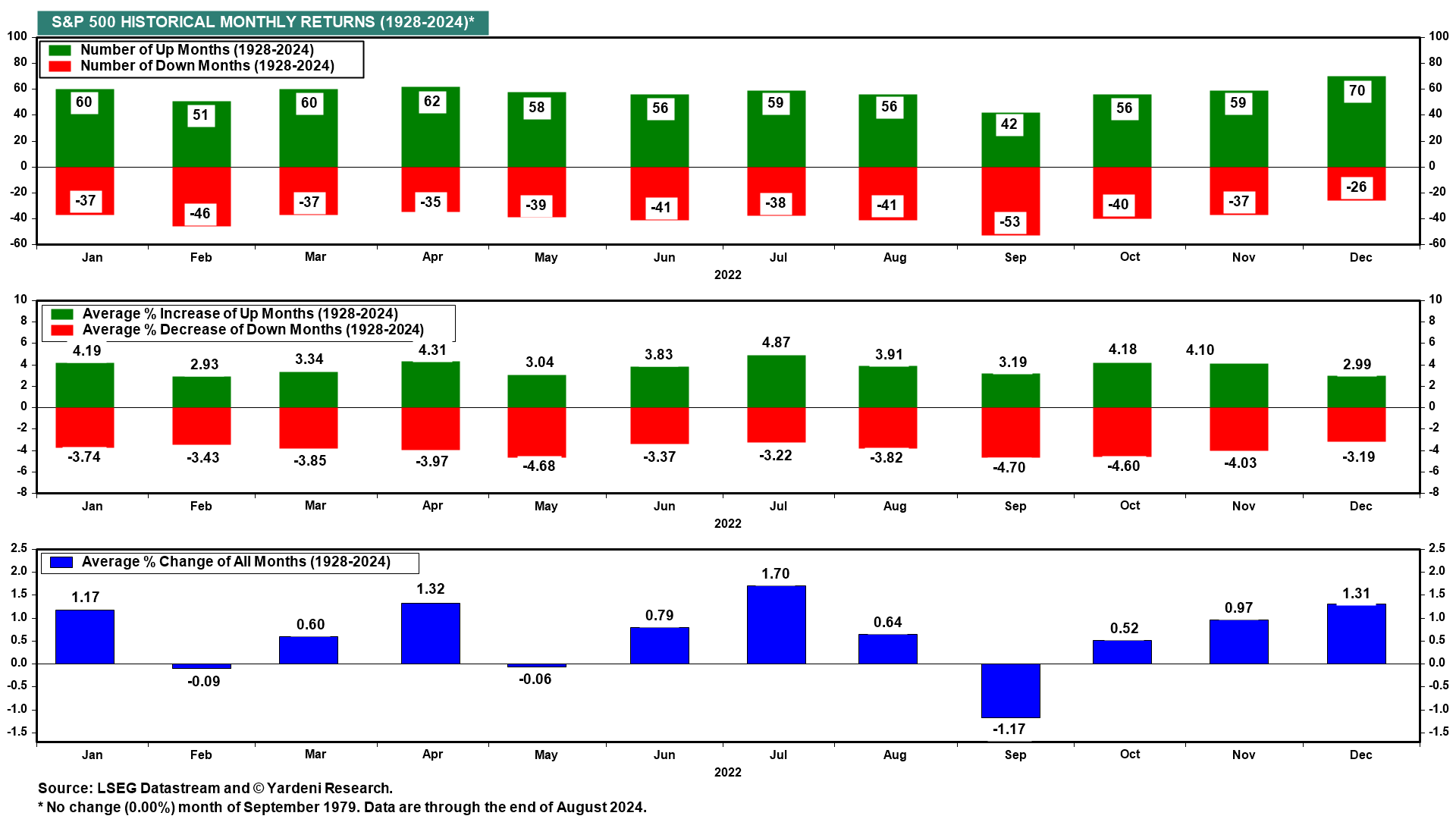

September has a history of being the worst month of the year for the stock market (chart). It's hard to imagine that it will be a bad one this year since the Fed is widely expected to start its latest monetary easing cycle on September 18 with a 25bps cut in the federal funds rate (FFR). In addition, the FOMC will release its latest Summary of Economic Projections on that date. It is widely expected to confirm that the Fed intends to cut the FFR several times in coming months.

Then again, the S&P 500 is up 18.4% ytd. So it seems to have discounted lots of good news. It's certainly too early to discount a bearish political outcome on November 5. In our opinion, that would be a sweep for either of our two political parties since the stock market tends to favor gridlock. However, the market does have a history of doing well no matter which party is in the White House (chart).