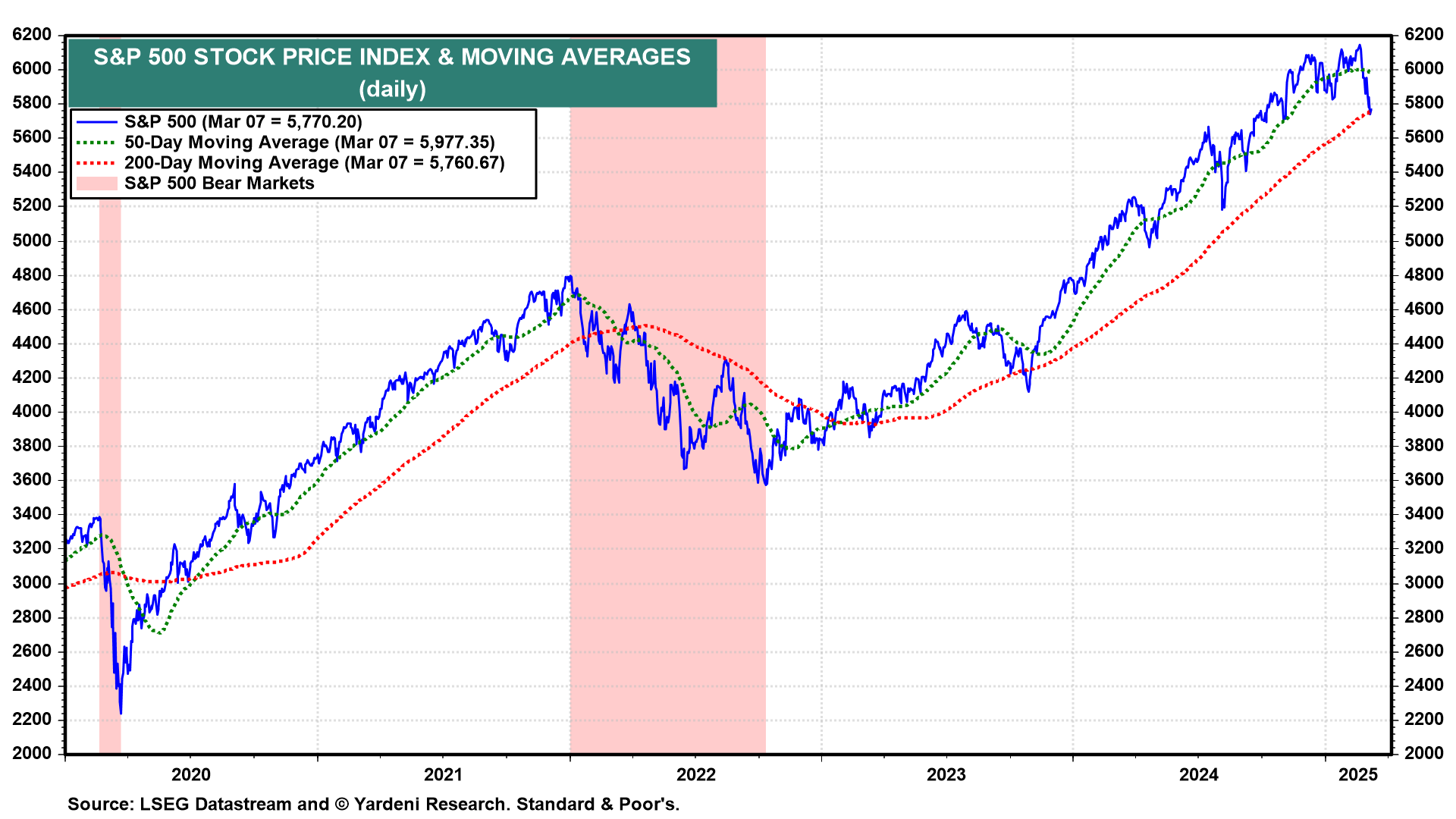

Anything is possible in Trump World. We can't rule out the possibility that a bear market started on February 20, the day after the S&P 500 rose to a record high (chart). It could be like the "flash crashes" that occurred during 1962 and 1987. It could happen quickly and reverse just as quickly. So the selloff could provide buying opportunities, especially in overvalued names that are now less so.

For now, the problem is that the Trump administration's rapid-fire policy initiatives are stress-testing the economy, which has been remarkably resilient so far, and raising fears of a recession.

Trump officials have heightened those fears in recent days. Today, in an interview with Maria Bartiromo on Fox News, the President himself refused to rule out a recession this year and said that the economy is in "a period of transition." He also acknowledged that tariffs might fuel inflation. On Friday, US Treasury Secretary Scott Bessent said that the US economy may slow as it transitions away from public spending toward more private spending, calling it a "detox period" needed to reach a more sustainable equilibrium.

The administration's policies that are currently being implemented (federal job cuts and tariffs) increase the risk of a stagflationary outcome. We give that scenario a 35% subjective probability, which we raised from 20% last Wednesday. But the stock market seems to be signaling that stagflation is even more likely than we think given how quickly stock prices have dropped since February 19 (chart).

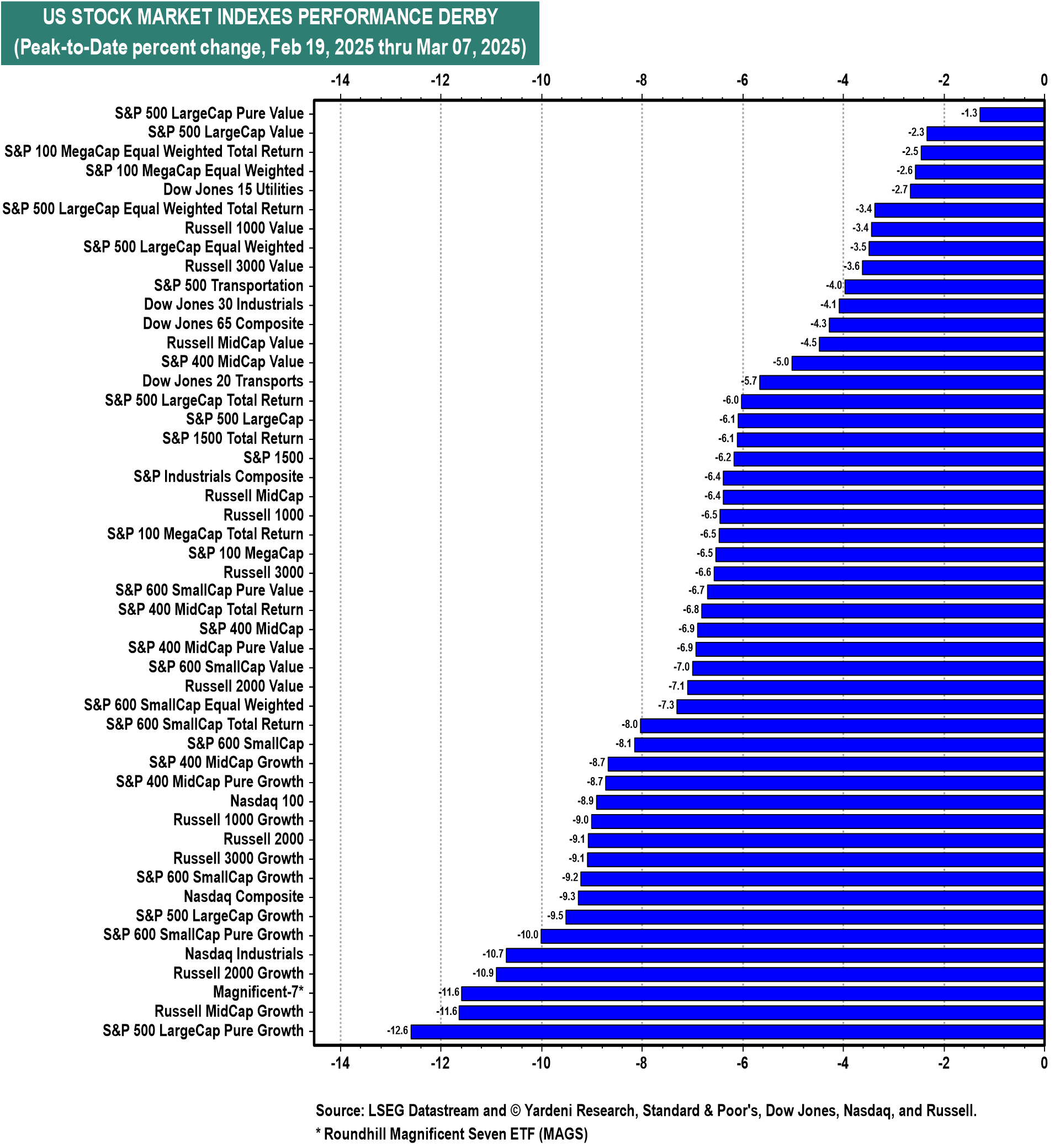

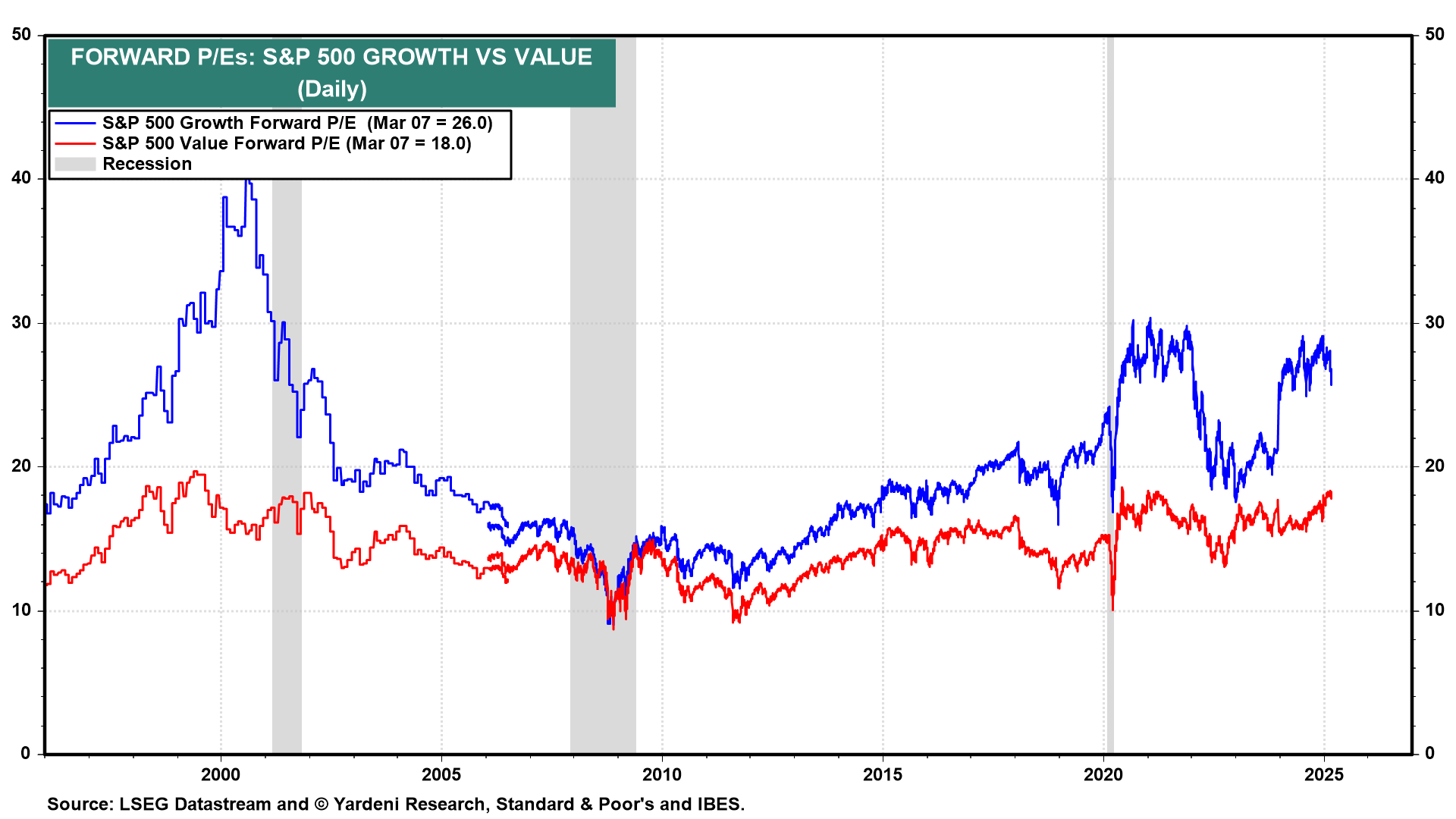

The biggest losers have been S&P 500 Growth stocks, confirming the market's fear of a recession. S&P 500 Value stocks have held up relatively well. At the end of February, the former had a forward P/E of 26, while the latter traded at 18 (chart).

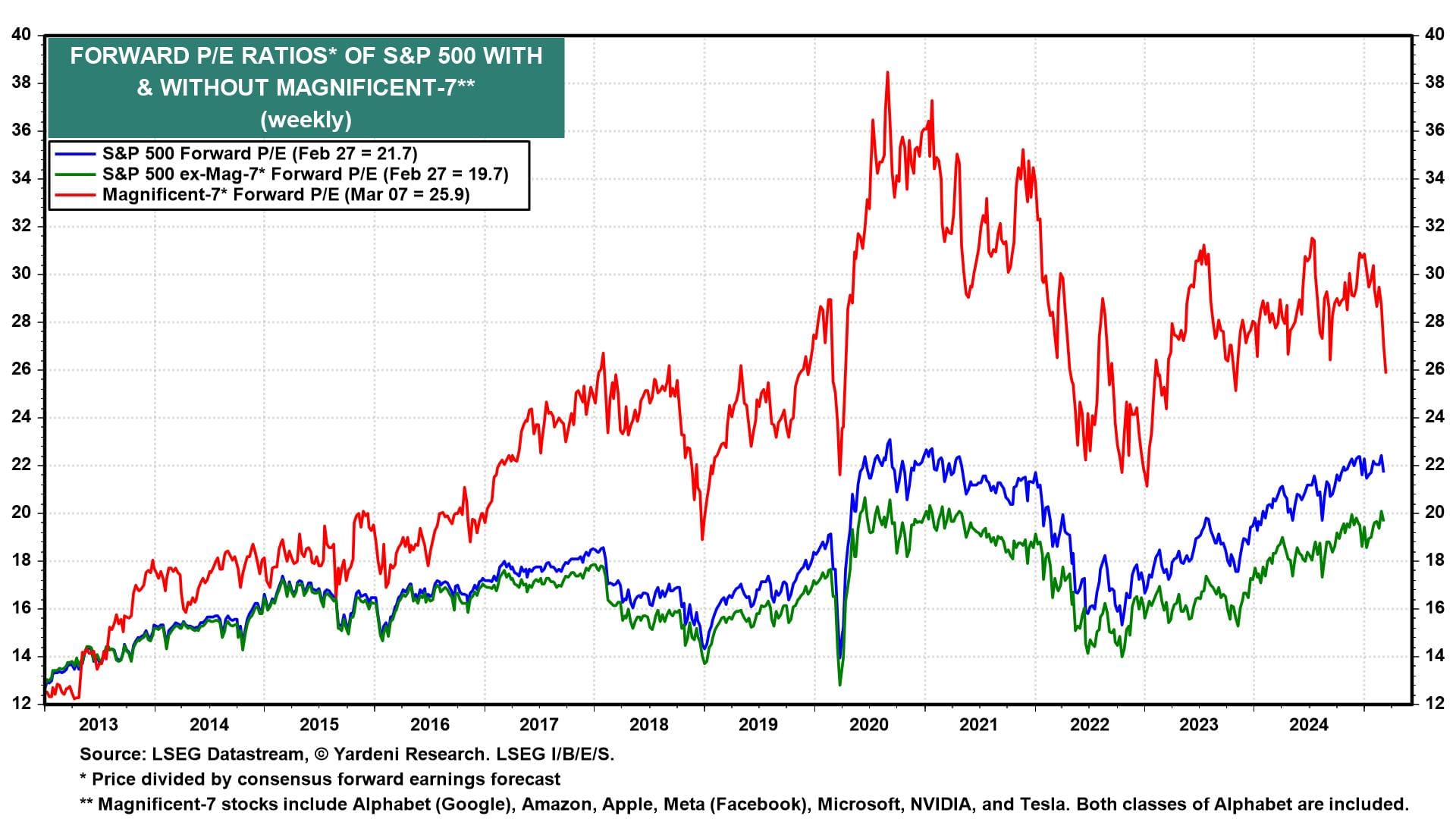

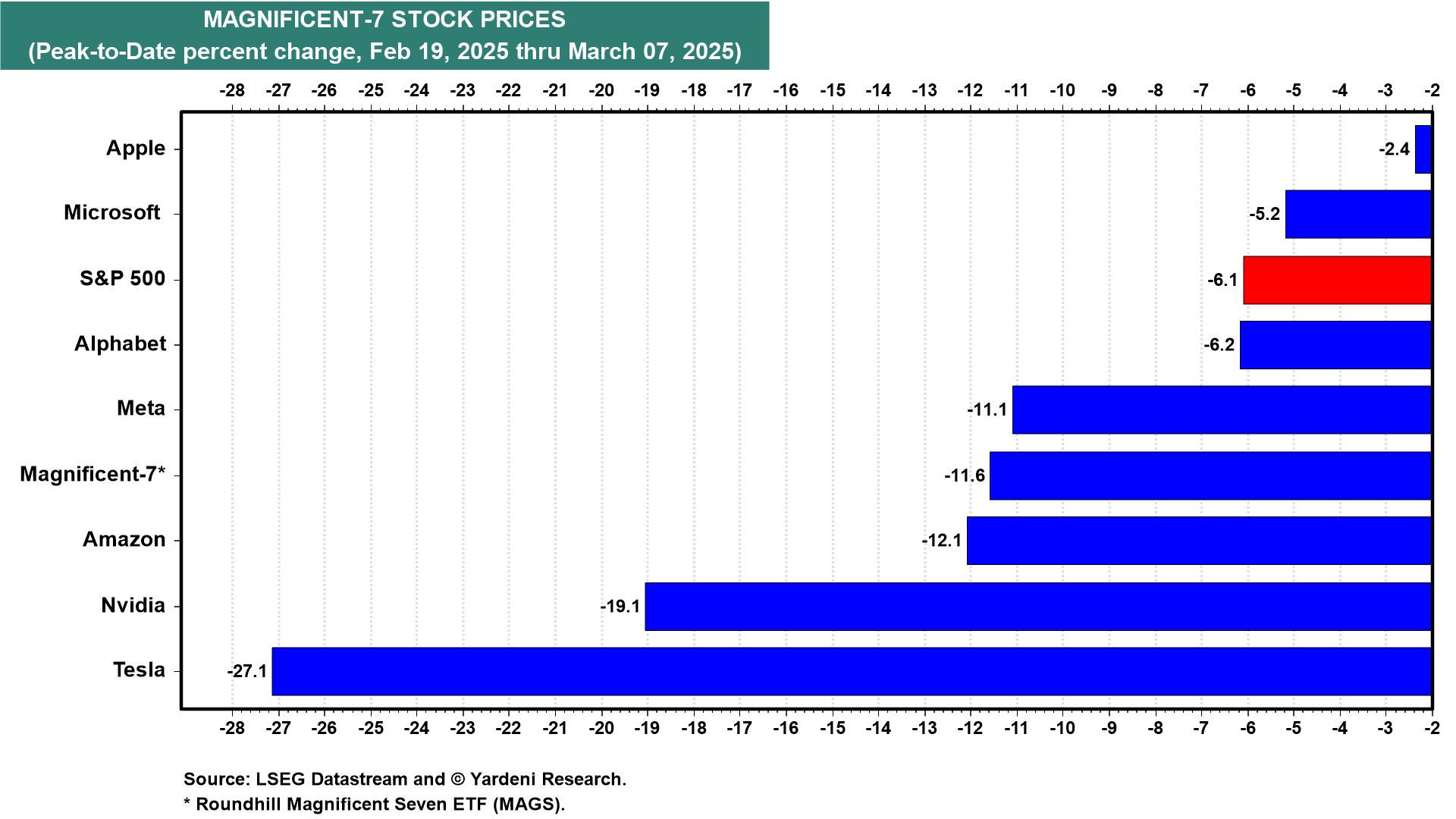

Leading the decline in the S&P 500 have been the Magnificent-7 stocks. Their collective forward P/E is down from over 30 at the start of the year to 26 on Friday (chart). The forward P/E of the S&P 493 has held up relatively well too so far around 20. We’ve been expecting a broadening of the bull market to the S&P 493, which seems to be happening on this pullback.

Contributing the most to the weakness in the Mag-7 and the S&P 500 since February 19 have been two stocks, Tesla and Nvidia (chart).

We aren't counting on the Fed to make a bottom in the stock market by easing, as has happened many times before. On Friday, Fed Chair Jerome Powell assured us all that the economy is in "a good place." He indicated that Fed officials are just as uncertain about how Trump's policies will affect the economy as everyone else. As a result, he reiterated that the Fed is in no rush to lower interest rates.

Without a Trump or Powell Put, bulls will have to bet on the resilience of the economy and earnings. We still think that's a good bet. The Roaring 2020s scenario has worked well for us so far. We think it will continue to play out over the rest of the decade.

We asked Michael Brush for an update on insider buying activity: "After staying sidelined for the past several months, actual insiders (not institutional owners who report because of large position size) have stepped up to buy in the past two weeks. Insiders with good records and buying in size ($100K or more) were most interested in cyclical areas like energy, technology, banking, and industrials. But they are also showing an interest in biotech, which has been especially weak." Thanks, Michael.