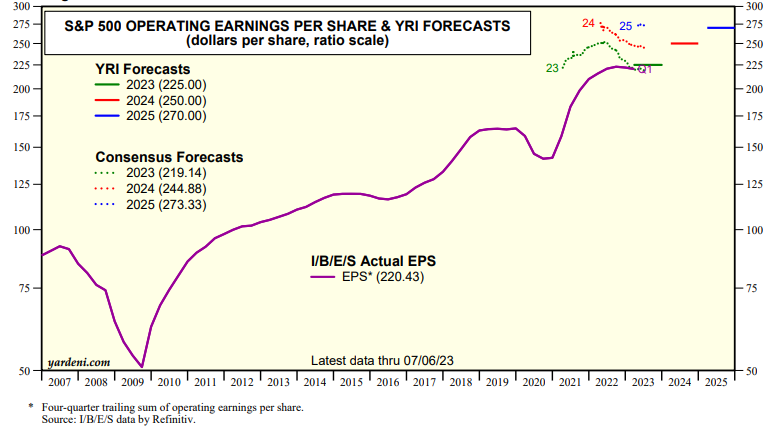

The S&P 500 is hot. The Nasdaq is even hotter. The mounting concern is that both might be getting too hot resulting in a stock market meltup that could set the stage for a meltdown. If so, we expect that the downdraft would be a correction rather than a new bear market since we give 25% odds to a recession scenario over the next two and a half years. We estimate that S&P 500 earnings should be $225 this year, $250 next year, and $270 in 2025 (chart).

So we see the bull market that started on October 12, 2022 continuing through at least the end of next year with the S&P 500 reaching a new record high somewhere between 4800 and 5400 over the next 18 months (with a forward P/E of 17.8 to 20.0 on $270 forward earnings).