Nvidia's three-day AI lovefest for developers starts Monday afternoon in San Jose, California. The FOMC meets Tuesday and Wednesday followed by Fed Chair Jerome Powell's press conference at 2:30 pm following the meeting.

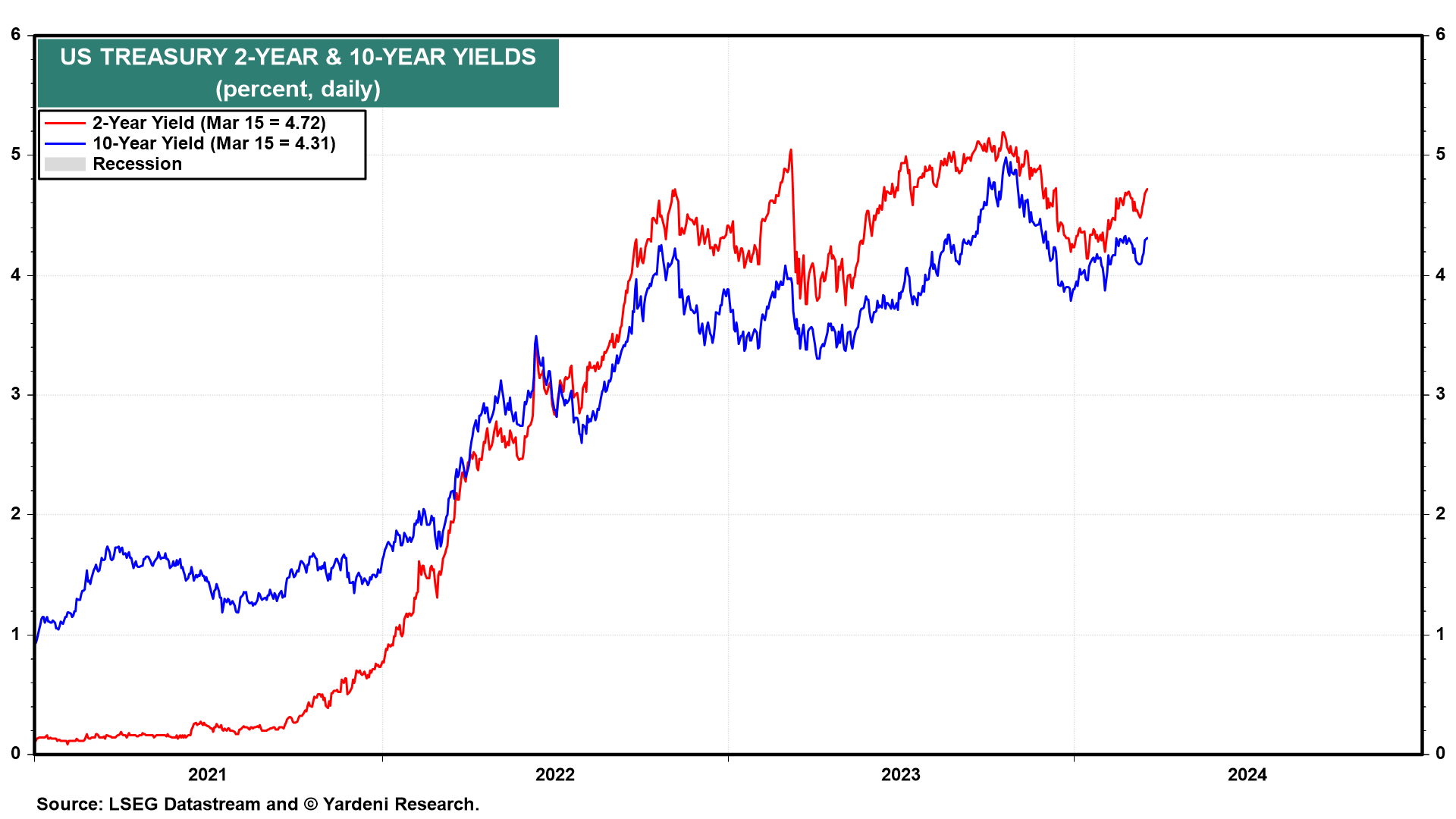

During his congressional testimony on March 7, Powell indicated that the Fed "is not far from...dial[ing] back the level of restriction." After last week's hotter than expected readings for February's PPI and CPI, we expect he will sound more hawkish on Wednesday. Furthermore, the FOMC's latest Summary of Economic Projections might show that the median expectations of the committee's members reflect a slower pace of moderation for inflation and perhaps two rather than three rate cuts this year. The markets made such an adjustment in recent days (chart).

We could see a scenario in which FOMO buyers jump into Nvidia and other tech stocks during Nvidia CEO Jensen Huang's talk from 4-6 pm EST on Monday. They might do so after the close or on the open Tuesday morning. Then bearish traders might take the market down Tuesday afternoon expecting a more hawkish Powell presser. They might keep selling if Powell dials back his talk about dialing back restriction.