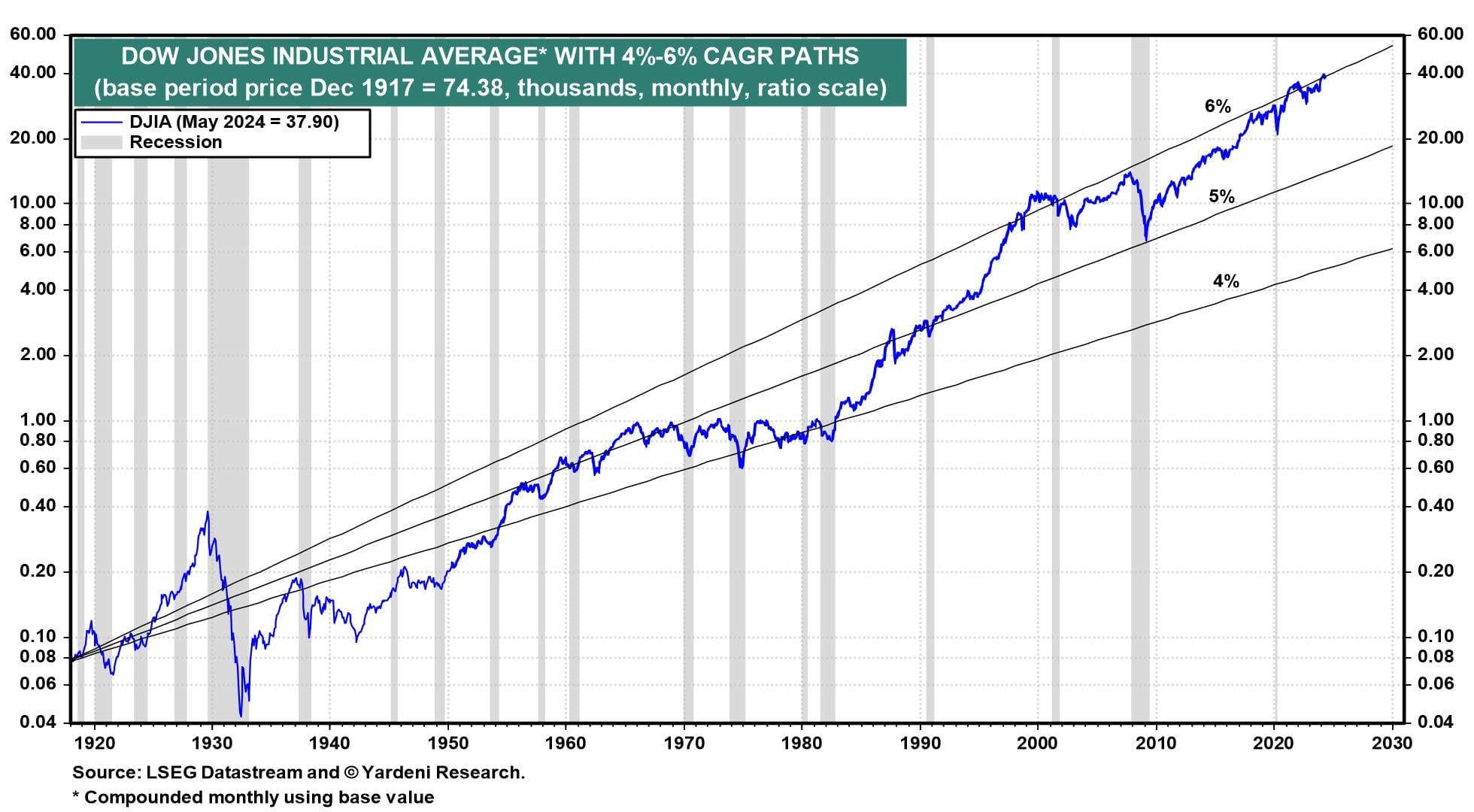

The Dow Jones Industrial Average closed above 40,000 on Friday for the first time. It's on track to rise 50% to 60,000 by 2030, in our opinion (chart). The S&P 500 should rise by as much to 8000. That target could be achieved with a forward P/E of 20 and forward earnings at $400 per share, up 60% from an estimated $250 per share this year. We think that's possible in our Roaring 2020s scenario.

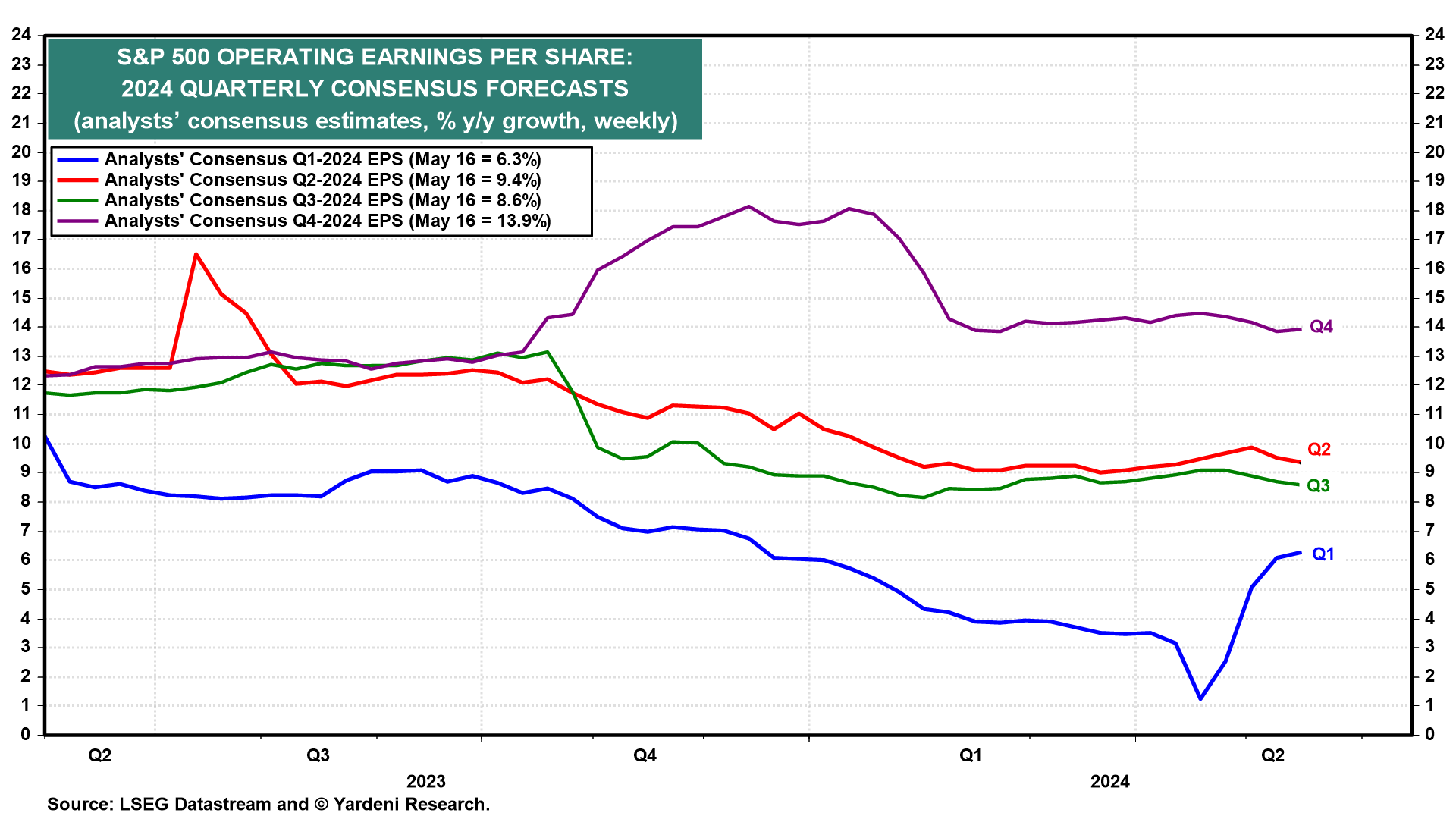

For the here and now, the Q1-2024 earnings season is over. Early on, the analysts' consensus estimate for S&P 500 EPS implied an increase of just 1.2% y/y for the quarter (chart). The actual result was a 6.3% increase.

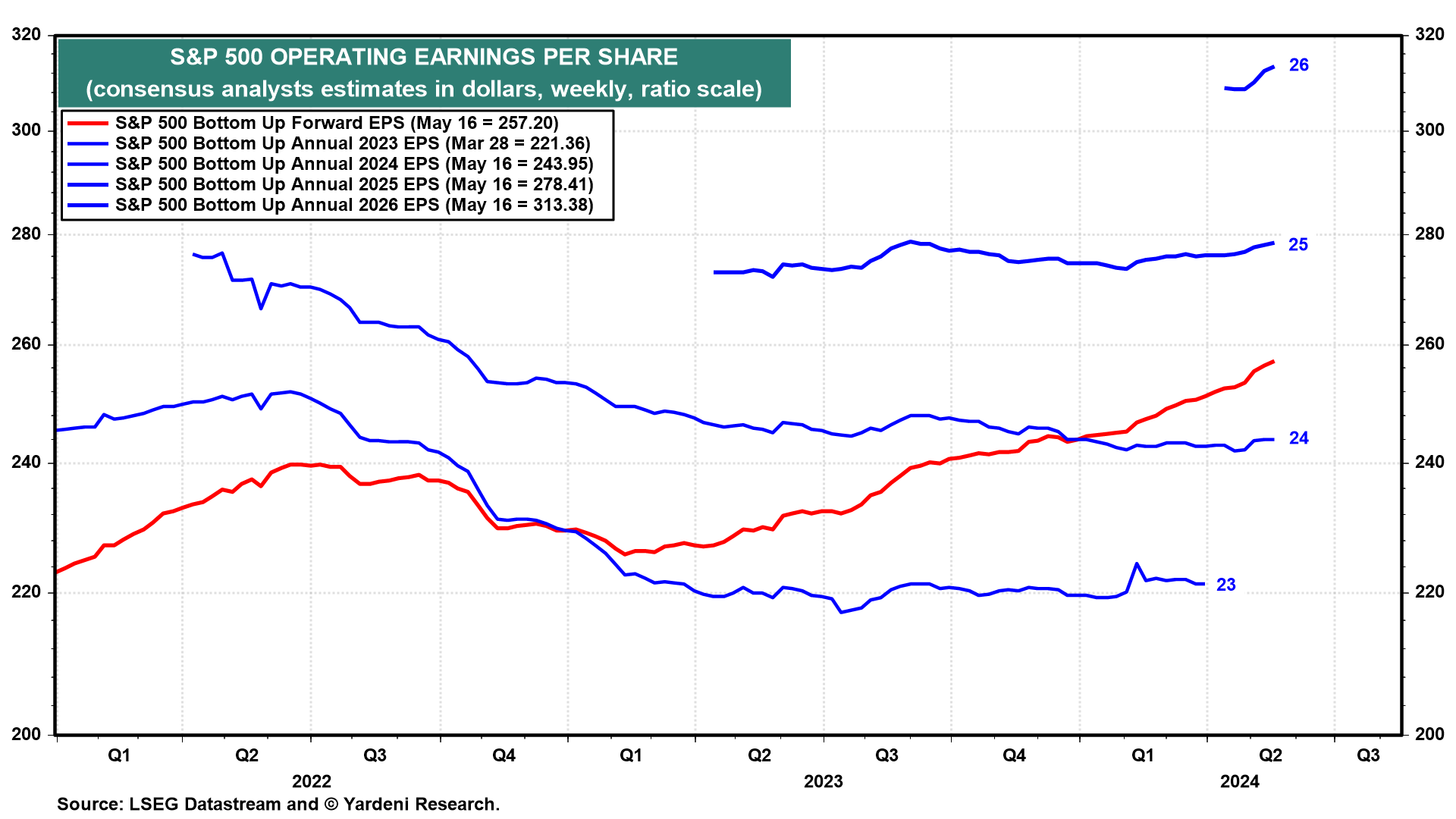

S&P 500 forward earnings (the time-weighted average of consensus estimates for this year and next year) rose to new record highs during the earnings season hitting $257.20 during the May 15 week (chart). The analysts currently estimate that earnings per share will be $244 this year, $278 in 2025, and $313 in 2026. These estimates suggest that $400 by 2030 is quite possible.

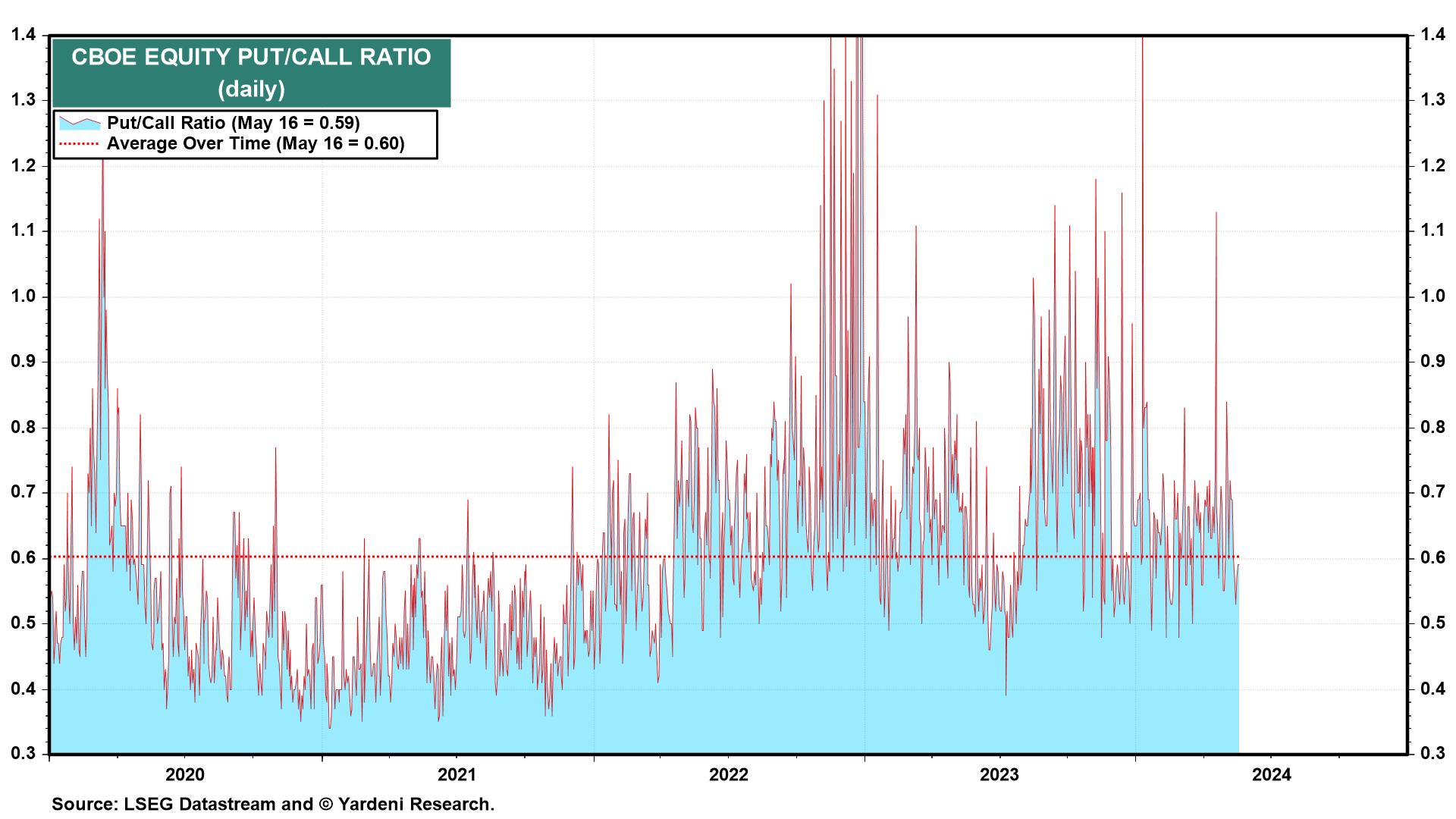

We asked Joe Feshbach for his outlook for the stock market from a trading perspective: "The stochastic indicator I use did an excellent job of anticipating a trend change/rally two weeks ago, and still remains positive. However, it doesn't tell us how big or small the rally will be—or how long it will last. We have to wait for the indicator to turn back down for it to signal the end of the rally phase. If we want to anticipate the rally's end, the stochastic will tell us a little late. I am expecting this rally to end very soon, though, because the put/call ratio has fallen much too low for anything meaningful to continue from here; it suggests a setback will soon take place (chart)." Thanks, Joe.

We asked Michael Brush for an update on insider activity: "As stocks hit new highs, the mixed signals from corporate insiders continue. Insiders remain in cautionary mode judging by the overall buy/sell ratio. But the uptick in actionable buys continues (bullish signals based on qualities like size, insider records, and cluster formations). That's particularly the case in interest-rate-sensitive areas like long-duration emerging tech, early-stage biotech, and closed-end funds with rich dividend yields. Insiders also have been acting opportunistically, picking off names that gap down or trade near their 52-week lows." Thanks, Michael.