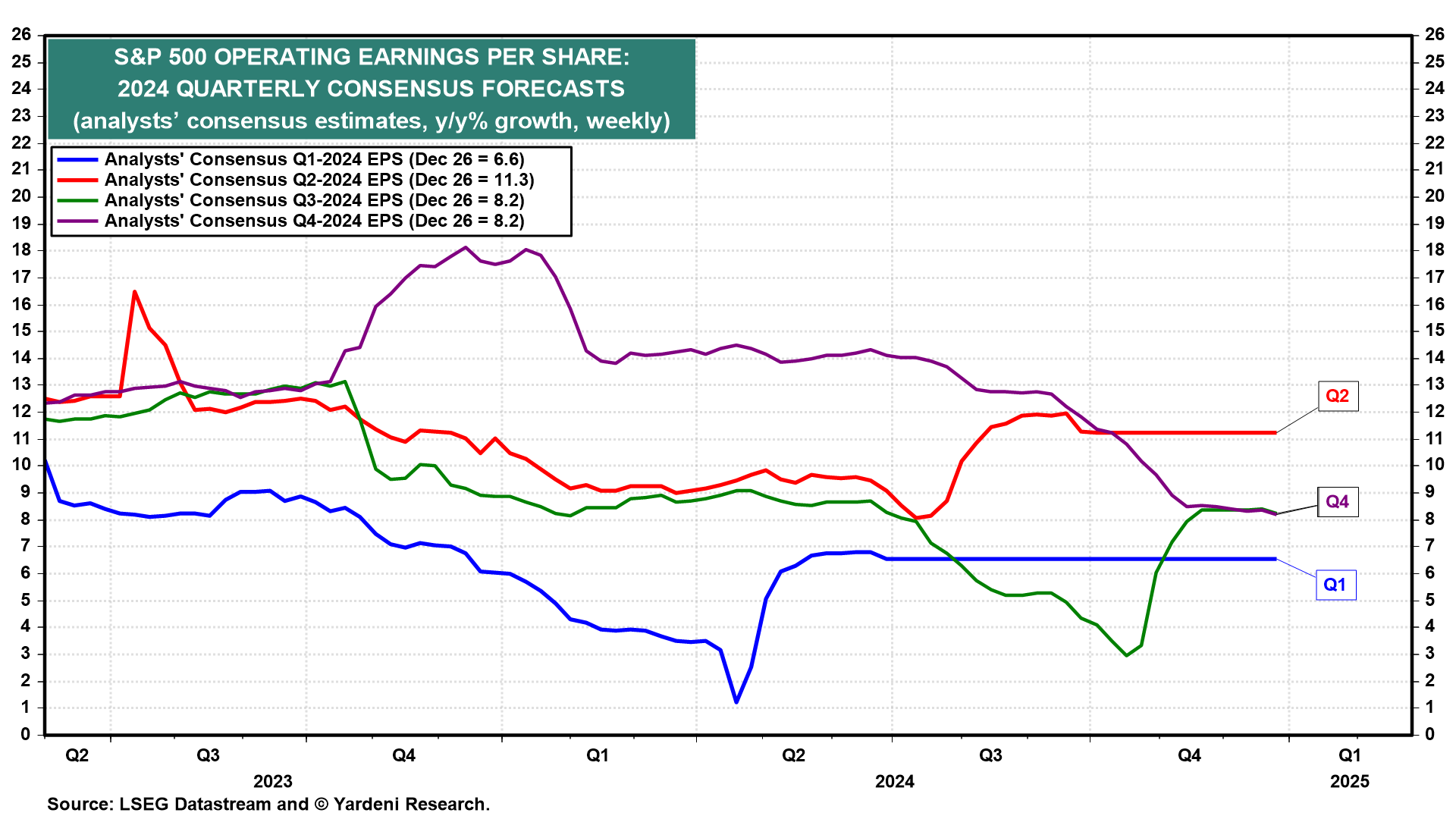

January could start the year off with some volatility in the bond and stock markets. There are lots of fundamental and technical crosscurrents and a few possible riptides. The Q4 earnings reporting season during January should show a solid increase in S&P 500 operating earnings per share of at least 8.5% y/y (chart). We expect closer to a 10.0% increase since positive earnings surprises regularly occur when the economy is growing.

Q4's real GDP won't be reported until January 30, but along the way, the Atlanta Fed's GDPNow tracking should show that it is likely to be around 3.0% (saar) with a solid increase in consumer spending. Nevertheless, the following could be sources of some turbulence:

(1) Portfolio rebalancing. Investors have huge capital gains, especially in the Magnificent-7. They might have held off rebalancing their portfolios in 2024 until the start of the new tax year in 2025. Such selling might feed on itself if the Mag-7 disappoint during earnings season because their massive spending on AI is weighing on their earnings.

Individual investors might also rebalance out of stocks and into cash, bonds, and other assets. US households have a record 43.4% of their financial assets in equities (chart). Furthermore, that might be yet another contrarian signal that investors are too bullish currently.