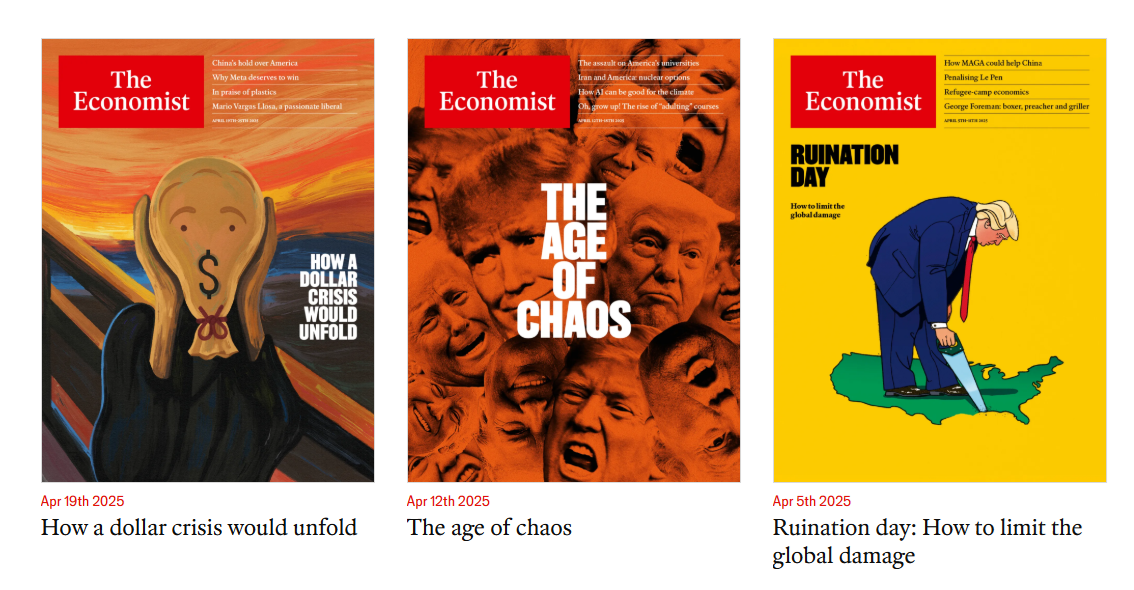

We don't recall this ever happening before. During the past three weeks, The Economist has featured three very bearish cover stories suggesting that the dollar might be on the verge of collapse and that so might the US stock and bond markets along with the global economy (chart). Contrarians of the world, unite!

As extreme bearishness pervades world markets, the old maxim “It’s always darkest before the dawn” comes to mind, or rather: “Markets are always at peak bearishness before the bull.” Granted, there are valid reasons for losing sleep in recent weeks: Donald Trump's chaotic trade war, American consumers' depressed confidence readings, global stagflation chatter, panicky bond markets, Chinese deflation, China's preparations to blockade Taiwan, the Russia-Ukraine debacle, Iranian nuclear machinations, the skyrocketing price of gold, and mounting fears of another Great Financial Crisis.

But the sheer scale of this year’s bull market in terms of angst could be a bubble all its own. If negativity is indeed overdone, then global equity markets may be due for a bounce—or, at worst, choppy stabilization until the dominant risks work themselves out.

One reason for optimism: China’s willingness to sit at Team Trump’s negotiating table. Last week, President Xi Jinping’s government said China is ready to talk trade—with preconditions, of course, including the Republican Party lowering the rhetoric temperature and Trump clarifying exactly what concessions he seeks.

But this step alone could give Trump geopolitical cover to whittle his 145% tariff down to a market-relieving double-digit figure or to suspend it. Hints that US-Japan bilateral trade discussions are progressing might also prompt Trump to pivot away from escalating his trade war.

The bottom line: It might require a stock market meltdown that matches or exceeds the 2008 Lehman Brothers crisis to justify the fever pitch of doom-and-gloom in world markets. There are no clear signs one is afoot.

Now consider the other signs of extreme bearishness, which are bullish from a contrarian perspective: