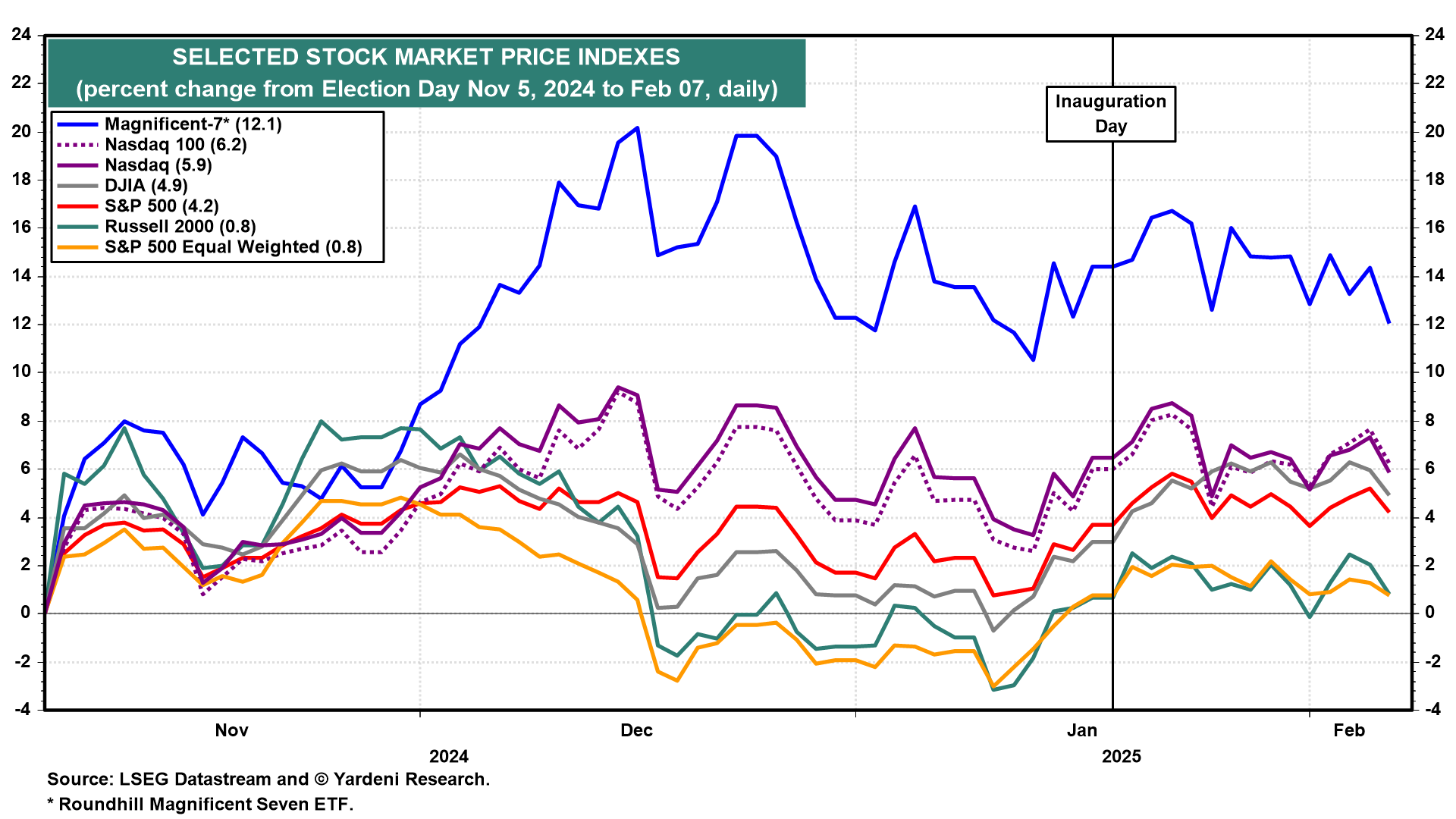

The major stock market indexes are still up since Election Day despite recent turbulence caused by DeepSeek and Trump Tariffs 2.0 (chart). The former is weighing on the shares of AI companies. However, cloud giants Amazon, Microsoft, and Google remain committed to spending record sums this year to build out their AI capacity. Asked last week about the AI cost efficiencies represented by DeepSeek’s widely followed advances, Amazon CEO Andy Jassy echoed the sentiments of other tech leaders in saying that he expects the trend to increase overall AI demand.

Trump Tariffs 2.0 hit the stock market hard on Friday after President Donald Trump said he plans to announce reciprocal tariffs on many countries by Monday or Tuesday of this coming week, a major escalation of his offensive to tear up and reshape global trade relationships in the America's favor.

We view this as a positive development given that Trump previously planned to impose a uniform 10%-20% tariff on all US imports. The reciprocal approach leaves plenty of room for the US to negotiate tariff cuts with each of America's trading partners separately. They're Trump's "art of the tariff" deals!

Trump's reciprocal tariff threat also spooked the bond market on Friday (chart). That's because higher tariffs would cause at least a one-time spike in consumer prices which might trigger a renewed inflation cycle. Another possible reason for the backup in the bond yield on Friday is that the Bond Vigilantes figure that Trump's reciprocal approach to tariffs suggests that he may be abandoning the idea of a uniform tariff aimed at raising revenues.

Here's more:

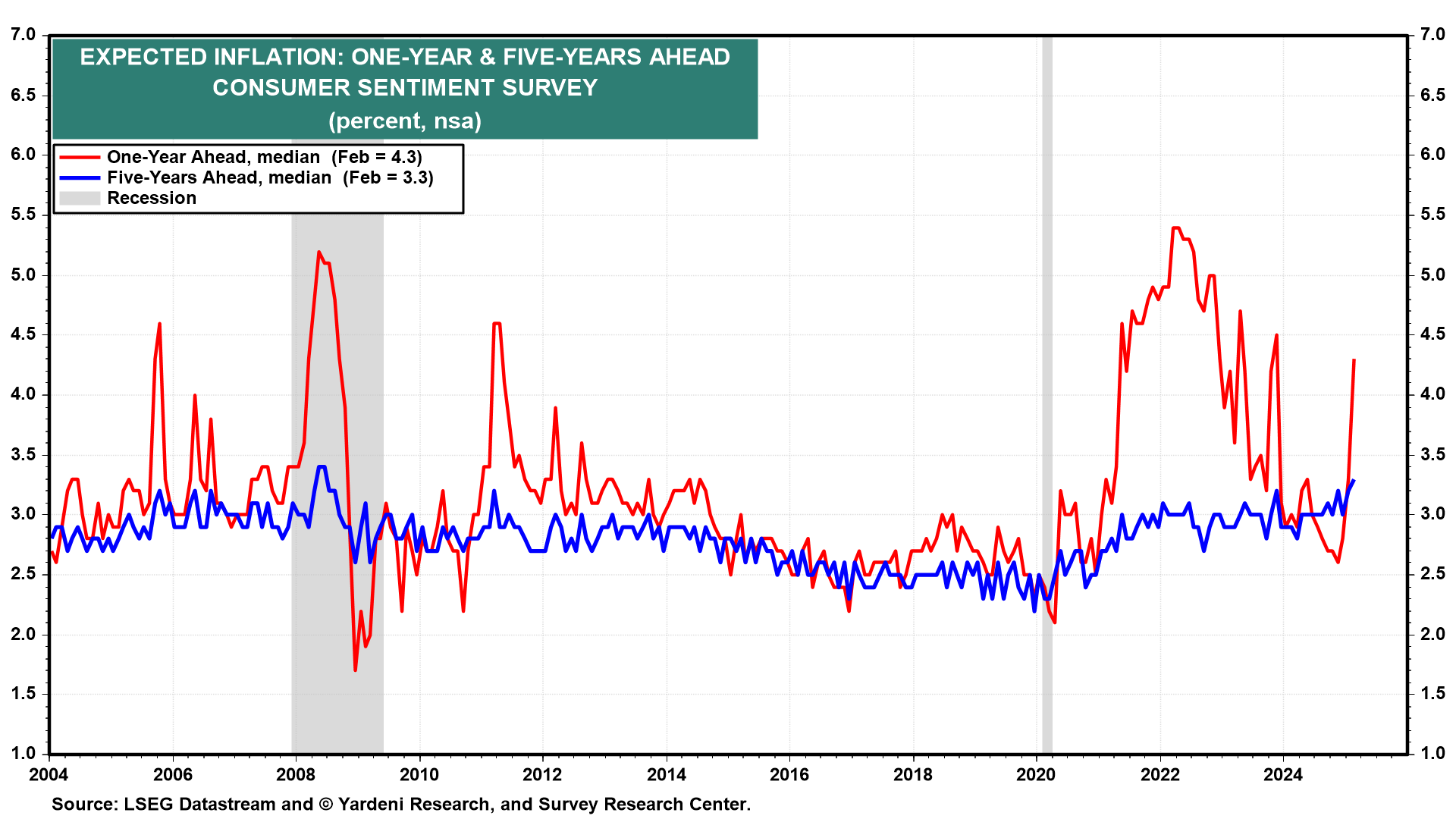

(1) Expected inflation. Exacerbating Friday's stock and bond market selloffs was news that the one-year expected inflation rate jumped to 4.3% this month from 3.3% in January, according to the University of Michigan's latest consumer survey (chart). The interviews for the survey concluded on February 4, just days after the Trump administration announced 25% tariffs on Mexico and Canada, which were quickly delayed by 30 days. But Trump slapped an extra 10% duty on Chinese goods which was met immediately with retaliation by China.

The jump in expected inflation reduces the likelihood that the Fed will be cutting the federal funds rate again anytime soon. For now, we remain in the none-and-done camp in 2025 regarding Fed rate cuts.

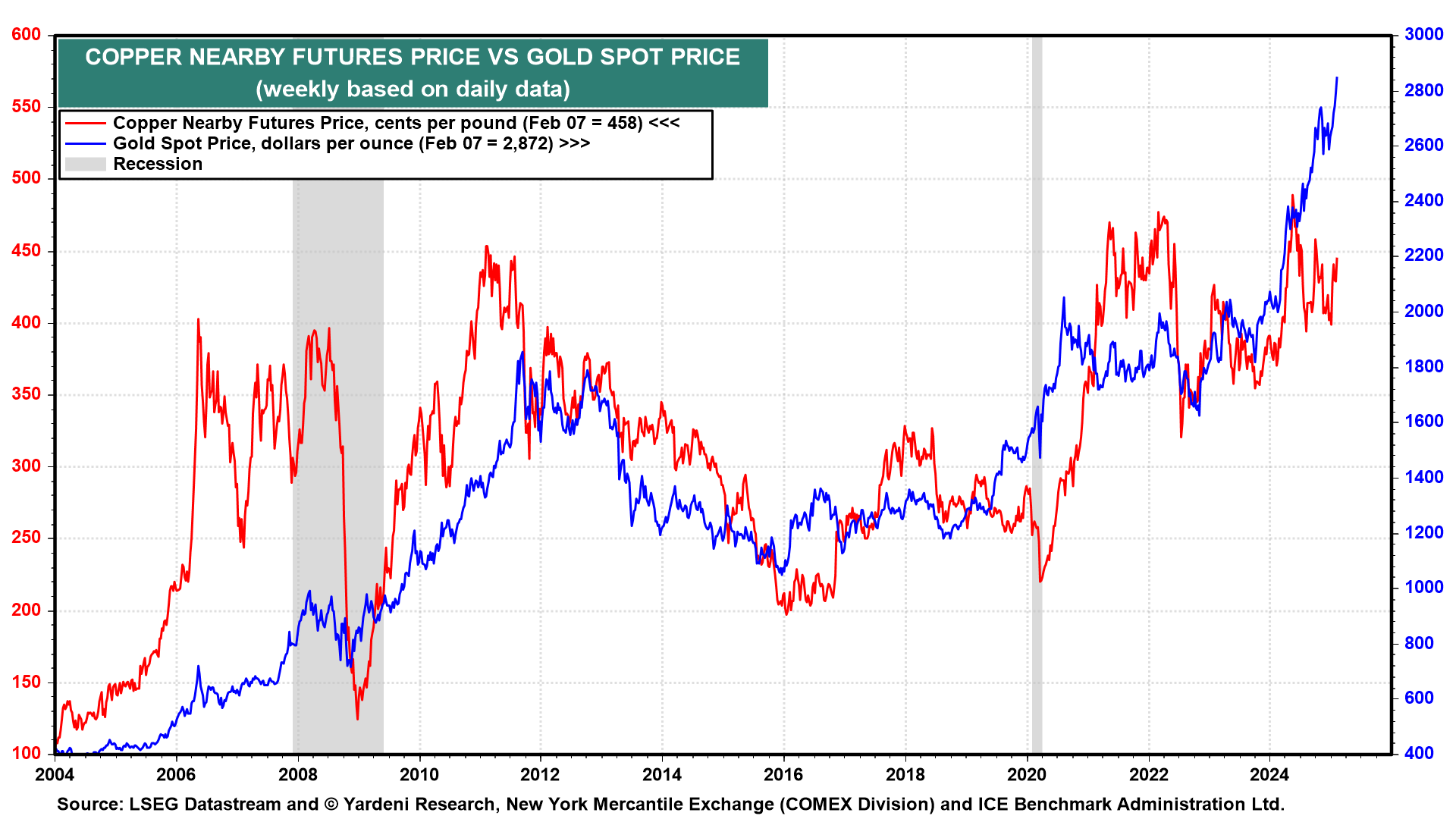

(2) Gold. On Friday, the price of an ounce of gold soared to another record high of $2872 on the tariff news (chart). This may be helping to pull the copper price higher, which might also be attributable to increased spending on data centers. We don't think this development reflects an improvement in China's economy.

The price of gold is likely to hit $3,000 soon and perhaps $4,000 in 2026 as the central banks of countries hostile to the US continue to accumulate it as a safe haven from US sanctions. They've been doing so since the US froze the international reserves of Russia when it invaded Ukraine in early 2022.

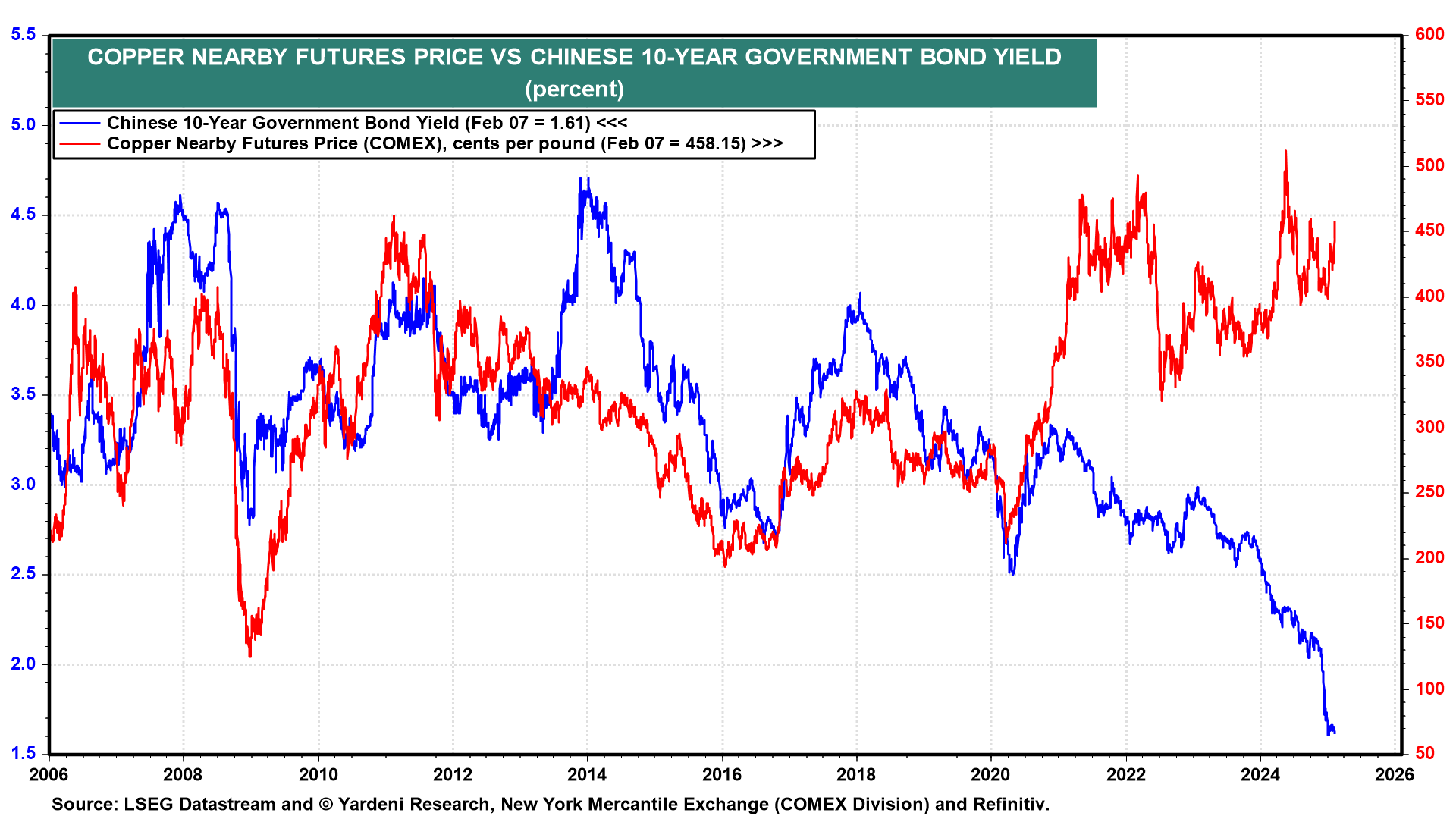

(3) Copper. Also raising doubts that copper is signaling an improvement in China's economy is the renewed drop in the Chinese government 10-year bond yield back down to its recent record low (chart). China's weak economy might explain why China's response to Trump's 10% tariff has been relatively muted so far.

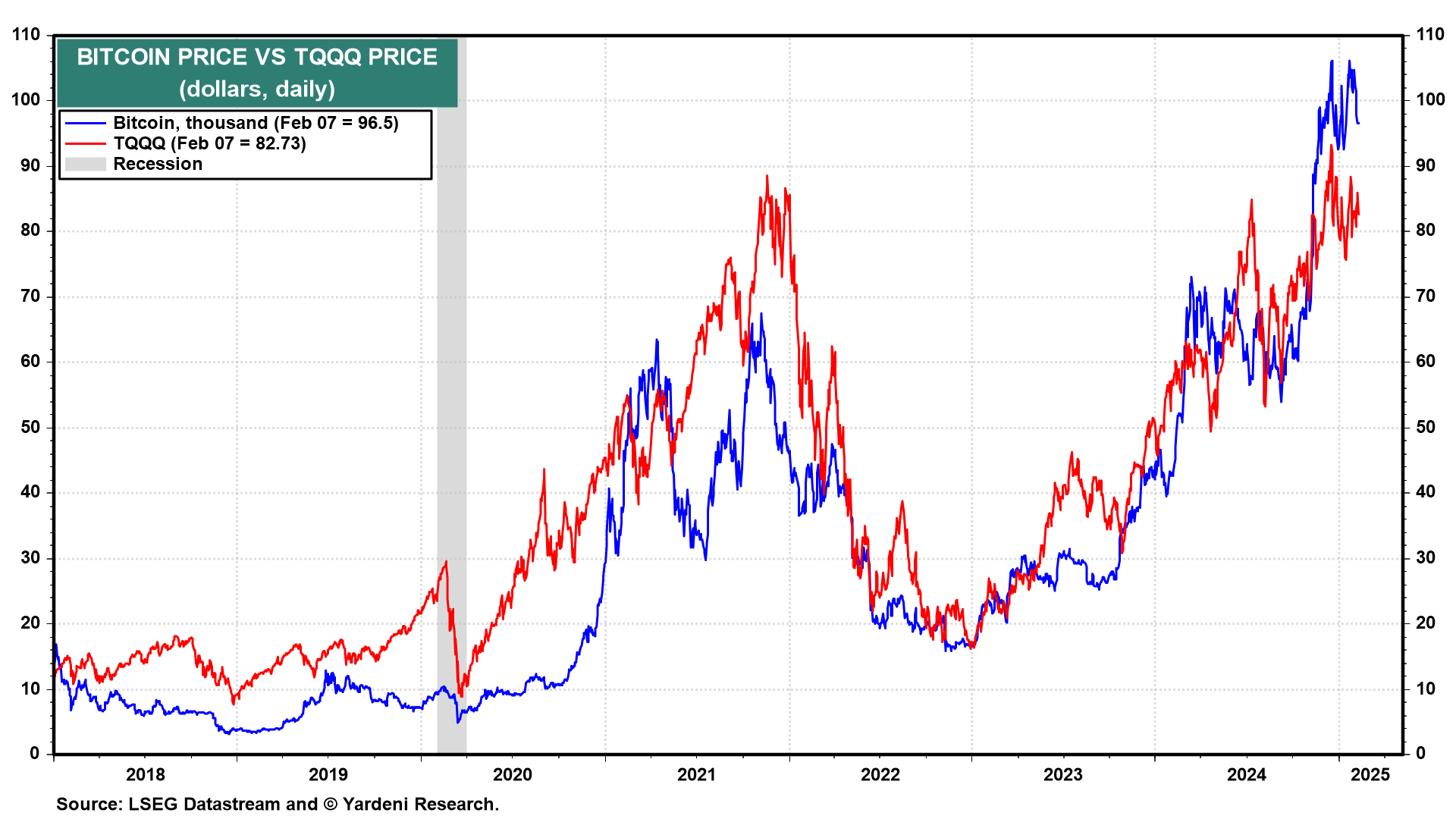

(4) Bitcoin. Tariff turmoil is boosting uncertainty and can explain some of the recent strength in the price of gold. Increased risk has recently weighed on the stock market, especially the riskiest segment such as the TQQQ (chart). Bitcoin has also underperformed gold lately. The former is a risk-on play, while the latter is a risk-off safe haven.

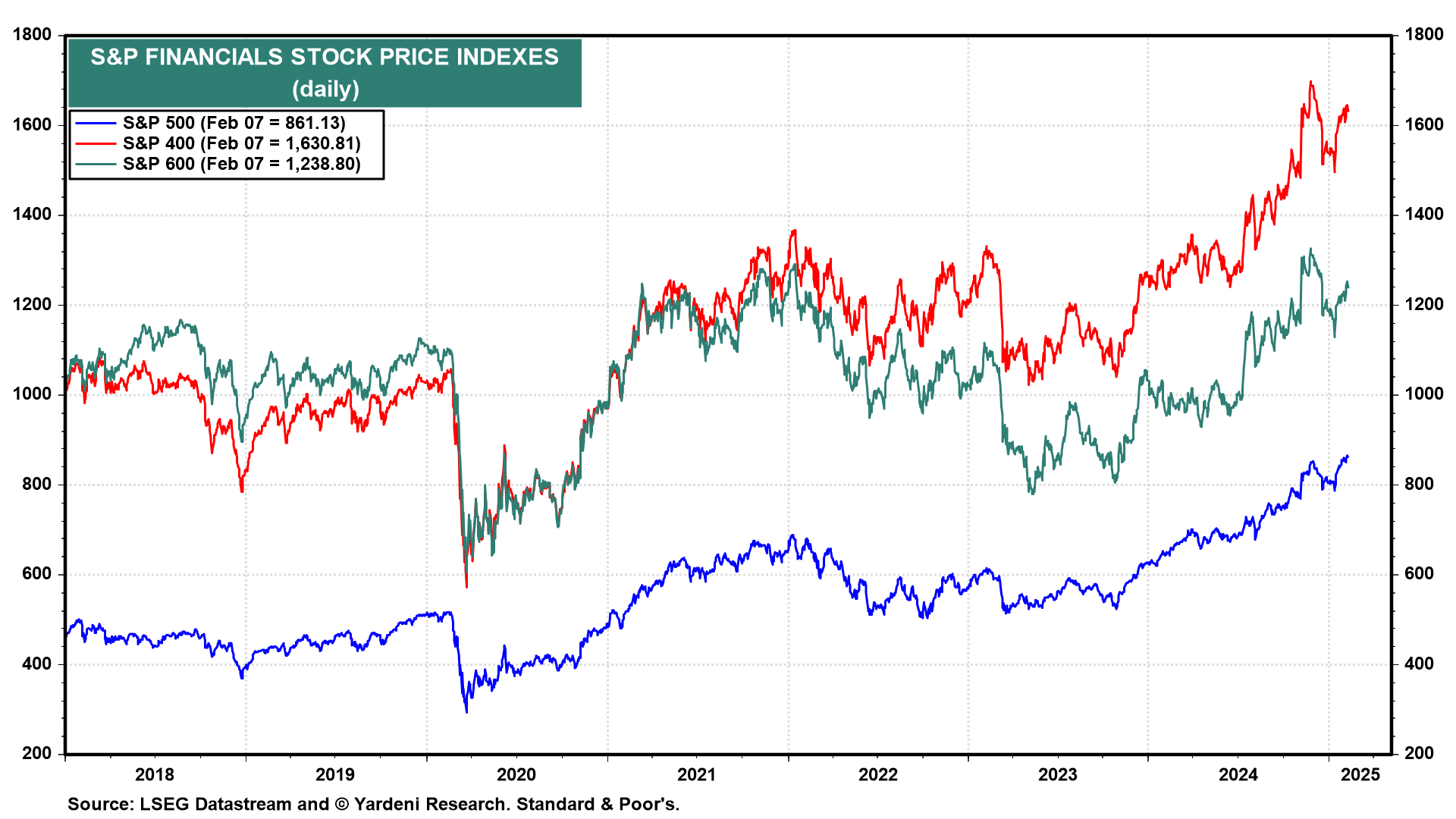

(5) Bottom line. We expect the the S&P 500 might remain choppy through midyear before resuming its climb in record-high territory to 7,000 by the end of this year. We still favor overweighting Information Technology, Communication Services, Industrials, and Financials sectors. The Financials sectors of the S&P LargeCap 500, MidCap 400, and SmallCap 600 indexes all are likely to outperform all the other sectors as long as Trump Tariff 2.0 turmoil persists (chart).