Geopolitical risk increased on Saturday after a rocket strike from Lebanon killed 12 people in Israel's Golan Heights. Israel retaliated with a strike on Hezbollah weapons caches and infrastructure on Sunday. This is all stoking fear of a wider war in the Middle East. So far, the region's turmoil since October 7, 2023 (when Hamas terrorists attacked and massacred Israelis) hasn't weighed on the stock market.

Instead, stock market investors are focusing on the upturn in earnings since early 2023, stretched valuations, and a rotation out of MegaCap stocks to Large Caps and SMidCaps on expectations of a Fed rate cut in September. In addition, technology stocks, especially the Magnificent-7, have been hit by concerns that AI costs a lot to implement while returns on this costly investment are uncertain. Consider the following:

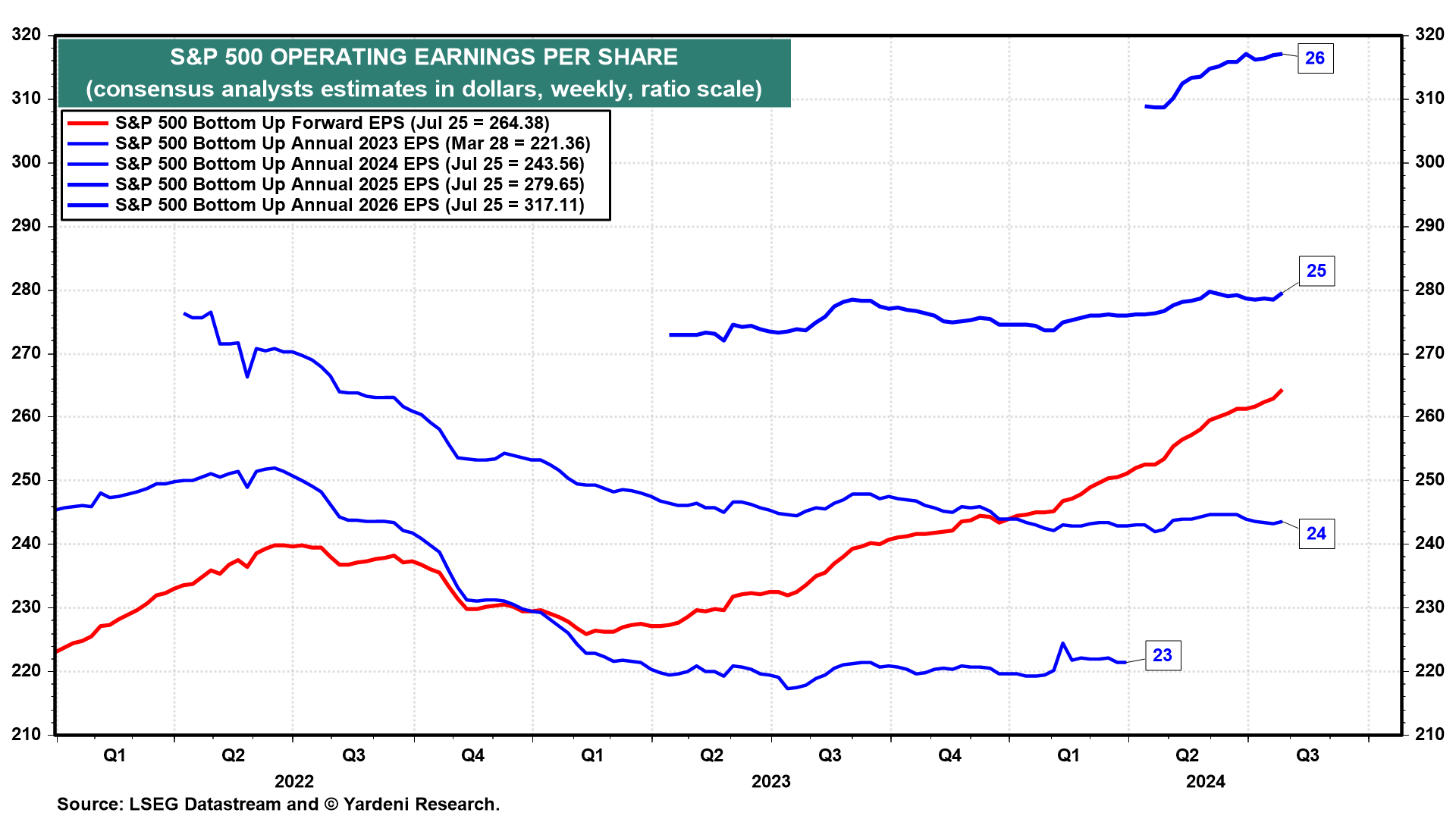

(1) Earnings. The consensus analysts' expectations for S&P 500 earnings per share rose during the latest week for 2024, 2025, and 2026 (chart). As a result, forward earnings rose to yet another new record high during the July 25 week.

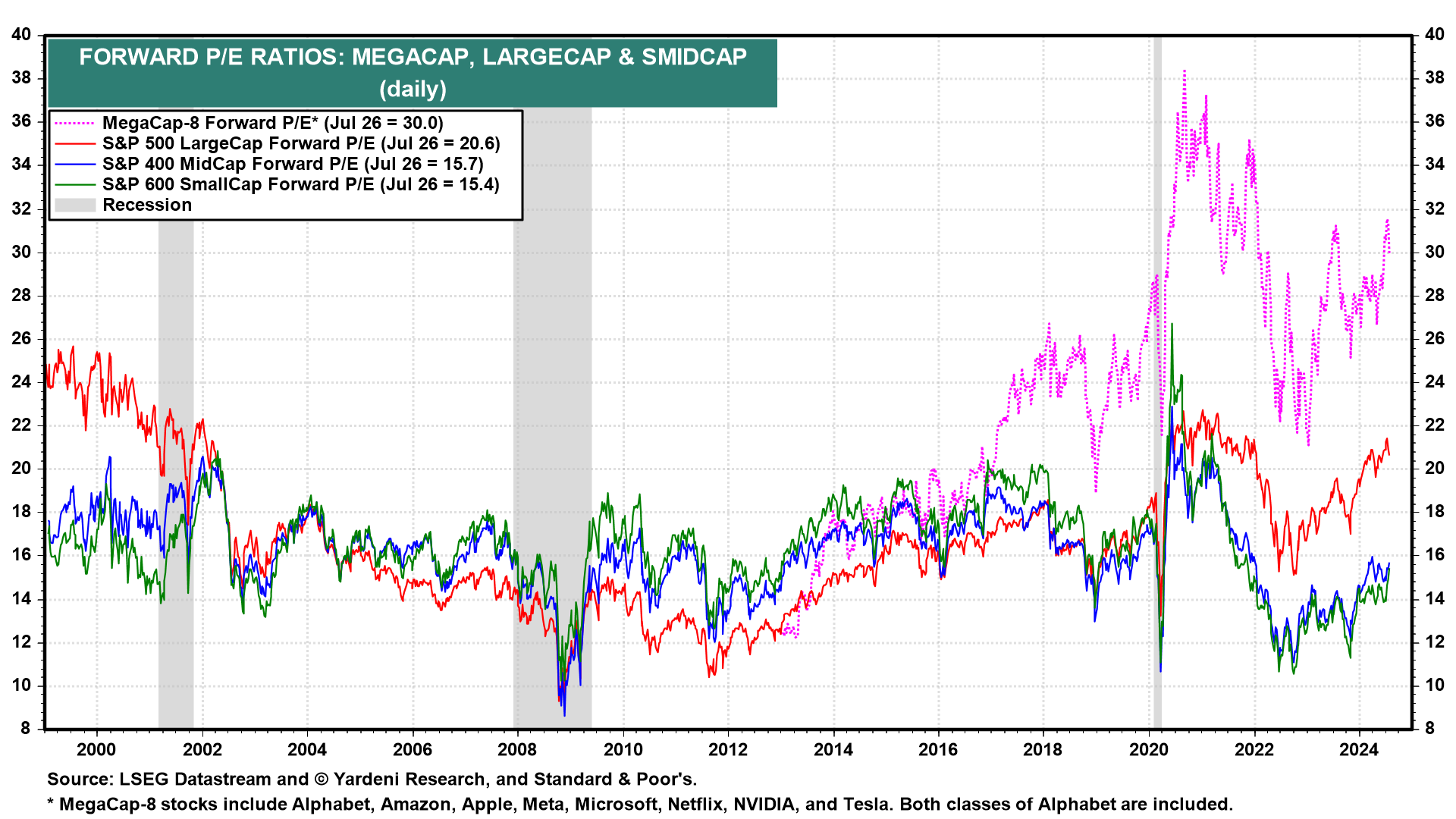

(2) Valuations. The S&P 500 forward P/E is relatively high at 20.6 currently. It is inflated by the 30.0 forward P/E of the MegaCap-8 (i.e., the Magnificent-7 plus Netflix) (chart). Excluding them, the S&P 492 are trading around 18.5. The S&P 400 MidCaps and S&P 600 SmallCaps are cheaper at 15.7 and 15.4. The problem with the S&P SMidCaps is that their earnings have been flat for the past couple of years. About 40% of the Russell 2000 universe currently are losing money.

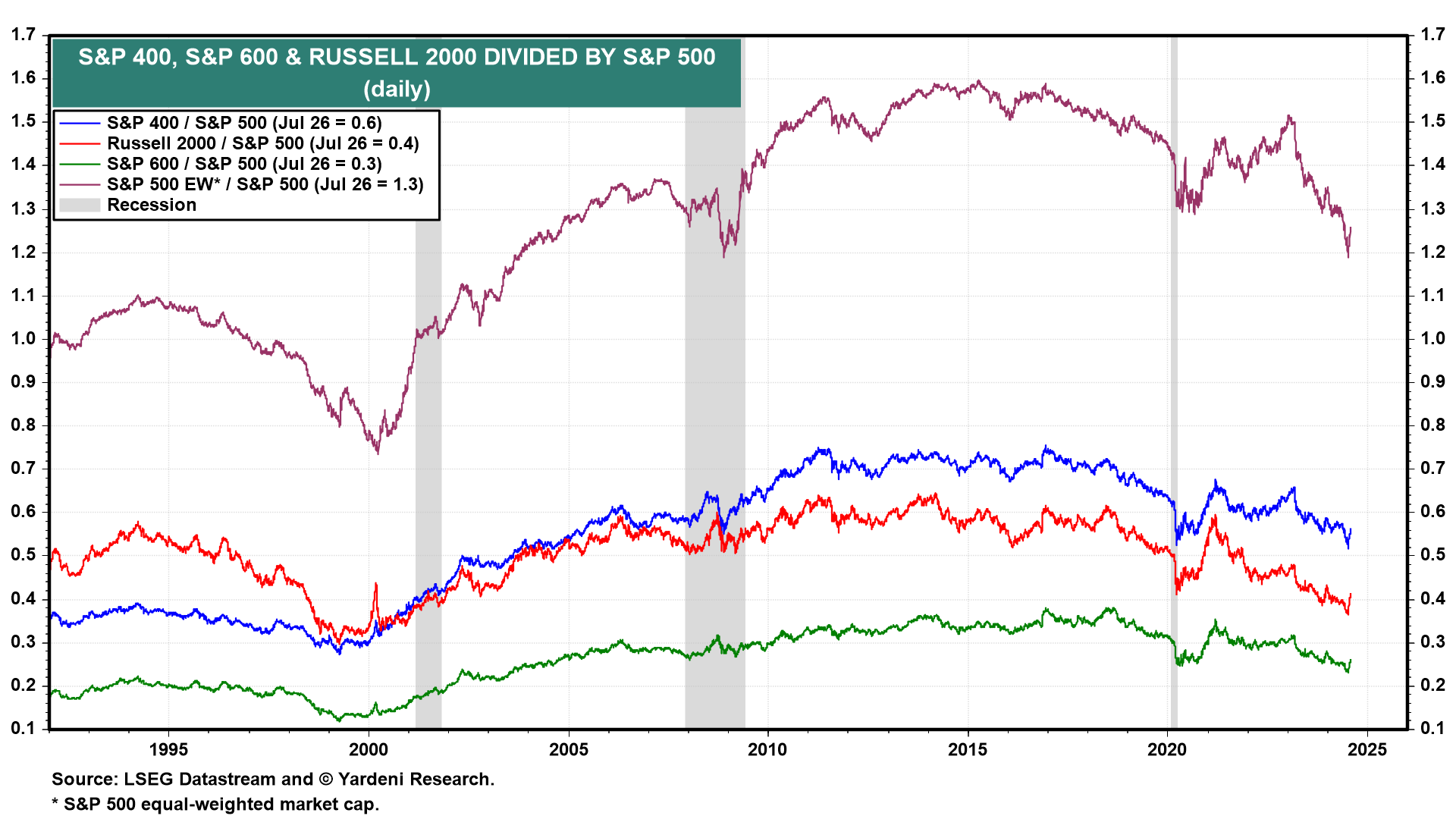

(3) Rotation. Yet, the SMidCaps have outperformed the LargeCaps since July 11, after June's lower-than-expected CPI bolstered expectations of a Fed rate cut in September and more to come (chart).

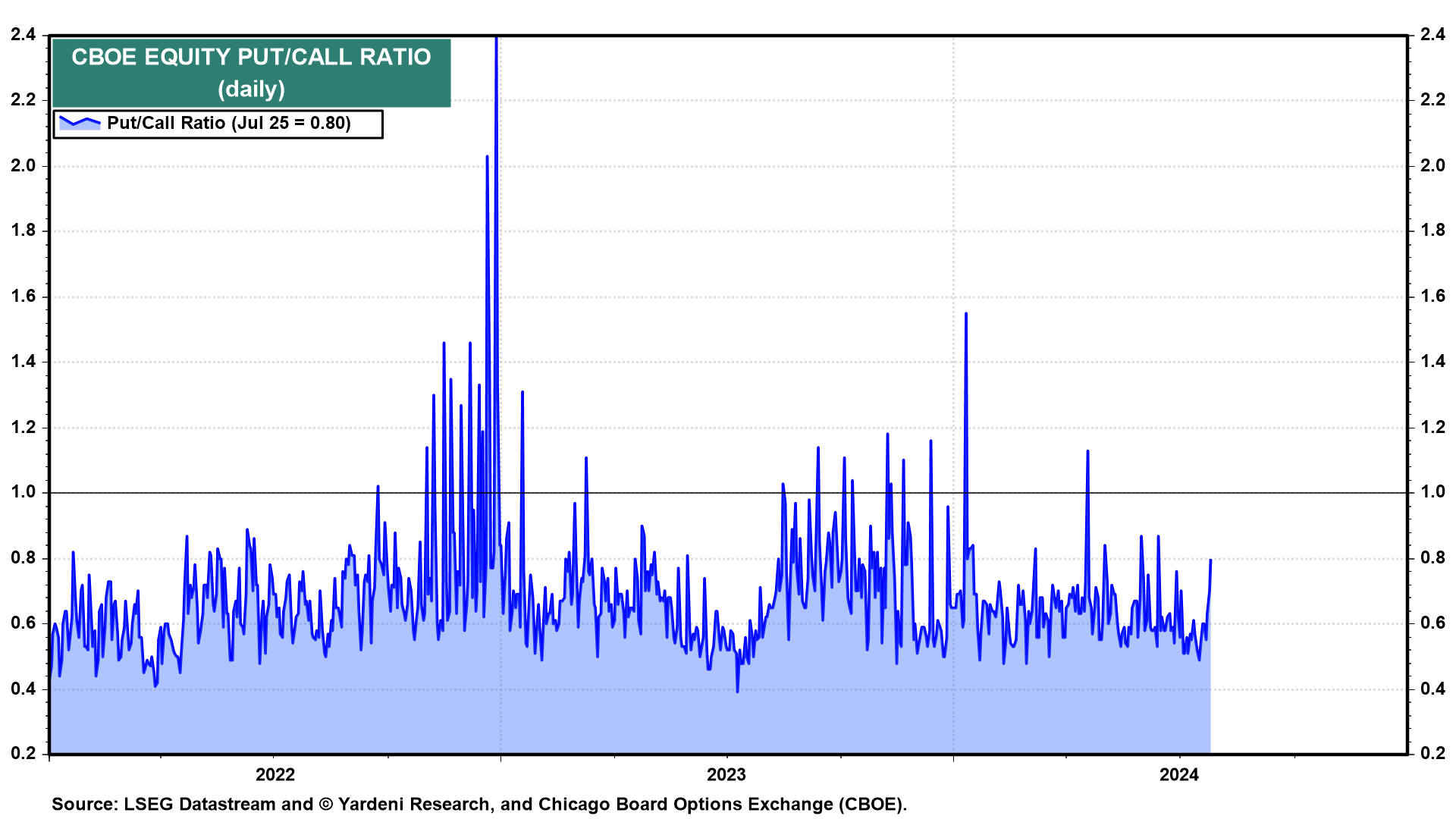

(4) Sentiment. As we noted last week, the Investor Intelligence Bull/Bear Ratio jumped to 4.31 during the July 23 week. The percentage of bulls rose to 64.2%, while the percentage of bears fell to just 14.9%. That's all bearish from a contrarian perspective. There was only a slight show of fear on Thursday when the Put/Call Ratio rose to 0.80 (chart).

Our hunch is that the stock market will continue to churn around current levels, rotating and remaining below its July 16 record high of 5667.20 through the presidential election. We expect a strong yearend rally to deliver a new record high.

We asked Joe Feshbach for his market outlook from a trading perspective: "Put simply with the levels of bullishness the sentiment indicators got to about a week ago it's tough to be anything but cautious on the stock market. Couple this with the parabolic look in tech stocks and the market should be in for tough sledding for a while."

We asked Michael Brush for an update on insider activity: "There's been no real step up in insider buying in the stock market pullback that started two weeks ago. But insiders are in an earnings season lockdown which distorts the picture. There has been an increase in buying at regional banks. This buying appears to confirm speculation that the Fed will soon start cutting short-term rates, which helps banks because it can reduce the cost of their deposit-base funding. Net interest margins may improve. A lower fed funds rate would also reduce competition for funds parked in their deposit accounts. There was also one sizeable insider buy of UPS in the cyclical transport sector. Like the insider buying at banks, this is a bullish statement on the economy, in my view."

Thanks, Joe and Michael!