We expect that the Santa Claus rally in stock prices that started on October 27 will continue over the rest of this year. It should be driven by the realization that inflation can and is moderating without a recession. That can only happen if productivity growth is making a comeback as we expect. China's economic woes are also an important source of "immaculate disinflation" for the US.

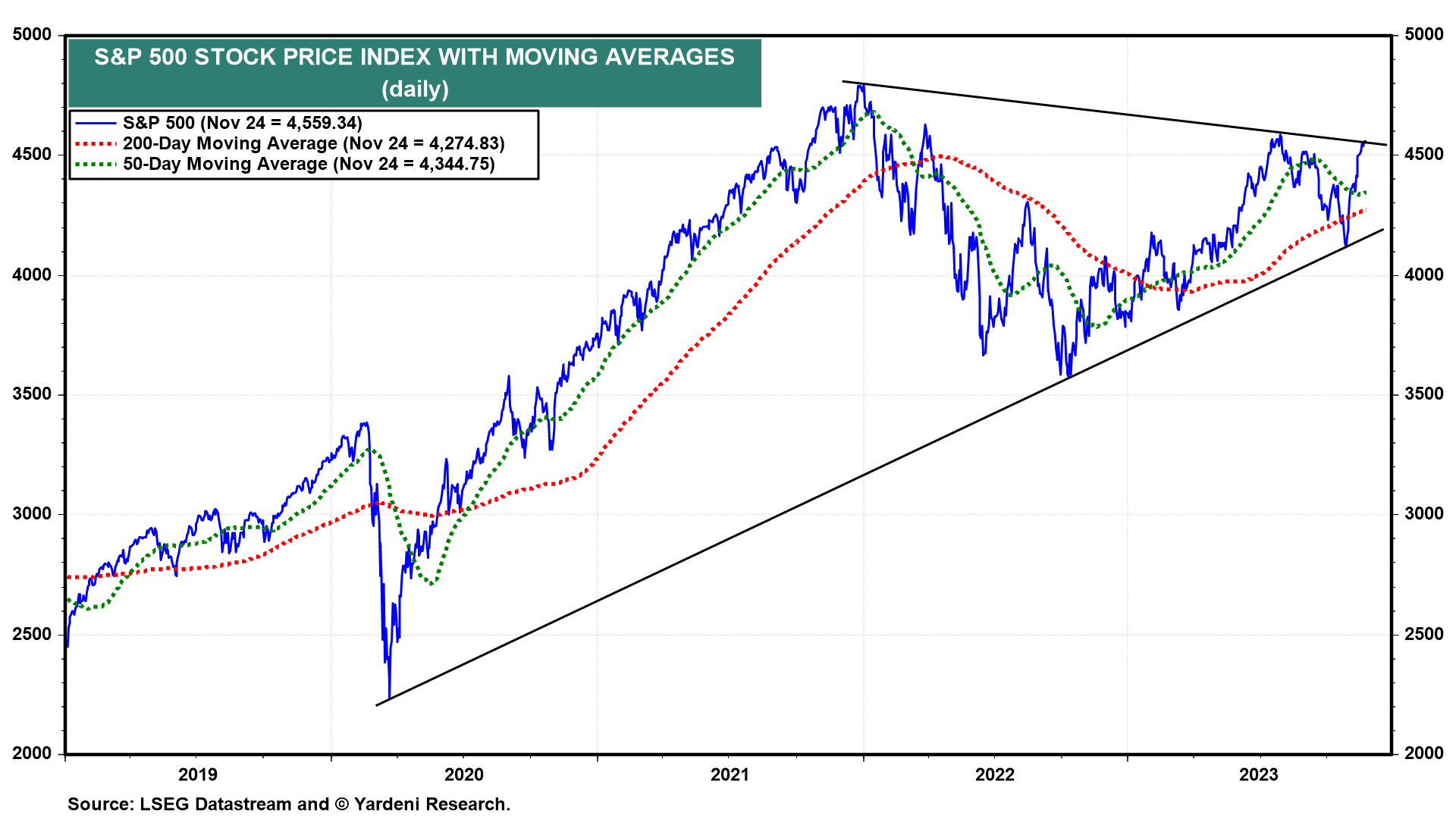

The 10.7% rally in the S&P 500 since October 27 has been spectacular (chart). The index is just 0.6% below this year's high on July 31. It is up 18.7% ytd, and a whopping 27.5% since October 12, 2022. It is only 4.9% below the record high on January 3, 2022.

The bull market is the real deal. That's been our opinion for just over a year. We expect that the S&P 500 will be making new highs early next year. Our 2024 yearend target is still 5400.

Helping to drive US stock prices higher is the 16.5% drop in the price of a barrel of Brent crude oil since September 27 (chart). That obviously indicates that energy inflation will remain moderate through November.