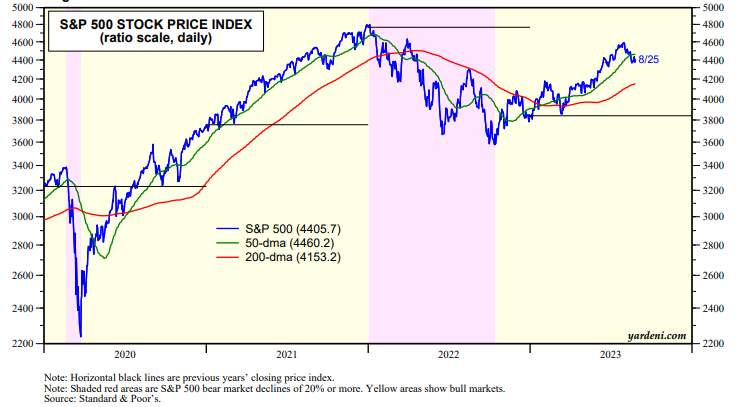

The S&P 500 has fluctuated around its 50-day moving average recently as the 10-year Treasury bond yield has done the same around 4.25%, which was last year's high on October 24 (chart). Sentiment is bearish in the bond market. It's less bullish in the stock market than it was during July.

Fed Chair Jerome Powell's Jackson Hole speech on Friday was hawkish. He avoided any mention of lowering interest rates. Instead, he said that the policy options were either high-for-longer or higher-for-longer interest rates. Interestingly the bond market didn't freak out but remained around 4.25% with the TIPS yield backing off a bit from 2.00% (chart). The stock market also didn't react much to Powell's hawkishness.