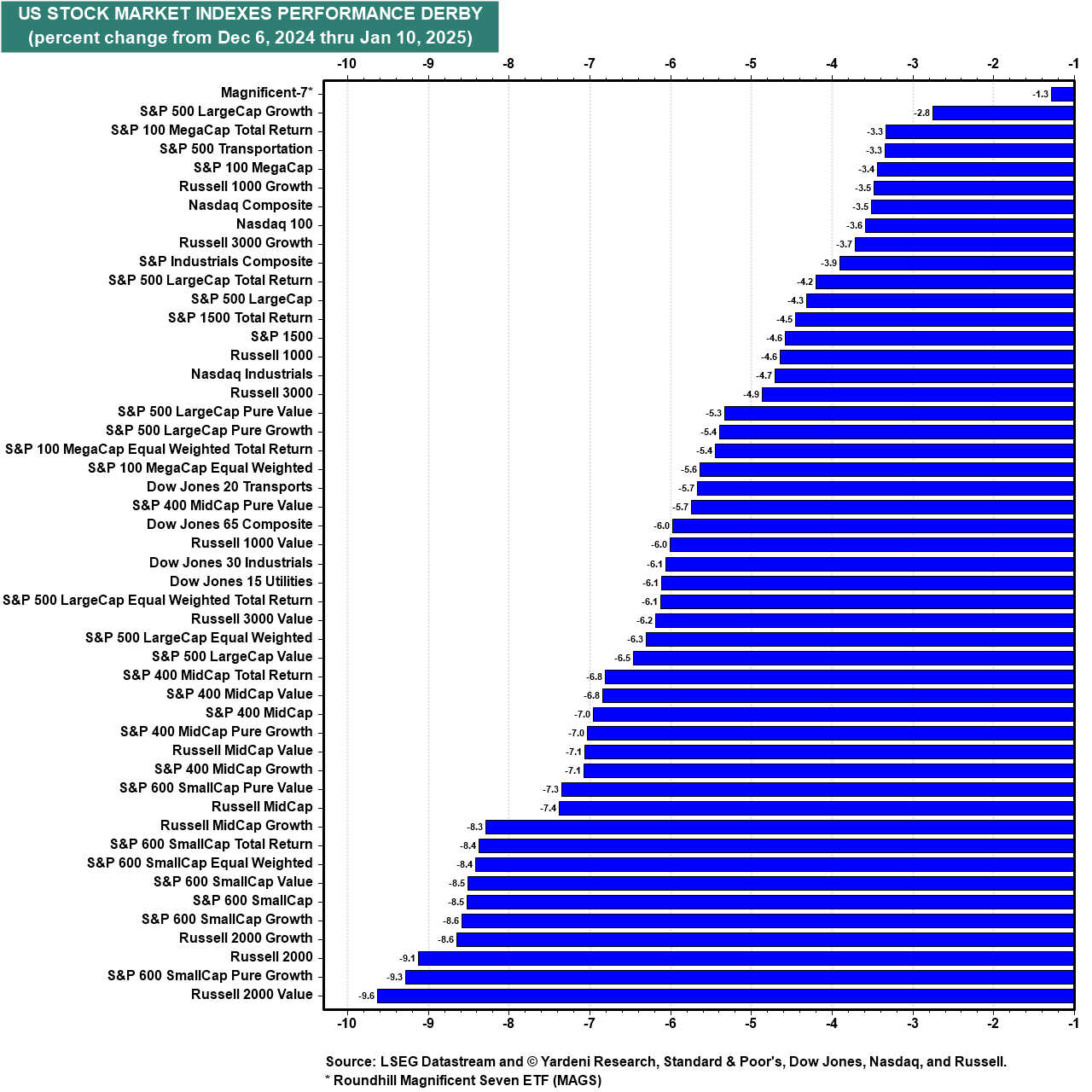

Last year, during August, we anticipated that US bond yields would rebound. Indeed, they have. During December, we expected a stock market correction at the start of the new year. So far, there has been a significant pullback in almost all of the major stock market indexes since the S&P 500 peaked at a record high on December 6, 2024 (chart). Some of these pullbacks, which are 5%-10% declines, could turn into corrections of more than 10% but less than 20% this coming week if Tuesday's CPI inflation rate for December is higher than expected, causing the 10-year Treasury bond yield to revisit 2023's high of 5.00%.

We aren't changing our forecast of 7000 on the S&P 500 by the end of the year. We still believe that the 10-year Treasury bond yield should trade mostly between 4.25% and 4.75% this year. So we think that the selloffs in the stock and bond markets are buying opportunities.

On the stock market front, we expect that the current earnings reporting season for Q4-2024 will be better than expected, as the season starts off later this week with solid earnings reports from the big banks. We are also encouraged to see that the percentage of bulls in the Investor Intelligence stock market sentiment survey fell sharply over the past couple of weeks (chart). Following Friday's rout, it undoubtedly fell again during the latest week, which will be reported on Wednesday. Many of the bulls joined the correction camp.